Ally sells $2.3B card book, TU's growth ambitions, and more...

Plus earnings recaps from COF, BAC, and JPM

Toaster PSAs:

These emails can get long, and email clients sometimes cut them off. The top right of this email has a ‘Read Online’ option.

The Free Toaster Podcast is actively interviewing all experts in Direct Mail Marketing. If you are an expert (or know one), please send them our way.

SPONSORED BY SPINWHEEL

Streamline your lending application pages with 2-fields.

If you’re anything like us, friction on application pages makes you nauseous.

It makes your CACs go up. It makes your volumes drop. It causes your CFO and CEO to say mean things.

The trouble is, application friction isn’t easy to fix. Your prod/eng is busy. We get it.

Spinwheel’s APIs streamline a lending application form with just a phone number and a birthdate - like magic (but it’s really just smart tech)! Then you get a 20-30% lift in your application rate.

Additionally, they can give you real-time, verified consumer credit data and seamless payment processing, which can help you serve customers beyond the initial application.

To see a demo, click below to connect with their Head of Growth and see this thing in action.

Schedule a free 15-minute demo

TL;DR

Ally Financial is exiting the credit card space, selling $2.3 billion in receivables and 1.3 million active cardholders to CardWorks, which aims to expand its near-prime portfolio.

TransUnion is doubling down on growth, acquiring Mexico's Buró de Crédito to boost Latin American financial inclusion and leveraging its Monevo purchase to build a Credit Karma-like marketplace. Meanwhile, the CFPB is keeping credit giants in check, challenging TransUnion on data accuracy and cracking down on rushed product launches.

Barclays may replace Goldman Sachs as Apple Card’s partner, while Rocket Companies rebrands and U.S. Bank partnered with Peyton Manning. Lastly, fraud remains a $34B headache, but banks are fighting back with AI, MFA, and other tools, as major players like Capital One, Chase, and Bank of America report strong growth and shifting deposit dynamics.

Top News

(1/22) Ally Financial, known for its digital banking and auto financing services, is selling its credit card business to CardWorks in a deal that includes $2.3 billion in credit card receivables and 1.3 million active cardholders. Ally says the move will allow it to focus on its core businesses, while CardWorks, a credit card issuer and servicer, sees the acquisition as a "natural fit" to grow its near-prime credit card portfolio. The deal is expected to close in 2025 after meeting standard conditions. [PR Newswire]

On January 8th, we shared our thoughts on TransUnion’s acquisition of Monevo and how it signaled, at least to us, their desire to compete in the affiliate marketplace space.

And thanks to an astute reader of The Free Toaster for pointing it out, our suspicions are confirmed.

Buried deep in the Q&A section of a different acquisition announced last week, which we cover below, we found this quote:

❝

"plus the Monevo transaction, which is a very small transaction [...] that gives us the consumer credit offering engine that we have wanted for some time to power both our direct to consumer site and really any industry participant that [...] wants to make available credit offers to their consumers."

(around the 23:30 mark of the deal conference call)

Toaster Team’s Take:

TransUnion’s latest quarterly report shows $848M in U.S. revenue. Credit Karma’s recently reported quarterly revenue was $524M. The bulk of TU’s revenue is selling data to banks, lenders and fintechs, and TU sees a big growth opportunity in building a consumer marketplace business of Credit Karma’s scale.

