Capital One & T-Mobile Partner on Credit Card Launch, Affirm Lands $750M Backing, Pagaya Adds $500M Auto Deal

Plus, the Fed’s SLOOS report signals cautious optimism for lenders, and Q3 results from Visa, PayPal, and Rocket Companies underline fintech resilience.

Hey Toaster Readers,

This week is sponsored by our friends at Fintel Connect.

Fintech partnerships took center stage. T-Mobile and Capital One rolled out a new Visa card designed to turn everyday purchases into rewards, while Affirm signed a $750 million loan purchase deal with New York Life, strengthening its funding pipeline. Pagaya added another major win, securing a $500 million auto loan agreement with Castlelake as private credit firms keep expanding their role in consumer lending.

Regulators are also in focus. The Federal Reserve’s October SLOOS survey shows banks slowly easing lending standards, even as VantageScore data points to higher delinquencies and TransUnion reports a widening credit gap between super prime and subprime consumers. At the same time, the CFPB rollback under the Trump administration continues, with new court rulings reinforcing the Fed’s discretion over fintech access to payment rails.

Earnings this week underline the divide between disciplined lenders and high-growth platforms. Upstart and Dave both posted their strongest quarters yet, while Visa and PayPal delivered steady gains in payments and cross-border volume. LendingTree, OneMain, and Rocket Companies rounded out the quarter with improved margins and cautious optimism for 2026.

Here’s what’s happening across fintech right now.

PS: To support our Newsletter, please share it with one colleague!

Capital One & T-Mobile Team Up On A Credit Card

Source: T-Mobile

T-Mobile, the supercharged Un-carrier, and Capital One, a major financial holding company, teamed up to launch the new T-Mobile Visa card, turning everyday purchases into T-Mobile Rewards. Cardholders get 2% in rewards on "every purchase, every day" and a whopping 5% in rewards on new phones, devices, and accessories purchased at T-Mobile. The card also gives members with eligible plans a special $5 monthly AutoPay discount on up to eight lines, a perk no other credit card can offer at T-Mobile. The card comes with no annual or foreign transaction fees, and it stacks on top of existing Magenta Status benefits with extra perks like "up to 50% off select hotels" through T-Mobile Travel. This partnership combines Capital One's deep investment in credit card innovation with T-Mobile's disruption history in financial services, aiming to give customers the "VIP treatment" they deserve. [PYMNTS]

Affirm Signs $750M Deal With New York Life

Affirm, a Buy-Now-Pay-Later payments company, just secured a new deal with New York Life Insurance, highlighting how traditional finance giants are deepening their ties with fintech lenders. Under the agreement, New York Life will purchase "up to $750 million worth of Affirm's installment loans through 2026," providing fresh off-balance-sheet financing. This funding will support "roughly $1.75 billion in annual loan volume" for the payments company. The deal extends a relationship that started in 2023 and follows a "broader trend" of insurers like Liberty Mutual Investments and PGIM moving into consumer finance, as higher interest rates make these assets more attractive. New York Life has already funneled "nearly $2 billion into Affirm’s collateral pools" since their partnership began. Affirm boasts strong credit performance, with "more than 90% of its borrowers" being repeat customers. [CNBC]

Pagaya Secures $500M Auto Loan Deal with Castlelake

Pagaya Technologies, a financial services platform that uses machine learning to assess borrower risk, just signed a "half-billion-dollar deal" to offload auto loans to private credit manager Castlelake. The agreement is a forward flow arrangement "worth up to US$500M," where the asset manager commits to purchasing auto loans as they are generated, giving the fintech immediate liquidity. This deal is the second major funding agreement this year between the two companies, following a "$2.5B deal focused on personal loans" announced earlier. CEO Gal Krubiner emphasized that Pagaya's model incorporates "rigorous dealer oversight and multiple layers of third-party verification" amid rising scrutiny in the auto lending sector. The forward flow agreement arrives as the company shows "improved financial performance," having entered "an era of profitability" in 2025. [Fintech Magazine]

