Citi's Comeback & Ally's Big Bet

The new Strata Elite card aims to take on premium rivals, as Ally's investment in women's sports boosts its brand, along with two new Toaster podcasts and more...

Hey Toaster Readers,

What a week. Citi is aiming to challenge Amex Platinum (again) with its upcoming “Strata Elite” card, and Cash App just tapped Timothée Chalamet for a major new campaign.

FICO is firing back at the credit bureaus, calling them a “de facto monopoly,” and in a separate showdown, a federal judge just vacated the CFPB's rule that would have removed medical debt from credit reports.

We're also digging into Ally's winning bet on women's sports, an end to Oportun’s proxy fight, and a new Gmail tool that could change email marketing forever (we hope you don't use it on us!).

There's a lot to break down. But before we do that, we have one favor to ask.

Favor to ask: Is there a story that you found interesting that you think we missed? Please forward along to newsletters@ghostmode.co

We’ve built a custom app that curates news we think is most important for you. A human still curates every story for this newsletter, but our app makes it significantly easier to cut through the noise and identify what’s most important.

We’re fine-tuning how the app includes/excludes stories, and we want to know if we missed anything important.

With the app, we’re able to curate the news in real-time, and we want to open the app to all toaster readers when it’s ready. It’ll be free for all verified Toaster subscribers.

Now let’s get to the news this week!