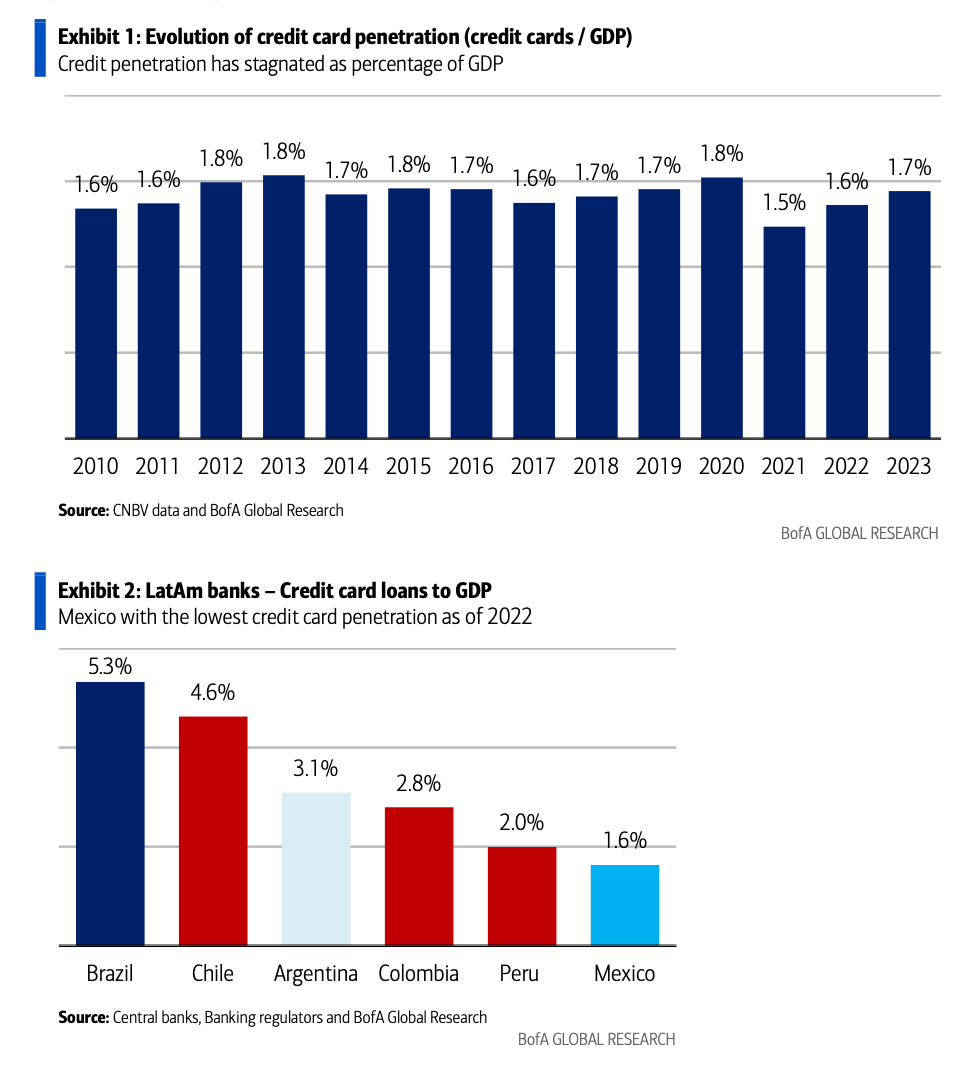

(1/16) TransUnion plans to expand in Latin America by acquiring a 68% stake in Mexico's Buró de Crédito consumer credit business for $560 million, boosting its ownership to 94%. Already a key player in Buró's operations, TransUnion aims to enhance financial inclusion and leverage its global technology to expand into areas like FinTech and insurance. This move positions TransUnion as the leading credit bureau in Spanish-speaking Latin America, with expected 2024 revenue of $145 million from the acquisition. The deal is set to close by the end of 2025, pending approvals. [TransUnion] [Deal Presentation]

TransUnion to Acquire Mexico’s Leading Consumer Credit Bureau

Toaster Team’s Take:

Overall, we think this is a good move for TransUnion. It’s relatively low risk (they’ve already been in this business for a while), and they’ve shown their ability to buy and operate a credit bureau in Latin America (in 2016, they bought a credit bureau in Colombia).

On the conference call announcing the deal, TransUnion management made a point to stress why this deal is so important to them. In particular, they stressed their commitment to ‘financial inclusion.’

[with this deal they can] “offer enhanced solutions beyond traditional reports to support credit access (trended data, alternative data, advanced analytics) and ID verification (biometrics, device risk)”.

This only helps expand access to credit in Mexico.

