Upgrade IPO timing, Why Upstart Spooked Investors, and more

News for Fintech Marketers: August 7, 2025

Howdy Toasterites! 😎

With Nick still in Hawaii chillin’, you’re stuck with me this week. A few stories have dropped in the last few days so here’s my quick and dirty briefing.

-Carlos

(Lending) Upgrade IPO is coming 2027-ish

So about that Upgrade IPO everyone keeps asking about... yeah, it's still not happening (yet). Renaud gave an 18 month target for the IPO, while adding:

“We recently exceeded $1 billion in annual revenue run rate, our operations are cash flow positive, and we see predictable growth in the next 3 to 4 years.”

Source: CrowdfundInsider

Their metrics look good, and they’ve been upgrading their exec team, too (sorry, couldn’t help myself 😀 ).

“Upgrade notes that it has boosted its management team by adding Jeffrey Meiler, former CEO of Best Egg, as Chief Operating Officer, Jason Swift as SVP, Operations Strategy, and Sumit Agarwal as Head of Cards.” [Crowdfundinsider]

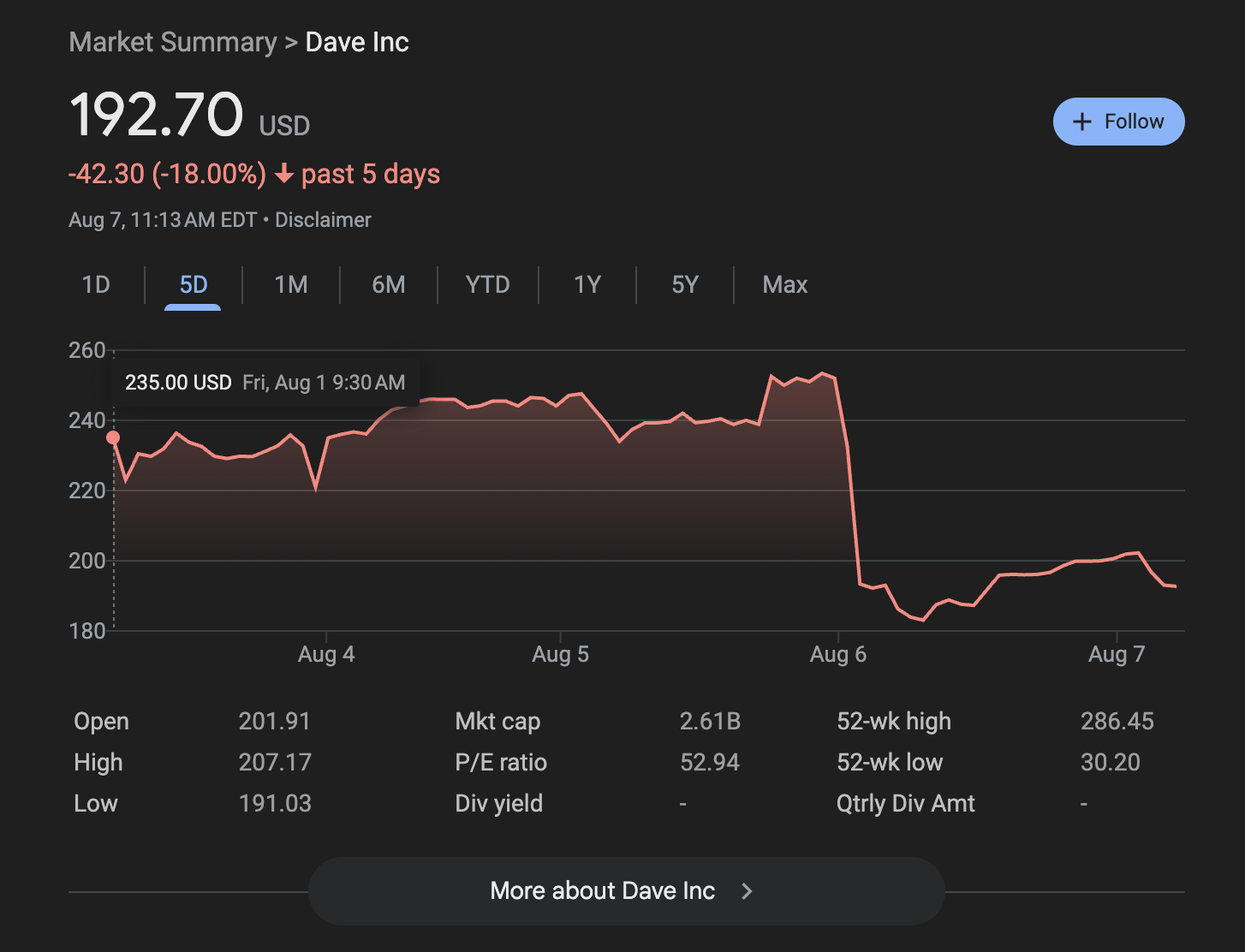

(Earnings) Upstart Earnings Beat Expectations and Stock Dropped 18%

Upstart had a great quarter. Go see the numbers for yourself in Upstart’s recent press release.

