Inside Oportun's Lending Proxy Battle

A Deep Dive into Strategy, Performance, and the Fight for Control

Hey Toaster Readers,

Our regular weekly news edition will be a day or two late this week. We got completely absorbed in a developing story: a proxy fight unfolding at Oportun.

We found the situation so compelling that we decided to dedicate a special deep-dive edition to it. We'd love to hear what you think of this!

Nick + Carlos

Inside the Oportun Proxy Battle: A Deep Dive into Strategy, Performance, and the Fight for Control

Oportun Financial (NASDAQ: OPRT), a publicly-traded lender with a social mission, is facing a notable challenge—not from regulators or competitors, but from an activist shareholder. Findell Capital launched a public campaign to overhaul Oportun's Board of Directors, claiming the current board has presided over a period of considerable loss in value and strategic missteps.

The situation presents two clear viewpoints. On one side, Findell argues that Oportun's leadership has underperformed through a failed attempt to become a diversified "neobank," culminating in a costly acquisition and deteriorating financial performance. On the other hand, Oportun’s management insists it already pivoted, is executing a "back to basics" turnaround, and that Findell’s campaign is a distraction that puts this progress at risk.

The central question for investors, employees, and the fintech community is this: Is Findell Capital a necessary catalyst for change at an underperforming company, or is Oportun's management already steering the ship back on course? This report lays out the facts for you to decide.

What is Oportun? The Mission and the Model

At its core, Oportun is a certified Community Development Financial Institution (CDFI), a designation from the U.S. Treasury awarded to institutions with a primary mission of serving low-to-moderate-income communities. It provides personal loans to individuals who are often "credit invisible," meaning they have little to no credit history and are shut out of the mainstream financial system.

Investor Presentation - June 2025

Today, Oportun's lending business is concentrated on two core products:

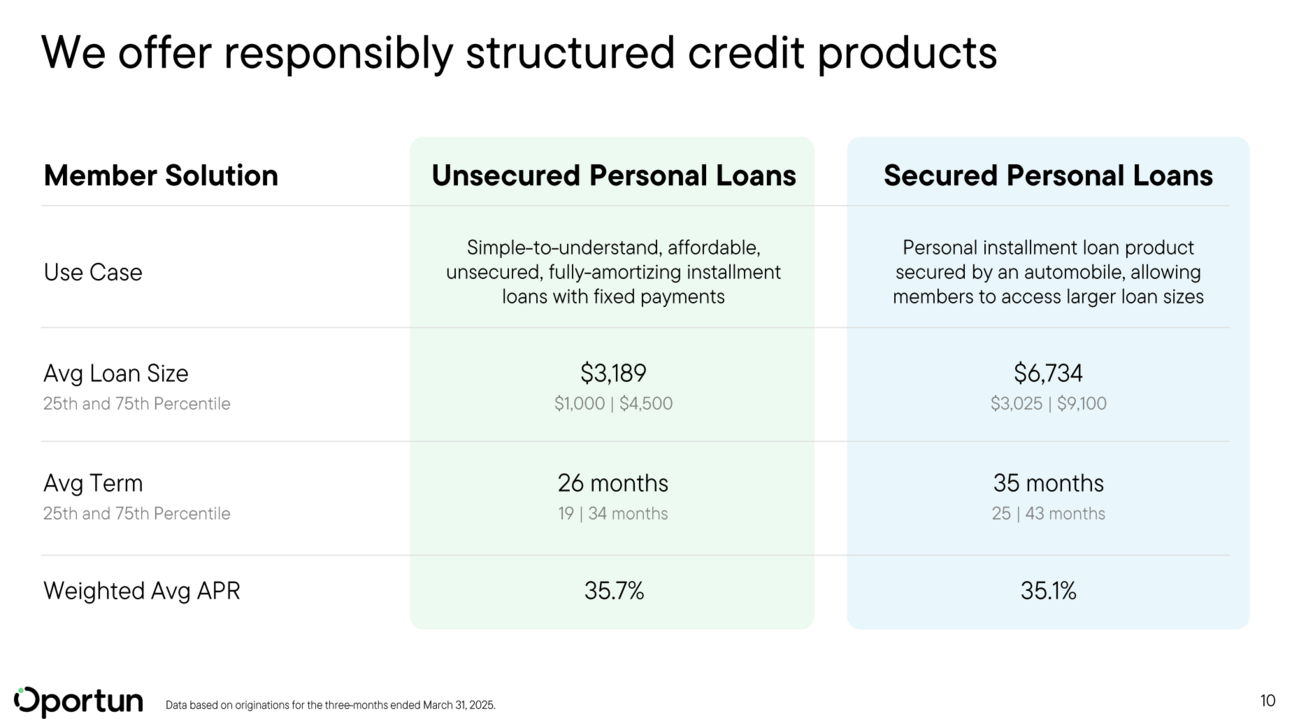

Unsecured Personal Loans: This is the company's foundational product and constitutes most of its revenue and profitability. These are simple, fully amortizing installment loans with fixed interest rates and an annual percentage rate (APR) capped at 36%.

Secured Personal Loans: Launched in April 2020, this product is secured by an automobile, allowing members to access larger loan sizes than they could with an unsecured loan. The company views this as a growth area due to its lower credit losses.

Investor Presentation - June 2025

The company makes money primarily through the interest earned on this loan portfolio. But the "mission-driven" angle is what truly defines the brand. Oportun targets hardworking, underserved consumers and has helped over 1.2 million people establish a FICO® score, providing a critical on-ramp to the formal financial system.

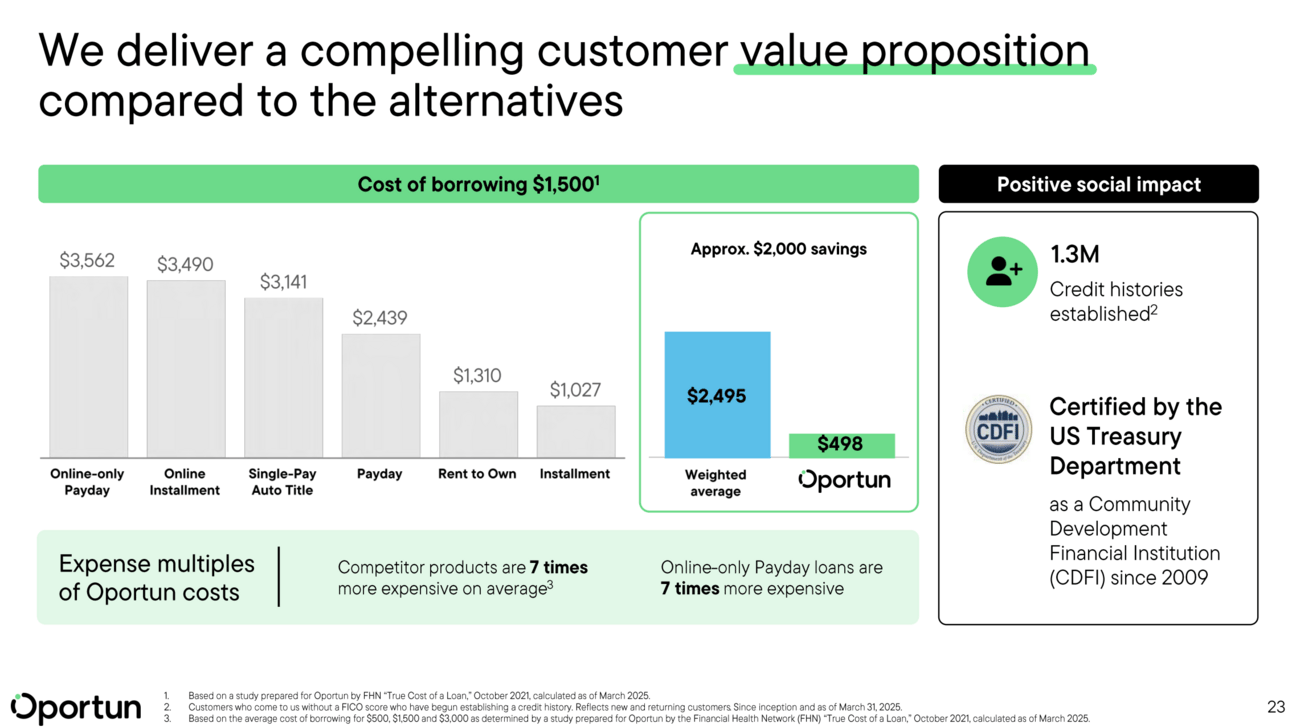

This mission is also a core part of its value proposition. Oportun claims its loans are, on average, "7 times less expensive" than alternatives like payday or pawn loans. This is based on a study commissioned by the Financial Health Network, which estimated that Oportun's members saved over $478 million in interest and fees in 2023 alone by choosing Oportun over those higher-cost options.