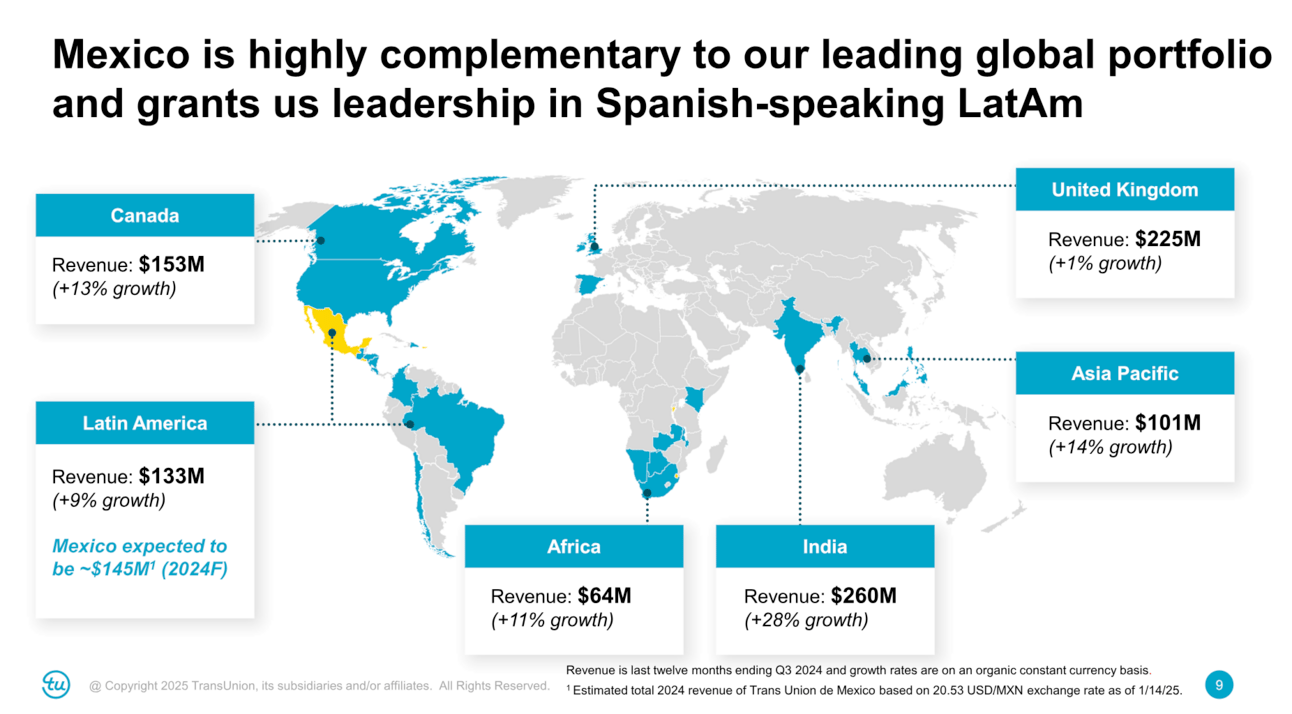

To help us understand the opportunity TransUnion sees, we found a great “Credit Card Primer” on Mexico from BofA Securities published in February 2024.

If you have time, you should read the report. If you don't, this is what we found interesting.

Credit Card Penetration

Low penetration rate: Mexico has only 48 million credit cards, equating to one card for every two adults.

By contrast, Brazil has 430 million credit cards (2.7 cards per adult).

The primary use of credit cards in Mexico is for hospital bills and retail purchases, with cash accounting for 80% of consumption.

Market Composition

Incumbent dominance: Five major banks (BBVA, Citi, Santander, Banorte, and HSBC) control 85% of the credit card loan book and 70% of issued cards.

BBVA and Citi hold the largest shares, collectively accounting for 54% of the market.

Smaller players like Invex (business cards) and BanCoppel (retail-focused) are gaining traction.

Growth Trends

Credit card balances grew at a 7% compound annual growth rate (CAGR) since 2010, reaching MXN 538 billion (~USD 30 billion) in October 2023.

Stagnation: Credit card balances as a percentage of GDP have remained flat over the past decade at ~1.7%.

The number of cards dropped during economic crises (e.g., 2009's global financial crisis and the 2018 Mexico earthquake) but rebounded in the past two years.

Competitive Landscape

Fintech Disruption:

New entrants include Nubank, Uala, Stori, Mercado Pago, Rappi, and Klar.