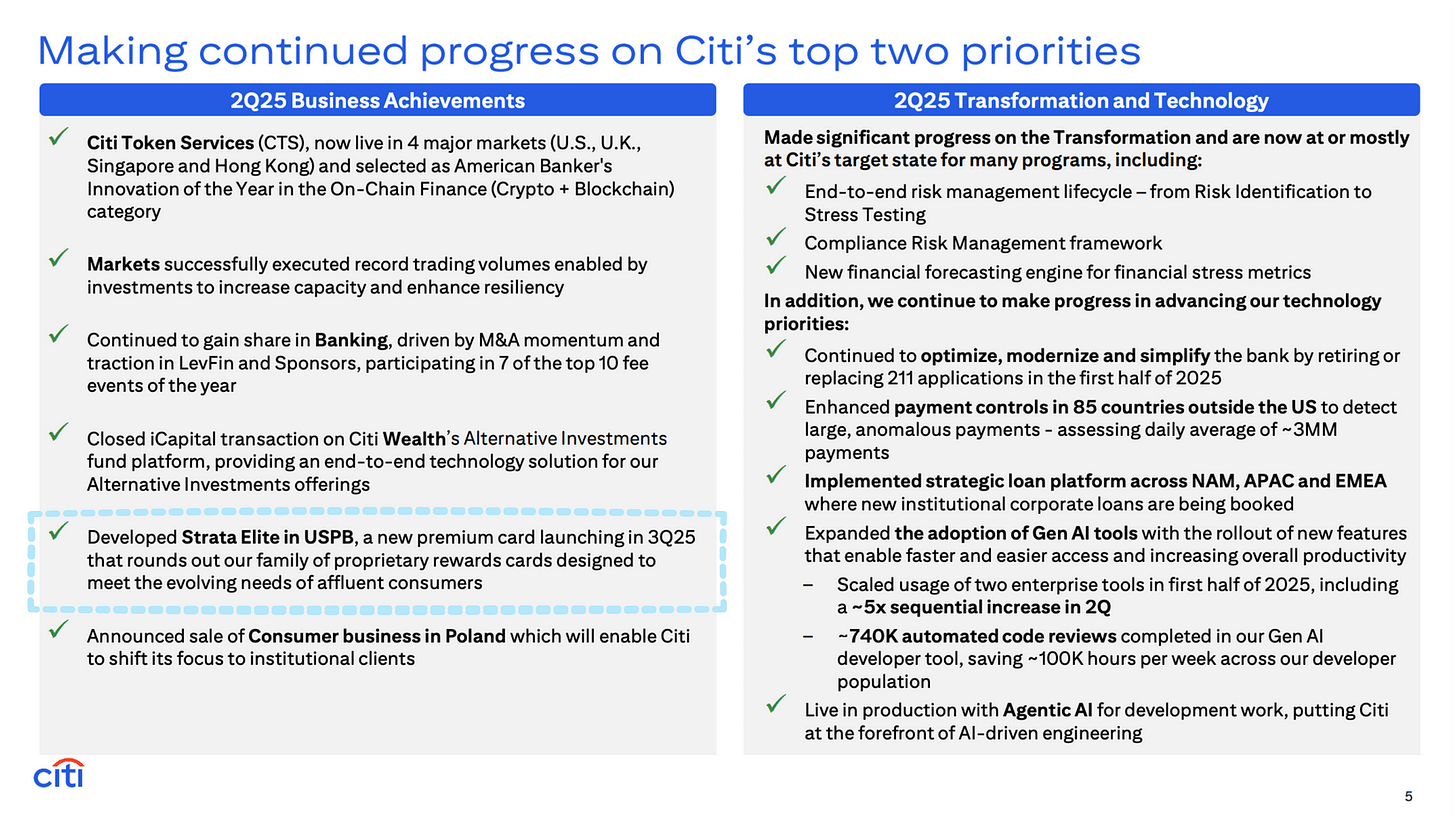

Citi Plans ‘Strata Elite’ Credit Card to Rival Amex Platinum

Citigroup is making a comeback to the premium credit card scene, preparing to launch its new “Strata Elite” card in the third quarter. The bank is re-entering the competitive field to target high-end customers, a space currently dominated by rivals like JPMorgan Chase & Co. and American Express. This marks a return for Citigroup, following its retreat from the premium market in 2021, when it discontinued its Prestige card. [Bloomberg] [Citi Q2 25 Earnings Presentation]

From the earnings call transcript: “As you saw with the American Airlines extension and the refreshed Costco Anywhere Visa Card, we are investing in our card portfolio to deliver more value for our cardholders. And later this quarter, we will introduce a new proprietary premium credit card, Citi Strata Elite, to our rewards family of products to expand our offerings for affluent customers.”

Ally made a bet on women's sports. Now it's winning big.

Ally Financial took a leap of faith in women's sports in 2022, and it's paying off in a big way. The auto lender and digital-only bank's pledge to equalize its ad spend between men's and women's sports was an "extraordinarily well-timed investment" that coincided with "skyrocketed" interest in leagues like the WNBA and NWSL. This strategy allowed Ally to get a "loud voice on a much smaller overall spend," helping boost its brand value by 31% in 2024. [American Banker]

(May 2023) Ally's 50/50 Pledge reaches 1-year milestone, all-star roster joins brand on quest for media equity in sports [media.ally.com]

Introducing: Timothée Chalamet for Cash App

Cash App is launching a new brand campaign with actor Timothée Chalamet, marking his first-ever partnership with a financial services platform. The new collaboration for the money app features Chalamet in a commercial, now airing in movie theaters, designed to "spark money conversations between generations." The integrated campaign also includes out-of-home advertising and limited-edition Cash App Card stamps designed in collaboration with the actor. [block]

FICO fires back, calls VantageScore and credit bureaus ‘a de facto monopoly’

After regulators approved VantageScore for mortgage decisions, FICO is firing back, accusing the three major credit bureaus of creating a "de facto monopoly." The credit scoring giant argues that because Experian, Equifax, and TransUnion own the rival VantageScore, they now have "complete pricing power" to squeeze FICO out of the market. FICO also deflected blame for high credit-pull costs and warned that using VantageScore is "grossly irresponsible" because it will "increase risk in the marketplace." [Mortgage Professional America]

Gmail’s new ‘Manage Subscriptions’ tool could change email marketing forever

Google is rolling out a new "Manage Subscriptions" tool in Gmail, providing users with a single place to view all their mailing lists and unsubscribe with a single click. This powerful feature for the world's second-most widely used email service gives users more control over their inbox and is being called "the end of sloppy email marketing." While some marketers worry, experts suggest that it could actually improve the quality of email lists and sender reputations, as peaceful unsubscribes are considered "better than spam complaints." [Fast Company] [TechCrunch] [Google]

CFPB Ban on Medical Debt Reporting Vacated by Texas Judge

A federal judge in Texas vacated a major Consumer Financial Protection Bureau rule that would have banned medical debt from credit reports, ruling the agency "exceeds the Bureau’s statutory authority". The decision is a significant win for credit reporting companies and debt collectors who argued that information about unpaid medical debts is an "important element" for assessing risk. The now-eliminated rule, finalized under the Biden administration, aimed to remove $49 billion in unpaid debt from the credit files of 15 million Americans. In a notable twist, the CFPB itself, under new leadership, sided with the industry plaintiffs to help eliminate the rule. [Bloomberg Law] [Link to Case]

With a single call to our simple, dev-friendly APIs, Spinwheel offers the only comprehensive connection to your consumers' financial accounts. Spinwheel delivers PII, real-time, verified account data, and the ability to make payments across all major debt categories – all within your brand's experience.