This model appears to resonate with its customer base, creating a competitive advantage built on loyalty. The company has a Net Promoter Score (NPS) of 76 for its personal loans. More impressively, the business is built on retention. As of the end of 2023, 82% of Oportun's entire loan portfolio value came from repeat customers. This isn't just a financial services company; for many of its members, it's a trusted financial partner.

The Pathward Partnership: A Critical Artery

A key to Oportun's national scale is its partnership with Pathward, N.A. Through this "Lending as a Service" model, Pathward, a bank, originates the loans that Oportun designs and services. This allows Oportun to operate in 38 states without needing to secure individual state-by-state licenses, a costly and time-consuming process.

The importance of this single partnership cannot be overstated. Pathward's share of Oportun's loan originations has grown from ~5% in 2022 to ~92% in 2024. While this represents a strategic success in achieving national scale, it also highlights a concentration risk, a point not lost on its critics.

The Omni-Channel Acquisition Machine

Oportun acquires its members through a diverse, multi-channel strategy that blends modern digital marketing with IRL community outreach.

Digital Channels: The Oportun Mobile App and website are the primary funnels, supported by paid and organic online advertising. A key digital channel has been its lead generation partnership with Credit Karma. This relationship highlights the interconnected nature of the fintech ecosystem, as Oportun's CEO, Raul Vazquez, also sits on the board of Intuit, Credit Karma's parent company. However, the scale of this partnership appears to have shifted. Payments from Oportun to Credit Karma have declined, from $8.9 million in 2022 to $1.6 million in 2023, and further to just $126,000 in 2024, indicating a de-emphasis of this channel as part of the company's evolving strategy.

Direct Marketing: The company actively uses direct mail, email, and SMS campaigns, and increased its spending on the direct mail channel by $3.5 million in 2024.

Physical Presence: Unlike many digital-only fintechs, Oportun maintains 128 retail locations for community-based outreach.

LaaS Partnerships: Beyond Pathward, Oportun has a lead generation program with partners like DolFinTech (at 491 retail locations) and has announced a new collaboration with Western Union, embedding itself in trusted community financial hubs.

This acquisition engine has become more efficient. Despite a decrease in total sales and marketing spend (from $75.3 million in 2023 to $67.0 million in 2024), Oportun’s Customer Acquisition Cost (CAC) fell 22.4% to just $125 in 2024.

The Activist's Case - Findell Capital's Accusations

Findell Capital’s case against the Oportun board is a direct criticism of its record, performance, and strategic judgment. The activist investor argues that the current board is responsible for the company’s poor stock performance, which has seen a -93% Total Shareholder Return (TSR) since its 2019 IPO. Findell believes the board has overseen financial performance and strategic blunders that have “led to a loss of more than $1.4 billion of stockholder value.” They assert that this outcome is the direct result of a "failed 'neobank' strategy" and a "lack of accountability" in the boardroom.

Here are Findell's key points:

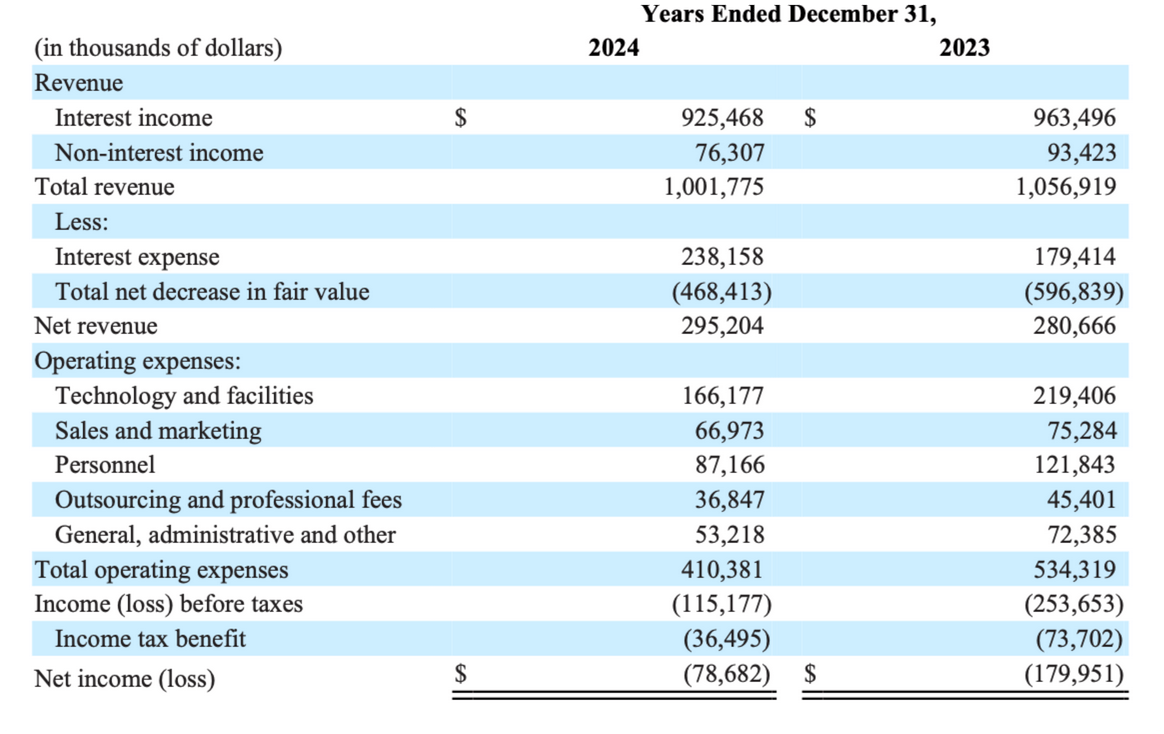

Financial Underperformance: Findell points to three consecutive years of net losses.

2022 Net Loss: $77.7 million

2023 Net Loss: $180.0 million

2024 Net Loss: $78.7 million

Decrease in Value: The stock price has fallen under the current board's tenure. The market capitalization of stock held by non-affiliates decreased from approximately $137.7 million in mid-2023 to $72.1 million by mid-2024.

A Flawed "Fintech" Strategy: Findell’s central critique is that the board chased a strategy to transform Oportun from a focused lender into a diversified "neobank." The main example cited is the acquisition of the savings app, Digit.

The Digit Acquisition: In what Findell calls a "costly strategic misstep," Oportun acquired Digit in November 2021 for approximately $212.9 million.

The Impairment: Just a year later, in 2022, Oportun recorded a $108.5 million goodwill impairment charge on Digit, an admission that the asset was valued at less than half of what the company had paid for it.

Deteriorating Credit Quality: Findell argues that while management was focused on its fintech ambitions, discipline in the core lending business declined. They point to the company's Annualized Net Charge-Off Rate, which rose from 10.1% in 2022 to 12.2% in 2023, before ticking down to 12.0% in 2024.