These players attract customers with higher deposit interest rates (~15%, compared to market rates of ~11%).

As of September 2023, Nubank in Mexico led non-bank lenders with 3.6 million users, followed by Stori with 2 million.

Industry Economics

Credit cards contribute 30% of Mexican banks’ core revenues (20% from net interest income and 70% from fees).

Key financial metrics:

On average, 18% of card balances revolve and the annual rate charged on this balance averages 29%.

The non-performing loan (NPL) ratio averaged 5.2% and reached a peak of 9.4% during the Global Financial Crisis.

Revolving balance: Averaged 18% of credit card debt.

In other (not so fun) TransUnion News:

(1/16) The CFPB is taking a stand against TransUnion for allegedly mishandling personal data on credit reports, like mixing up phone numbers and failing to disclose information sources. As part of their broader mission to hold credit reporting companies accountable, the CFPB filed an amicus brief, pushing back on TransUnion's claim that accuracy requirements don’t apply to personal identifiers like phone numbers. This follows other actions against credit giants, including a recent lawsuit against Experian for failing to investigate consumer disputes. The message is clear: bad data has real consequences, and the CFPB isn’t letting it slide. [CFPB]

(1/21) U.S. Bank teamed up with NFL legend Peyton Manning for a playful new ad campaign promoting its Smartly™ Visa Signature Card. The commercial, which debuted during the College Football Playoff National Championship, shows Manning diving into birdwatching with the help of the Smartly card—earning cash back on all his quirky purchases like gear and supplies. The card, launched in late 2024, pairs with a Smartly Savings account to maximize rewards with no annual fee. Expect another Manning TV spot later in 2025. [U.S. Bank]

(1/21) Rocket Companies, the fintech giant behind mortgage, real estate, and financial services brands, unveiled a sleek rebrand featuring a new logo, wordmark, and softer color palette aimed at appealing to women, Gen Z, and the Hispanic community. Led by CMO Jonathan Mildenhall, formerly of Airbnb and Coca-Cola, the refresh is part of a larger push to simplify homeownership and position Rocket as "culturally significant." The company will reveal its new creative ethos during a Super Bowl 59 ad, promising a shift toward "community-driven storytelling." Meanwhile, Rocket faces scrutiny over a DOJ lawsuit alleging discrimination, which the company denies. [Adweek] [Creative Bloq]

(1/16) A recent podcast highlights the CFPB's crackdown on financial institutions launching products before they're market-ready. In two recent cases, one involving a virtual banking platform and the other a credit card issuer, regulators flagged major oversights like inadequate vendor vetting, insufficient testing, and disregarded warnings. The result? Consumer harm and hefty penalties for the companies. The takeaway is that skipping "industry-standard risk management practices" to hit the market fast can backfire. [Troutman Pepper Locke LLP]

(1/20) Barclays is reportedly in talks with Apple to replace Goldman Sachs as the Apple Card partner, according to sources cited by Reuters. Discussions, ongoing for months, come as Goldman shifts away from retail banking despite a partnership contract with Apple lasting until 2030. Barclays recently took over General Motors’ credit card program and joins other contenders like JP Morgan Chase and Synchrony Financial for the coveted Apple deal. This follows a $90 million penalty levied against Apple and Goldman by the CFPB in 2024 for customer service issues. [FinTech Futures]

(1/14) Medical credit cards, like CareCredit, are drawing scrutiny as they increasingly burden patients with deferred interest and hidden costs. These cards, pushed by providers for procedures often not covered by insurance, can charge steep interest rates—up to 32.99%—if balances aren’t paid off during promotional periods. Critics argue both providers and lenders exploit vulnerable patients, leading to lawsuits, growing debt, and even wage garnishments. While some states, like California and Illinois, have implemented regulations to curb misuse, the CFPB and advocacy groups continue to monitor and challenge these practices. [Time] [Stories by Alana Semuels]