With many happy customers, including:

Insights from the CFPB’s Latest Report on Credit Invisibility

An updated report from the Consumer Financial Protection Bureau, which utilized corrected methodologies and enhanced data, revealed significant changes in the landscape of credit access in the United States over the last decade. The report emphasized the following key findings:

Reduction in Credit Invisibility: By December 2020, the share of adults considered "credit invisible" had decreased to 2.7%, representing approximately 7 million consumers. The CFPB report suggests this decline highlights improvements in credit accessibility and the success of initiatives designed to bring more individuals into the credit system.

Increase in Scored Credit Records: The report found that the proportion of adults with scored credit records rose from 81.6% in 2010 to 87.5% in 2020. The CFPB determined this increase reflects progress in credit scoring methodologies and broader access to opportunities for building credit.

Revised Estimates for Unscored Records: The share of adults with unscored credit records for December 2010 was revised upward from 7.4% to 12.7%. The report notes this change was due to the impact of including previously excluded data, such as records that only contained deferred student loans, collections, or closed accounts. [Troutman Pepper Locke]

Is loan growth returning? Bank earnings reveal green shoots.

Based on second-quarter earnings reports, U.S. banks are showing an "uneven" return to loan growth after several years of "dismal" performance. While some banks are reporting positive momentum, others continue to experience sluggish conditions.

Several large banks reported positive results including:

JPMorgan Chase grew its average loans by 3% from the prior quarter and 5% from the previous year, though the growth was uneven across different segments.

Bank of America reported that lending grew across every business segment on both a quarterly and yearly basis.

In contrast, other banks showed more modest figures:

Wells Fargo's second-quarter loans were up 1% from the prior quarter and flat from a year ago due to what an executive called "pretty tepid demand".

According to Federal Reserve data, overall industry loan growth from June 2024 to the week of the report reached 4.2%, marking the first time year-over-year growth surpassed 4% since late 2023. The same data indicates that large banks have outperformed smaller ones, with total loans growing by 3.8% at large institutions compared to 3.3% at smaller ones over the last year. [American Banker] [JPMorganChase] [Bank of America] [Wells Fargo]