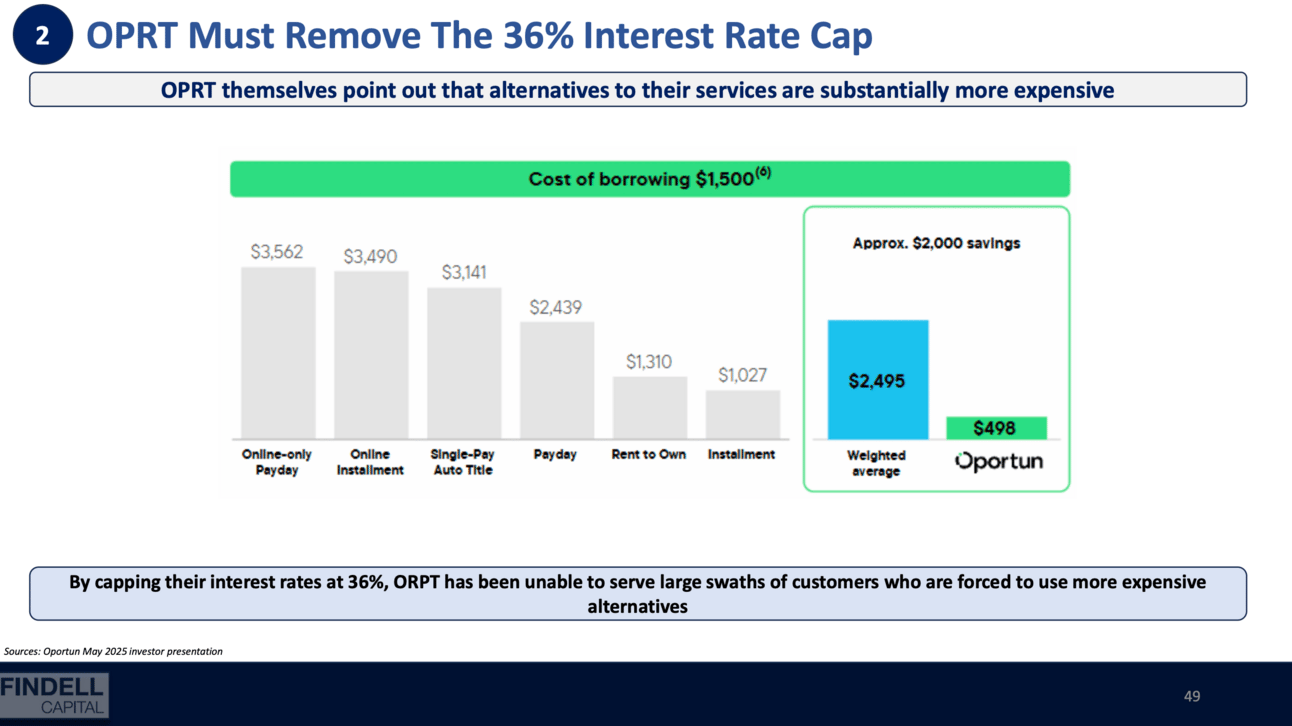

A Controversial Strategic Recommendation: Remove the 36% Rate Cap: Perhaps Findell's most contentious argument is that Oportun should abandon its long-standing policy of capping all loan interest rates at 36% APR. Findell claims that "By capping their interest rates at 36%, OPRT has been unable to serve large swaths of customers who are forced to use more expensive alternatives." They point out that Oportun itself highlights that its competitors are substantially more expensive, implying Oportun could charge more and still be a better option.

Findell Capital - Opportunity at Oportun

However, this argument conflicts with a widely held view among regulators and consumer advocates. An APR of 36% is broadly considered the dividing line between affordable credit and predatory lending. The Military Lending Act (MLA), a cornerstone of federal consumer protection, codifies this by capping loans to service members at 36%. Leading advocacy groups like the National Consumer Law Center (NCLC) and the Center for Responsible Lending (CRL) define loans above this threshold as high-cost and harmful, trapping borrowers in cycles of debt. This standard is also reflected in the market; on Credit Karma, one of the largest loan marketplaces, it is difficult to find personal loan offers with APRs exceeding 35.99%. For Findell to advocate for crossing this line is a direct challenge to Oportun’s brand as a "responsible" lender.

Findell's goal is to reconstitute the Board of Directors with new, independent members who will provide effective oversight and refocus the company on its core lending business to "right the ship."

Oportun's Defense - The Turnaround is Working

Oportun's management doesn't deny the past challenges. Instead, they argue that they have recognized the issues, made the necessary decisions, and are executing a strategic turnaround that is yielding results. In their view, Findell’s campaign is a distraction that could derail this progress.

Management’s defense rests on a "Back to Basics" strategy with two main pillars:

Simplifying the Business: In an implicit admission that the diversification strategy was not successful, Oportun has unwound its non-core ventures.

It sold its credit card portfolio in November 2024, describing it as a "key milestone towards our initiative to enhance profitability by simplifying the business."

It has sunset other non-core products, including investing tools and partnerships like its arrangement with Sezzle.

"Workforce Optimization": The company has undertaken cost-cutting measures to right-size the organization and improve profitability.