(1/19) Card fraud, which hit an estimated $34 billion globally in 2024, remains an ever-evolving arms race between scammers and issuers. Innovations like EMV chips, magnetic stripes, and online tokenization were designed to combat fraud, but criminals keep adapting with tactics like skimming, social engineering, and hacking merchant databases. Issuers now rely on advanced tools like AI-driven risk scoring, MFA, and tokenization to stay ahead, but the cycle of innovation and fraud persists. The question remains: how will hackers outmaneuver these defenses next? [Financial Rewards Substack]

Earnings

Capital One - Total company marketing expense of $1.4B in the quarter, up 10% YoY. Credit card purchase volume of $172.9B, up 7% YoY and 4% QoQ. Card net charge-off rate of 6.02%, up 69bps YoY and up 42bps QoQ. Q4 2024 Earnings Release Presentation

“Total company marketing expense in the quarter was $1.4 billion, up 10% year-over-year. Our choices in Domestic Card are the biggest driver of total company marketing. We continue to see compelling growth opportunities in our Domestic Card business.”

-Richard Fairbank, Capital One CEO

Bank Of America - BAC created 900,000 new consumer credit card accounts in the quarter (76% of these sales were initiated and/or booked via their digital platforms). Card net charge-off rate of 3.79%, up from 3.70% in the prior quarter. Average consumer bank deposits of $942.3B down 1.8% YoY but up 0.8% QoQ. Q4 2024 Financial Results Presentation

“The biggest story in consumer this quarter is deposits because these are the most valuable deposits in the franchise. And in the last 6 months, we believe we've seen the floor begin to form after several periods of slowing decline. Consumer Banking deposits appear to have bottomed in mid-August at around $928 billion and ended the year at $952 billion on an ending basis. Looking at averages, you can see then the deposits grew $4 billion from the third quarter to $942 billion, all while our rate paid declined to 64 basis points.”

Alastair Borthwick, Bank of America CFO

J.P. Morgan-Chase acquired nearly 10M new card accounts (!). Card services net charge-off rate of 3.30% for the quarter, up from 2.79% a year prior and 3.24% a quarter prior. Debit and credit card sales volume of $477.6B up 8.3% YoY and 5.3% QoQ. Q4 2024 Earnings Presentation

“In CCB, we had a record number of first-time investors and acquired nearly 10 million new card accounts.”

“On credit, we expect the 2025 card net charge-off rate to be in line with our previous guidance of approximately 3.6%.”

Jeremy Barnum, J.P. Morgan CFO

Shout out to Cole Gottlieb, for his timely and detailed earnings coverage, which helped us pulled together our rundown.

Regulation

(1/16) American Express to Pay $230 Million to Settle Deceptive Marketing Claims. [The New York Times]

(1/16) Cash App Owner Pays States And CFPB To Settle Alleged Anti-Money-Laundering Deficiencies And Fix Its Failures On Fraud. [Substack]

(1/17) CFPB calls on states to be more aggressive in enforcing consumer financial protection laws. [Consumer Finance Monitor]

(1/16) Trump 2.0 Could Mean a More Bank- and Fintech-Friendly Environment. [JD Supra]

(1/21) New FDIC Chair Pledges ‘Wholesale Review’ of Bank Regulations. [PYMNTS]

(1/21) EY Reports Growing Divide in Global Finserv Regulations. [FinTech Magazine]

(1/15) 🎤 RegFi Episode 54: Imagining the Future of the CFPB and Consumer Financial Regulation. [Orrick]

Launches & Partnerships

(1/14) Sezzle Unveils Money IQ: An Interactive Rewards Program Promoting Financial Education. [Sezzle]

(1/16) SoFi and PGIM Fixed Income Announce $525 Million Securitization Agreement, Signaling Continued Demand for Personal Loans. [Business Wire]

(1/21) Gate City Bank selects Lama AI for GenAI-powered loan origination tech. [FinTech Futures]

(1/21) OTTOMOTO Partners with Algebrik AI to Enhance Embedded Lending with AI-Driven Insights. [Business Wire]

(1/15) Upstart Unveils Enhanced Showroom and Auto Financing Solutions that Boost Dealership Sales, Elevate Customer Experience. [Upstart]

Canada

(1/17) 🎤 Revolutionizing Canadian Fintech: Rob Khazzam on Float’s $70M Series B and the Future of Business Banking. [Tank Talks]