Robinhood and Sage Home Loans Team Up On Mortgage Offer

Source: Robinhood

Robinhood, the financial services platform, just fully rolled out a new mortgage offer for its Gold subscribers through an exclusive partnership with Sage Home Loans, a modern digital mortgage lender. Starting immediately, all eligible Robinhood Gold subscribers can access mortgage rates "at least 0.75% below the national average," plus receive a "$500 credit toward closing costs" for new home purchases or refinances, all powered by Sage Home Loans. Robinhood Director of Partnerships Sakhi Gandhi says this new benefit, which was piloted over the summer, supports the company's mission to "democratize finance for all" and "reduce financial barriers to homeownership". Sage Home Loans CEO Mike Malloy emphasized that their goal is to help more people turn financial progress into homeownership by making the mortgage experience "simple, digital, and transparent". This collaboration highlights a major transformation in the mortgage industry, where "data-driven technology, transparency, and user experience" are rapidly reshaping how people buy and refinance homes. [Robinhood]

TransUnion Reports Credit Card Originations Increased 9% YOY in Q2 2025

TransUnion's Q3 2025 Credit Industry Insights Report revealed a "divergence in consumer credit risk," as the percentage of consumers in the "super prime" risk tier continues to rise, hitting 40.9% in Q3 2025, while the "subprime" segment has returned to pre-pandemic levels at 14.4%. This two-sided movement suggests that while many consumers are navigating the economy well, others are facing financial strain. This divergence showed up most clearly in credit card and auto lending, where year-over-year growth in both new account originations and total balances was "strongest in these two tiers". Credit card originations, driven by "super prime and subprime segments," rose 9% year-over-year in Q2 2025 for the third consecutive quarter, while unsecured personal loan originations saw a "substantial" 26% year-over-year increase. Mortgage activity also ticked up 8.8% year-over-year, but the consumer-level 60+ DPD delinquency rate "edged up" to 1.36%. Auto loan originations "rose 5.2% YoY," led by growth in the super prime and subprime tiers, but delinquency rates among newer vintages remain elevated. [TransUnion]

The October 2025 Senior Loan Officer Opinion Survey on Bank Lending Practices

The Federal Reserve’s October 2025 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) shows that banks kept consumer lending standards mostly unchanged in the third quarter. Auto loans saw a small easing in terms, while credit cards and other personal loans stayed steady. Compared with the sharp pullbacks seen in 2020 and 2022, lenders appear to have found a cautious middle ground, maintaining credit access while monitoring repayment trends and household budgets.

Source: Federal Reserve

The survey also shows a slight increase in banks’ willingness to make new consumer installment loans. It’s a quiet but notable shift after more than a year of tightening. Even so, most banks remain selective, balancing credit growth against rising delinquency ratios and the high cost of funds. The tone of this report suggests lenders are ready to lend again, but only where performance and risk data justify it.

On the demand side, consumers continue to send mixed signals. Credit card and personal loan applications have picked up, likely driven by holiday spending and short-term liquidity needs, while auto loan demand continues to weaken as elevated rates dampen affordability. For fintechs and lenders, the message is clear: growth opportunities are strongest in short-term and revolving credit, while big-ticket financing remains a tougher sell. [Federal Reserve]

SavvyMoney Raises $225M to Accelerate Innovation for Financial Institutions

Source: SavvyMoney

SavvyMoney, a financial wellness and growth solutions provider, just raised a "minority investment" of $225 million, co-led by PSG and Canapi Ventures, with continued backing from Spectrum Equity. CEO JB Orecchia cheered the validation, noting they've spent years proving that community banks and credit unions can deliver value-driving financial wellness tools. PSG, specializing in scaling B2B software, brings its software expertise to enhance the platform's ability to drive customer engagement. Canapi Ventures contributes deep financial services expertise through its network of over 70 financial institutions, providing direct insight into banks' needs. This fresh capital will "accelerate" SavvyMoney's product roadmap and market investments, helping it better serve its core community of over 1,500 financial institutions. The company has almost doubled its institutional footprint since 2021. [SavvyMoney]

