The AI Finfluencers Are Coming

The next billion dollar distribution channel for lenders

If you want a look into marketing-geek anxiety, go grab a coffee with a fintech lending CMO and ask about their distribution channels. Listen long enough, and many will quietly admit their growth is closely tied to the affiliate marketplace category. They mean sites like Credit Karma, Experian, NerdWallet, Bankrate, and a few others.

These channels have been great for growth, but concentration has been an unintended side-effect.

Our informal convos with U.S. fintech lenders suggest that anywhere from 30% to 70% of their new customer volume comes from affiliate marketplaces, with the remainder coming through direct mail, paid search, paid social, and some first party channels.

The global affiliate marketing industry (all categories, not just lending) is expected to reach $18.5B in 2025, while global affiliate revenues are set to hit nearly $32B by 2031. In U.S. consumer lending specifically, we estimate brands spent $4B-$6B per year on affiliate marketing.

As the category grows, lenders are left hoping they remain in good standing as marketplace platforms tinker with rankings, increase product/competitive density, and perfect their algorithms.

In parallel, lender innovation is accelerating.

Take Yendo’s vehicle-secured credit card, which lets subprime consumers unlock up to $10,000 in credit, by backing the card with an auto title. Or consider the upcoming Coinbase One Credit Card, which plans to pay a full 4% on every purchase for consumers that hold enough assets in their Coinbase accounts.

Product innovation will lead to more competition. And more competition will put increasing pressure on consumer lending brands to find new (and growing) sources of customer acquisition.

The Setup: Finfluencers Are Under-Monetizing

The global creator economy—spanning from YouTube to TikTok—has minted its own crop of “Finfluencers” who have established a level of trust with their audiences that lenders would kill for.

In 2024, the influencer marketing industry hit an estimated $24B, almost doubling since 2019. Influencers over-index on audience trust and engagement, yet only about 13% of them (across all categories) earn more than $100,000 per year in 2023.

With more than 400,000 followers and posts that average 100,000 views, Clint Brantley is a big creator. But he only made $58,084 in 2023 (less than the U.S. median pay for full-time workers).

Huge financial creators like Vivian Tu (aka Your Rich BFF) had an audience of over 5MM viewers in 2022, and pulled in over $3MM in revenue that year (paying herself $300,000).

Influencers have mastered getting attention, but are still in the infancy of monetization.

Social platforms own the rails, fintechs own the product, and creators are monetizing with one-off sponsorships or course sales rather than ongoing affiliate partnerships that pay them a percentage of the value they create for their brands.

How Much Money Could Vivian Tu (Your Rich BFF) Be Making?

Let’s study the $3MM in revenue Vivian made in 2022 from her 5MM audience. That’s 60 cents per audience member per year.

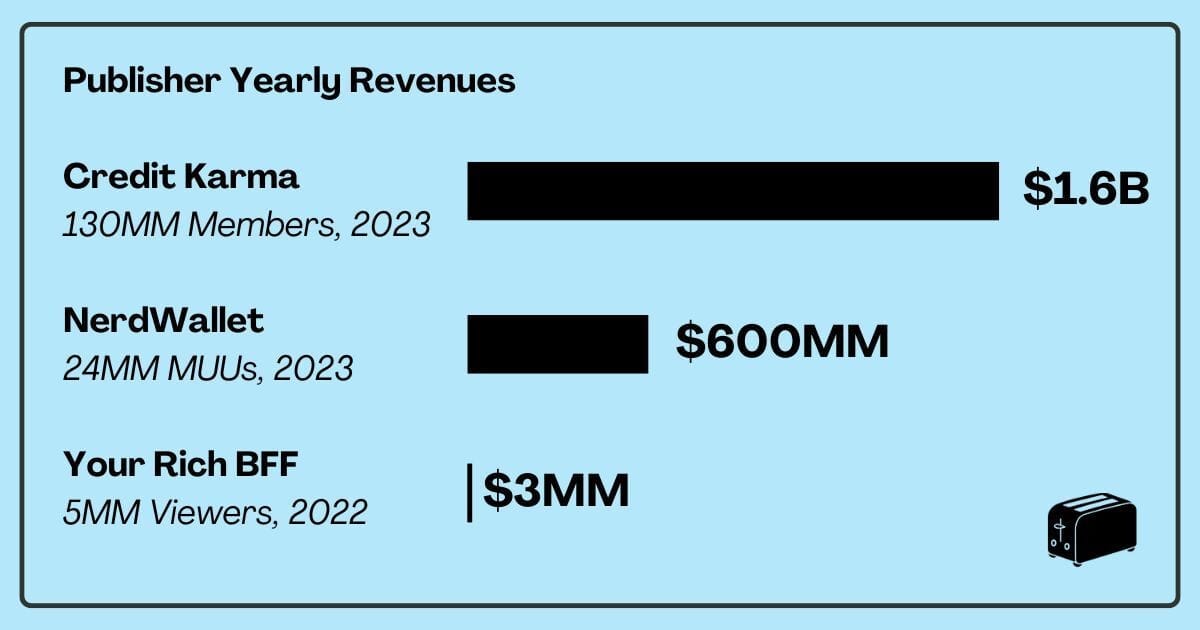

To make the analysis simple, we’ll look at Credit Karma and NerdWallet, two publishers who report their revenues and audience sizes publicly.

Credit Karma made $1.6B in revenue in fiscal 2023, with a member base of 130MM. That’s $12.31 per audience member per year—20X better monetization than Vivian.

NerdWallet made nearly $600MM in revenue in fiscal 2023, with an average of 24MM monthly unique users (MUUs). That’s $25 per MUU. That’s difficult to compare to Vivian’s performance since we only know her total audience, and not her MUUs.