(1/16) Report from Visa Highlights Potential of Uplinq to Transform Lending in Canada. [Fintech.ca]

(1/15) Feds impose new limits on ‘predatory lenders’ following grassroots campaign. [NB Media Co-op]

UK

(1/20) UK green fintech start-up Tred to wind down. [FinTech Futures]

(1/16) Scoop: Barclays to shutter Rise fintech accelerator, coworking spaces. [Axios]

(1/15) UK’s Intelligent Lending plots expansion with TotallyMoney acquisition. [FinTech Futures]

(1/21) Revolut Expands Security Features with In-App Calls for Personal Customers. [Finance Magnates]

(1/20) Revolut launches new option for its credit-card customers to pay by instalments. [MSN]

Other stuff we’re reading and listening to

(1/21) 🎤 Where Citi Ventures is placing its fintech bets in 2025 American Banker

(1/19) 🎤 Reaching the Unbanked through Fintech: A Conversation with Steve Royster, MoCaFi Apple Podcasts

(1/21) Highnote Secures $90 Million Series B, Announces Expansion into U.S. Merchant Acquiring Business Wire

(1/21) Stripe is laying off 300 people, but says it still plans to hire in 2025 TechCrunch

(1/20) Klarna's pre-IPO moves: Expand Stripe alliance, dump loans American Banker

(1/15) Afterpay co-founder's new act raises $17M Axios

(1/15) Borrowers with poor credit ratings make up majority of BNPL borrowers Consumer Finance Monitor

(1/15) Wells Fargo shared their Q4 2024 Earnings Presentation

Jobs

Spotlight of the week:

VP Growth Marketing, Deposit Accounts, US at Zeta

About the Role

We are looking for someone with a deep understanding and hands-on experience in strategizing, defining, and managing high-volume acquisition programs for Retail DDA, Checking and Saving Accounts, including but not limited to one or more of SEM, SEO, Content Marketing, Influencer Marketing, Digital aggregators, affiliate marketing, and referral marketing.

The ideal candidate has hands-on experience across various dimensions of managing new customer acquisition for large fintechs or neobanks including -

Digital Marketing - Experience in setting up and optimizing CAC and funnel conversion for SEM and social ad campaigns

Affiliate and Influencer Marketing - Selecting, negotiating, and setting up affiliate and influencer marketing campaigns

Digital Aggregators - Hands-on experience in negotiating, setup, and funnel optimization with aggregators like BankRate, Nerd Wallet etc

Funnel Conversion and Optimization - Expertise in A/B testing, funnel optimization, conversion optimization

Analytics - Experience in creating conversion dashboards and measuring and optimizing CAC to ensure our financial goals, including payback period and RoA are served

Automation knowledge - In-depth knowledge of various campaign management tools and analytics tools

Other jobs:

Growth Marketing Associate (Credit Karma)

Marketing Program Manager (Robinhood)

Senior Visual Designer, Go-To-Market (Robinhood)

Dir, Affiliate Growth & Optimizations, CNBC Select (NBCUniversal)

Product Marketing Manager (BitGo)

Product Marketing Manager (Narmi)

Director of Marketing (Narmi)

Senior Manager, Financial Partnerships, Americas (Airwallex)

Director Growth Team- FinTech (Serent Capital)

Head of Product, Growth and New Solutions (Cardlytics)

AVP, Lead Product Marketing Manager (Triumph Financial)

Director, Product Marketing (Santander)

Executive Director, Digital & Marketing Channels (Northwest Bank)

Director, MPS Brand Strategy (U.S. Bank)

Growth Associate - CRM (London) (Capital on Tap)

About Us

Welcome to The Free Toaster! The newsletter for marketing pros at banks and lenders.

Inspired by the free toasters banks used to give to each new customer, we’re here to help you acquire more customers at scale. We deliver fresh news, data, and insights to help you acquire more customers—minus the breadcrumbs.

Want to follow the authors on social media? Find Nick Madrid and Carlos Caro on LinkedIn.

Have an idea for a newsletter?

Ghostmode built this newsletter and can build yours, too.

(click here or reply to this email to learn more)