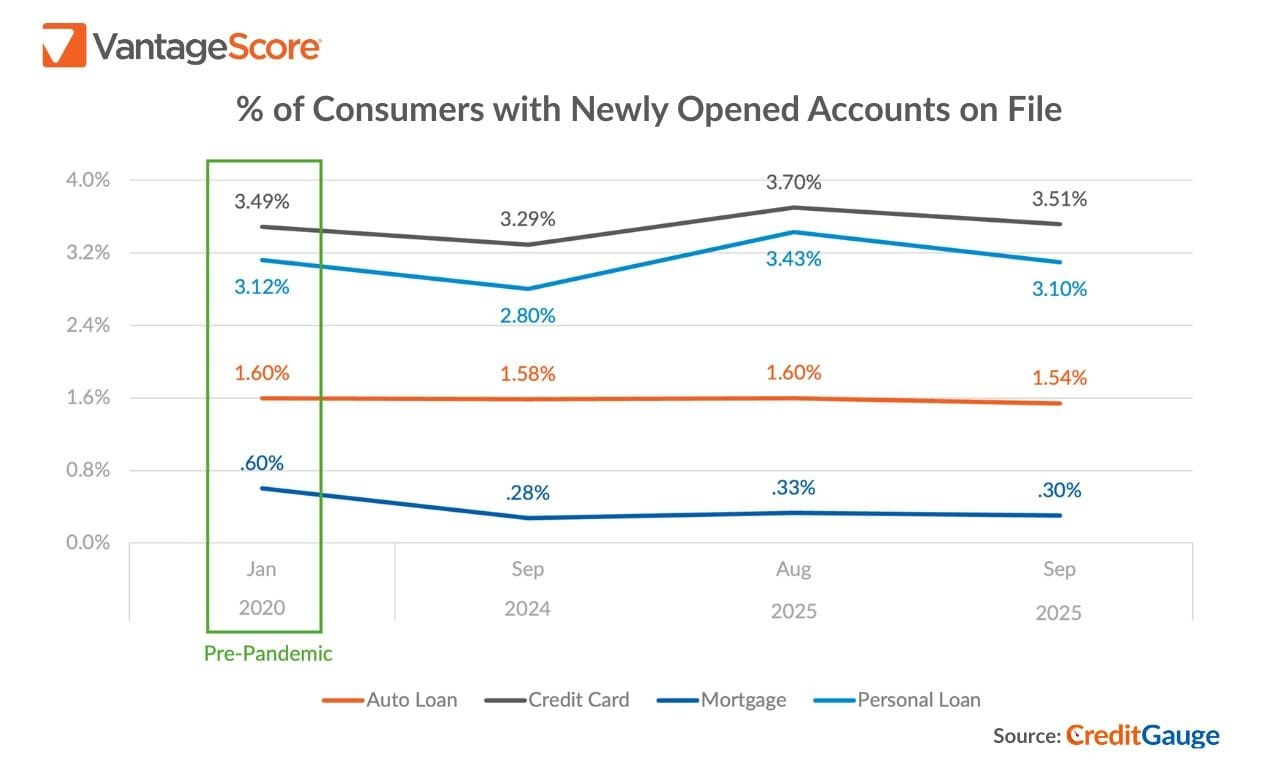

Banks’ New Consumer Credit Activity Cools, Mortgage Credit Delinquencies Increase

Source: VantageScore

Banks appear to be "reining in new lending" after a strong summer, leading to new consumer credit activity cooling modestly in September 2025, according to VantageScore's CreditGauge report. Originations "declined across all products month-over-month," with Personal Loans leading the drop, followed by Credit Cards, Auto Loans, and Mortgages. Meanwhile, Mortgage credit delinquencies rose "across all stages of delinquency" month-over-month and year-over-year. This rise was "most pronounced" in late-stage (90-119 Days Past Due) accounts, which hit their highest level since January 2020. Overall early-stage delinquencies are also rising, with 30-59 Days Past Due accounts reaching a year-to-date high and "nearing the pre-pandemic threshold" for the first time in five years. The average VantageScore 4.0 credit score "remained stable at 701" in September. [VantageScore]