But the stock was hit hard after the earnings call, raising questions about what spooked investors.

Source: Google

According, to MarketWatch, two things spooked investors: (1) Upstart holding more loans on balance sheet, while Wall St prefers they sell them off (2) Upstart cut their guidance on net interest income to $65MM for the full year, down from $90MM previously. [MarketWatch]

(Earnings) Remitly Earnings

Remitly delivered impressive Q2 results, beating revenue expectations with a 34% year-over-year increase to $411.9 million. The company achieved GAAP net income of $6.5 million, swinging from a $12.1 million loss in the prior year. Key operational metrics showed solid progress: send volume surged 40% to $18.5 billion, active customers grew 24% to 8.5 million, and Adjusted EBITDA jumped 144% to $64 million.

However, EPS of $0.03 came in significantly below the $0.19 analyst consensus, disappointing investors focused on per-share profitability metrics. Despite this earnings miss, the company demonstrated confidence in its trajectory by announcing a $200 million share repurchase program and raising full-year guidance. Revenue is now projected at $1.61-1.62 billion with Adjusted EBITDA of $225-230 million for 2025 [Remitly]

(Earnings) Dave Earnings Meet Market Skepticism

Dave Inc. reported outstanding Q2 performance with revenue accelerating 64% year-over-year to $131.7 million—the company's fastest growth rate in over five years. EPS of $3.14 crushed analyst expectations of $1.49, driven by a 16% increase in monthly transacting members and remarkable 42% growth in average revenue per user (ARPU). Adjusted EBITDA more than tripled to $50.9 million, representing a 39% margin.

Source: Google

Despite these impressive results and the announcement of expanded banking partnerships, Dave's stock fell 13% in pre-market trading. Market reaction reflected concerns about the company's elevated valuation multiples and cooling investor enthusiasm following a substantial rally earlier in the year. The company raised full-year revenue guidance to $505-515 million, betting on continued product adoption and operational leverage. [Investing.com]

(Earnings) Chase Reports Q2 Earnings Exceeding Wall St Expectations

JPMorgan delivered Q2 results that exceeded Wall Street expectations: EPS reached $5.24 versus the $4.48 consensus, while revenue came in at $45.7 billion. Net income remained strong at $15 billion despite a 17% year-over-year decline (largely due to comparisons with prior-year Visa-related gains). Return on tangible common equity (ROTCE) held steady at 21%, demonstrating consistent profitability.

The bank benefited from volatile market conditions, with fixed income trading revenue jumping 14% to $5.7 billion and investment banking fees rising 7% to $2.5 billion on higher debt underwriting and advisory activity. Importantly, JPMorgan raised its 2025 net interest income guidance to approximately $95.5 billion, highlighting management's confidence despite economic uncertainties and ongoing investments in digital banking capabilities.

Market reaction was modestly positive (+0.47% in early trading), with analysts praising JPM's continued ability to generate strong returns and maintain dividend payments despite broader banking sector challenges and market volatility. [CNBC]

(Toaster Editorial) 6 Hard-Earned Lessons On Income Verification, From Kirill Klokov, CEO at Truv

Income verification might not be the sexiest part of fintech, but it's arguably one of the most important. What's the point of having a slick lending app if you can't tell whether borrowers have the means to pay you back?

We recently caught up with Kirill Klokov, CEO of Truv, to get his take on how lenders should think about income verification in 2025. He shared his hard-earned lessons that every lender should internalize.

(Toaster Podcast) E030 - Launching Affiliate Marketing Programs With Alana Levine, CRO at Fintel Connect

We sat with Alana Levine, Chief Revenue Officer at Fintel Connect, to uncover what financial institutions get wrong when launching affiliate marketing programs—and more importantly, how to get it right from day one.

Support The Free Toaster

Need an affiliate marketing platform/network? Chat with Fintel Connect

Need help hiring key roles? Email Connie Buehler and mention TOASTER

Need to improve application page conversions? Chat with Spinwheel

Need to accelerate your affiliate marketing? Chat with New Market Growth

Need to win on other growth channels? Chat with FIAT Growth

None of the above? Share our Newsletter in your favorite Slack channel

About Us

Welcome to The Free Toaster! The newsletter for marketing pros at fintechs, banks, and lenders.

Inspired by the free toasters banks used to give to each new customer, we’re here to help you acquire more customers at scale. We deliver fresh news, data, and insights to help you acquire more customers, minus the breadcrumbs.

Want to follow the authors on social media?

Carlos Caro is the founder of NMG, an agency that helps lenders build affiliate programs.

Nick Madrid the co-founder of Ghostmode, a media company that builds Newsletters, Podcasts, and communities in high-value B2B niches