If Vivian monetized at Karma’s $12.31 per audience member per year rate, she would have pulled in $61.5MM in revenue in what’s probably a 2 or 3 person operation.

Now she’d be Your Even Richer BFF.

And to make it crazier, I can think of reasons why Vivian’s monetization could be better than Karma’s (with the right infrastructure behind her). But that’s a rabbit hole for another day.

What I want you to take away is that even the best Finfluencers are severely underpaid, when you compare them to best-in-class monetization benchmarks in the traditional financial media space.

Lenders Will Continue To Funnel Advertising Dollars To Finfluencers

Consumer demand for trusted, direct financial advice keeps climbing. And the influencer channel is producing strong returns for the brands already investing.

How do we know that?

Businesses see an average of $6.50 in revenue for every $1 spent on influencer marketing, highlighting the yield influencers can drive as performance marketers.

The above data isn’t specific to the lending industry.

But our analysis above—showing how Finfluencers like Vivian Tu are severely under-monetizing relative to traditional publishers—help paint the picture that 2025 Finfluencer media could be an exceptionally good deal for lenders.

The Rise Of The Digital Twin

A technological wave is forming that will drag both lenders and creators—willing or not—into the future.

The global AI chatbot market is exploding, growing from under $14B in 2025 to a projected $46–47B by 2029. In financial services alone, AI-powered agents are expected to save the industry $80B in customer service costs by 2026, with chatbots automating between 30% and 80% of interactions depending on the institution.

But it’s not just big orgs that will benefit from this tech.

What’s coming is that any Finfluencer can deploy a “digital twin” at unlimited scale.

These “twins” will be 24/7 personal finance assistants that answer questions in the creator’s voice, recommend products from a curated affiliate catalog, and provide compliant, personalized advice.

And these twins won’t be just chatbots. They’ll be voice agents you can call and video agents you can chat with on Zoom. They’ll have the image, voice, and likeness of the creator. It’s going to be wild.

Imagine a creator with 250,000 followers who’s never been able to scale 1:1 advice suddenly mobilizing an army of “digital twins” that matches individual audience members with lending products, explains APRs, terms, fees, and handles application handoffs—with bank-approved compliance and reporting built-in.

This is what will get Vivian to $61.5MM in revenue per year (in practice it’ll be even more revenue, because she’ll have more resources to reinvest in content, distribution, and technology).

The Skeptics May Be Losing Sight of Consumer Behavior

When I chat informally with friends in the industry I hear:

“Lenders will never delegate distribution to creators and AI.” “Creators won’t trust bots to speak for them.” “No one really wants advice from an AI, right?”

But the facts are telling another story:

Lenders are actively exploring how to diversify customer acquisition; the white space for new origination channels (especially B2B and embedded distribution) is a top boardroom topic. [CAIS Group]

AI chatbots now resolve up to 80% of customer service inquiries without human intervention, with customer satisfaction scores increasing as implementation matures. [Kayako]

Consumers are acclimatizing to AI-powered advice as trustworthy in their digital finance lives [CFP.net]

Early-mover lenders who figure out compliance and content governance will lead the next distribution land grab.

The Next Billion Dollar Distribution Platform

A platform is going to emerge—and fast—where Finfluencers can launch always-on AI assistants, seamlessly integrating with affiliate partners and full-stack compliance engines. Creators focus on building trust and content; the platform takes care of product matching, disclosures, compliance, and payments; lenders gain access to performance-based, customer origination at scale in a channel their competitors are ignoring.

The VCs and operators that power Finfluencer Monetization for the ecosystem at large will be drinking Cristal and flying private to the Maldives for their off-sites.

How Fintech Lenders Should Prepare

If you’re a fintech lender reading this, the playbook is coming into focus:

As reasonable as the above preparations sound, many lenders won’t take any action at all. Because combining AI with social media will be viewed with skepticism.

It will feel like a nightmare from a compliance perspective, and it will feel overwhelming from a partnership perspective (who’s going to go find, sign, and manage all these Finfluencers?)

But guess what?

Lenders were skeptical of internet-sourced loan applications in the early 2000s.

Lenders were skeptical of paid search in the mid 2000s.

Lenders weren’t sure if consumers would bank on mobile devices when the iPhone shipped in 2007.

Lenders weren’t sure Credit Karma was going anywhere in 2010.

Lenders weren’t sure social media ads would produce a return in 2012.

And, the list goes on.

By design, lenders are paid to worry and be skeptical. They manage risk for a living.

So you might be skeptical that AI Influencers will have any impact on your distribution strategy. And that’s OK. But what bets can you place today to keep a pulse on the market, so that you can lean in when it starts working?

Support The Free Toaster

Need an affiliate marketing platform/network? Chat with Fintel Connect

Need help hiring key roles? Email Connie Buehler and mention TOASTER

Need to improve application page conversions? Chat with Spinwheel

Need to accelerate your affiliate marketing? Chat with New Market Growth

Need to win on other growth channels? Chat with FIAT Growth

None of the above? Share our Newsletter in your favorite Slack channel

About Us

Welcome to The Free Toaster! The newsletter for marketing pros at fintechs, banks, and lenders.

Inspired by the free toasters banks used to give to each new customer, we’re here to help you acquire more customers at scale. We deliver fresh news, data, and insights to help you acquire more customers, minus the breadcrumbs.

Want to follow the authors on social media?

Carlos Caro is the founder of NMG, an agency that helps lenders build affiliate programs.

Nick Madrid is the co-founder of Ghostmode, a media company that builds Newsletters, Podcasts, and communities in high-value B2B niches.