Corporate staff was reduced by approximately 40% in 2023 and another 12% in 2024.

The total U.S.-based corporate headcount has been reduced from 875 employees at the end of 2022 to 361 at the end of 2024.

Management argues that these changes are already bearing fruit, pointing to several "bright spots" as proof that the turnaround is working.

Improved 2024 Performance:

The net loss shrank from $180.0 million in 2023 to $78.7 million in 2024.

Marketing efficiency improved, with the Customer Acquisition Cost (CAC) falling 22.4% to just $125.

Improving Credit Quality:

The 30+ Day Delinquency Rate—a leading indicator of future loan losses—improved from 5.9% at the end of 2023 to 4.8% at the end of 2024.

You Be the Judge

The fight for Oportun's future presents two distinct narratives.

Findell's View: A board that presided over a decrease in value from a failed strategy and poor oversight cannot be trusted to fix the company. The recent "turnaround" is simply an admission of their prior failures. New, experienced oversight is required to restore discipline and shareholder trust.

Oportun's View: We have acknowledged the challenges, made a decisive strategic pivot back to our core strengths, and the positive results are now clear. Our customer loyalty remains strong, and our financial and credit metrics are moving in the right direction. A disruptive proxy fight now puts this progress at risk.

This leaves stakeholders with a difficult choice and several critical questions:

Does Oportun's recent progress and strategic realignment prove the current board has learned from its mistakes and deserves the chance to see its plan through?

Or, does the scale of past value destruction and the Digit misstep suggest that new oversight, as demanded by Findell, is essential to ensure future discipline?

What is the right path forward for a company with a strong social mission but a troubled financial history?

The answer will determine not only the composition of Oportun's board but the very future of a company at the crossroads of mission and margin.

Appendix (Additional Sources)

6/23/25 - Oportun Issues Letter to Stockholders Detailing CEO Raul Vazquez’s Record of Proven Leadership - https://www.sec.gov/Archives/edgar/data/1538716/000119312525144755/d38779ddefa14a.htm

6/25/25 - Findell Capital Issues Rebuttal Presentation on Oportun Financial - https://www.sec.gov/Archives/edgar/data/1538716/000092189525001826/dfan14a13982002_06232025.htm

https://findell.s3.us-west-1.amazonaws.com/OPRT+Response+Presentation.pdf

6/18/25 - Oportun Releases Investor Presentation Highlighting Strategic Progress - https://cdn.prod.website-files.com/682f1c8d9e64348bd764a613/6852ea765b71cd9af49750ed_Oportun%20Financial%20Investor%20Presentation.pdf

6/16/25 - Findell Capital Releases Presentation on Oportun Financial - https://cdn.prod.website-files.com/6811d78a81ecf5002c312bfc/685060f9ad8c07f0328ac2c6_Findell-OPRT-Investor%20Presentation%20-%20FINAL.pdf

6/13/25 - Findell Capital Provides Facts in Response to Oportun’s Misleading Narrative - https://www.sec.gov/Archives/edgar/data/1538716/000092189525001760/dfan14a13982002_06132025.htm

6/12/25 - Oportun Lead Independent Director Neil Williams Issues Letter to Stockholders - https://www.sec.gov/Archives/edgar/data/1538716/000119312525140057/d65310ddefa14a.htm

6/5/25 - Findell Capital Management Spotlights Why Ginny Lee Should Not be Appointed Oportun's Next Lead Independent Director - https://www.sec.gov/Archives/edgar/data/1538716/000092189525001709/dfan14a13982002_06042025.htm

6/2/25 - Oportun Issues Letter to Stockholders and Mails Definitive Proxy Materials - https://www.sec.gov/Archives/edgar/data/1538716/000119312525133321/d19925ddefa14a.htm

6/2/25 - Important Update Regarding Annual Stockholder Meeting - https://www.sec.gov/Archives/edgar/data/1538716/000119312525133318/d900373ddefa14a.htm

5/29/25 - FINDELL CAPITAL PARTNERS, LP - https://www.sec.gov/Archives/edgar/data/1538716/000092189525001637/defc14a13982002_05292025.htm

5/28/25 - FORM l0-K - https://www.sec.gov/Archives/edgar/data/1538716/000119312525129577/d869078dars.pdf