Fed Cuts Rates Again, but Powell Raises Doubts About Easing at Next Meeting

The Federal Reserve approved its second consecutive interest rate cut by a 10-2 vote, lowering the benchmark overnight borrowing rate to a range of 3.75%-4%. The central bank's Federal Open Market Committee also announced it would end the reduction of its asset purchases, known as quantitative tightening (QT), on December 1st, rolling maturing mortgage securities into shorter-term bills. Despite the rate cut, Chair Jerome Powell "rattled markets" by saying a "further reduction in the policy rate at the December meeting is not a foregone conclusion," citing "strongly differing views" among officials. The committee reiterated concerns about the labor market, stating that "downside risks to employment rose in recent months," while noting that available economic activity indicators "suggest that economic activity has been expanding at a moderate pace". The decision came even as the Fed lacked key economic data due to a government suspension of reports, forcing the committee to rely on "available indicators". [CNBC]

Court Backs Fed’s Power to Block FinTech Access to Payment Rails

The U.S. Court of Appeals for the Tenth Circuit backed the Federal Reserve's "full discretion" to deny master account applications, upholding the denial to Custodia Bank, a Wyoming-chartered digital-asset institution. The court's 2-1 ruling in Custodia Bank v. Federal Reserve Board concluded that the Reserve Banks are authorized to "receive deposits" but are not compelled to do so, rejecting the bank's argument that a clause in the 1980 Monetary Control Act required automatic approval. This decision validates the Fed's tiered, risk-based review framework, which applies the strictest scrutiny to firms that lack federal deposit insurance or supervision, like Custodia. The Kansas City Fed denied Custodia because its crypto-centric business model carried "undue risk" to the payment system and was "highly likely inconsistent with safe and sound banking practices". The ruling reinforces the Fed's authority to limit access to payment rails for crypto-focused or unsupervised firms, likely stalling efforts by other fintechs seeking "skinny" or limited-purpose accounts. [PYMNTS]

US Consumer Finance Watchdog Formally Kills Biden-era Bad Actor Registry

Source: Reuters

The top U.S. government watchdog for consumer finance, the Consumer Financial Protection Bureau (CFPB), formally killed a registry for non-bank financial companies caught violating consumer laws, claiming the costs outweighed any public benefit. The registry, originally proposed under the Biden administration to help catch and deter "repeat offenders," was scrapped as part of President Donald Trump's "wholesale reduction" of the agency's legal authorities. The CFPB's cost-benefit analysis stated the offender registry merely duplicated an existing multi-state registry system and that ending it would result in only about $360 in "reduced costs per company". While "industry organizations and state regulators" supported the repeal, the advocacy group Better Markets warned the move would increase risks to consumers and lessen deterrence. Better Markets emphasized that "50 percent of the US lending market" is now held by non-banks. [Reuters]

How Trump’s Hatchet Man Is Destroying Consumer Protections

Source: Forbes

The Trump Administration, through acting head of the Consumer Financial Protection Bureau (CFPB) Russell Vought, is systematically dismantling the agency, putting consumer protections at risk across various financial products. The administration has "permanently dismissed 22 CFPB enforcement actions," allowing "at least $120 million" due to consumers to stay in companies' pockets, with another "$240 million slated to be paid out" potentially facing the same fate. For example, the administration erased a ruling forcing Toyota Motor Credit to give customers $48 million back for sneakily including unwanted products in auto contracts. Vought, who reportedly aims to shut the agency down entirely in a few months, has seemingly halted the CFPB's supervisory examinations of large financial institutions and ordered staffers to stop much of their work, creating an "almost complete abandonment" of its obligations. Financial institutions are getting the message that there are "fewer cops on the regulatory beat," leading to less investment in consumer compliance. This rollback comes as consumer delinquencies on credit card and auto loans have risen to "12-year highs," putting vulnerable Americans at greater risk of predatory practices in areas like subprime auto lending and credit reporting. [Forbes]

US Fintech Lettuce Financial Raises $28m in Zeev Ventures-led Round

Source: Lettuce

Lettuce Financial, a US-based fintech start-up serving solopreneurs, just completed a $28 million funding round led by long-term backer Zeev Ventures to enhance its AI-powered platform for independent workers. Lettuce Financial, established in 2023, automates tax and accounting processes and provides an array of business management tools for solopreneurs, contractors, and freelancers. The new cash injection will fund platform expansion initiatives, focusing on retirement planning with Solo 401(k) and SEP IRA guidance. The company also plans to upgrade its AI services to improve "workflow and accessibility," including a voice interface that "enables solopreneurs to manage their business operations conversationally". Alongside the funding, Lettuce announced it acquired Besolo, an Arizona-based start-up focused on health and retirement benefits access, for an undisclosed sum, with Besolo's team joining to lead Lettuce's healthcare offering. [Fintech Futures]

How Will Payments Change with Revolut’s 1:1 Stablecoin Rate?