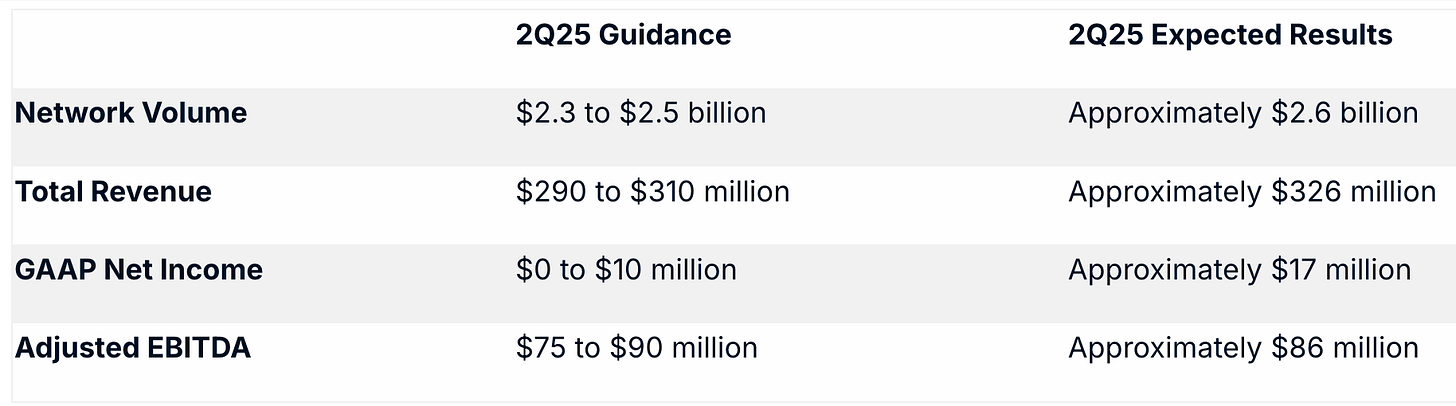

Pagaya Announces Preliminary Second Quarter Results

Pagaya announced preliminary Q2 2025 results that are expected to exceed prior guidance. The company expects network volume of approximately $2.6 billion, revenue of $326 million, and GAAP Net Income of $17 million. Pagaya emphasized the results are preliminary and unaudited, with final results to be reported on August 7, 2025. [Pagaya]

Oportun Enters Cooperation Agreement with Findell Capital

Note: This is an update to a story we reported on last month: Inside Oportun's Lending Proxy Battle

Oportun entered into a multi-year cooperation agreement with investor Findell Capital to end a contested director election. Under the agreement, Findell will withdraw its director nomination and support Oportun's nominees at the 2025 Annual Meeting of Stockholders. In return, the Oportun Board of Directors will appoint Warren Wilcox as a director following the meeting. [Oportun]

NEW TOASTER PODCASTS (Direct Mail & Compliance)

E028 - 10 Direct Mail Pitfalls That Kill Programs (with Rich Walker)

E027 - The State of Compliance In Lead Gen, With John Henson, Founder at Henson Legal

Find the show here:

Spotify // Apple // Audible // Podbean // iHeart

In Other News

(Cards) Wawa debuts new credit card CStore Dive

(Venture Capital) Rex Salisbury’s Cambrian Ventures raises new fund, bucking fintech slowdown TechCrunch

(Stablecoins) Mastercard, JPMorgan Chase, Citi, BofA share stablecoin plans American Banker

(Stablecoins) The misplaced debate about interest-bearing stablecoins American Banker

(Stablecoins) Will GENIUS Act Reshape US$238bn Stablecoin Market? FinTech Magazine

(Stablecoins) Why one midsize bank is excited about stablecoins American Banker

(Student Lending) Massachusetts AG reaches settlement with student loan company, Earnest Operations LLC Consumer Finance Monitor

(Capital Markets) Pagaya Signs New Forward Flow Agreement with Castlelake to Purchase Up to $2.5 Billion in Personal Loans Business Wire

(Capital Markets) WSFS Financial completes sale of Upstart consumer loan portfolio Investing.com

(Credit Union) Cabrillo Credit Union Selects Upstart for Personal Lending Business Wire

(Regulation) New OCC Head Set to Focus on Digital Assets and New Bank Formation PYMNTS

(BNPL) HUD studies BNPL housing risks Payments Dive

(BNPL) Fed's Barr warns of BNPL 'debt trap,' other risks American Banker

(Macro) Why Jamie Dimon says we ‘may have seen peak private credit’—and why you should care Fortune

(Technology) Heron Raises $16 Million for Lending Automation Offering PYMNTS

(Technology) Fifth Third: FinTech Platforms Drive Loan Growth Despite ‘Tepid’ Environment PYMNTS.com

(Technology) Andrews Federal Credit Union Taps Scienaptic AI to Elevate Lending and Expand Credit Access Business Wire

(Tokens) Robinhood Dealing With Fallout of Tokenized Equities Offering PYMNTS

Support The Free Toaster

Do you need:

An affiliate marketing platform/network? Chat with Fintel Connect

Help hiring key roles? Email Connie Buehler and mention TOASTER

A way to improve application page conversions? Chat with Spinwheel

A way to accelerate your affiliate marketing? Chat with New Market Growth

A way to win on other growth channels? Chat with FIAT Growth

None of the above? Share our Newsletter in your favorite Slack channel

About Us

Welcome to The Free Toaster! The newsletter for marketing pros at fintechs, banks, and lenders.

Inspired by the free toasters banks used to give to each new customer, we’re here to help you acquire more customers at scale. We deliver fresh news, data, and insights to help you acquire more customers, minus the breadcrumbs.

Want to follow the authors on social media? Find Nick Madrid and Carlos Caro on LinkedIn.