Revolut, the British banking app, introduced a 1:1 conversion rate for stablecoin transfers, allowing users to exchange $1 USD for exactly 1 USDC or 1 USDT in-app, with "no variation in price". This move aims to "completely eliminating the pain of going on and off-chain" and dissolve concerns about moving money between crypto and fiat. Revolut's Head of Product, Crypto, Leonid Bashlykov, says the company is bringing the same "revolution to crypto" that it brought to currency exchange years ago, with "transparent FX, no hidden markups, no crazy fees". For payments, this means users can exchange at "US$1.00 every time" and "move across 6+ supported chains (incl. Ethereum, Solana, Tron and others)". The news follows Revolut's crypto arm being granted the Markets in Crypto Assets (MiCA) authorization by the Cyprus Securities and Exchange Commission (CySEC), which allows it to begin trading in Europe. The London-based company now serves "more than 65 million customers across 38 countries" and is targeting entry into 30 new markets by 2030. [Fintech Magazine]

Growth Tracker: Earnings and New Investments

LendingTree reported Q3 2025 net income of $10.2 million ($0.73 per share) on revenue of $307.8 million, up 18% year over year and marking its sixth straight quarter of growth. Adjusted net income reached $23.8 million ($1.70 per share) and adjusted EBITDA rose 48% to $39.8 million, driven by double-digit gains across all segments, with Insurance up 20% to $203.5 million, Consumer up 11% to $66.2 million, and Home up 18% to $38.1 million. The company also refinanced its debt with a new $475 million credit facility, lowering leverage to 2.6x and improving flexibility. Following the passing of founder and CEO Doug Lebda, new CEO Scott Peyree said the company remains committed to his vision of empowering consumers through choice, while CFO Jason Bengel said LendingTree is “well positioned” for 2026, reaffirming full-year guidance of $1.08 to $1.09 billion in revenue and $126 to $128 million in adjusted EBITDA. [LendingTree]

OneMain Holdings posted third quarter 2025 net income of $199 million, or $1.67 per share, as revenue grew 9% year over year to $1.6 billion and pretax income rose to $263 million. The company’s Consumer and Insurance segment delivered adjusted earnings of $1.90 per share, supported by solid credit trends and receivable growth. Managed receivables reached $25.9 billion, up 6% from last year, and loan originations totaled $3.9 billion. OneMain also increased its quarterly dividend to $1.05 per share and authorized a new $1 billion share repurchase program. CEO Doug Shulman said the company’s focus on innovation and disciplined execution continues to strengthen its position for long-term growth. [OneMain Holdings]

Upstart recorded strong third quarter 2025 results, with revenue climbing 71% year over year to $277 million and loan originations rising 80% to $2.9 billion. Net income reached $31.8 million ($0.23 per share), reversing a loss from the prior year, while adjusted EBITDA increased to $71.2 million and adjusted net income reached $60 million ($0.52 per share). The company originated more than 428,000 loans in the quarter, with 91% completed through full automation on its AI platform. CEO Dave Girouard said Upstart’s model “continues to deliver as designed,” balancing profitability and growth. For the next quarter, the company expects revenue near $288 million and projects full-year revenue of about $1.04 billion. [Upstart]

Dave delivered its strongest quarter yet, with Q3 2025 revenue rising 63% year over year to $150.8 million and net income jumping to $92 million. Adjusted net income reached $61.6 million, while adjusted EBITDA climbed to $58.7 million as profitability and operating leverage continued to improve. ExtraCash originations grew 49% to $2 billion, supported by a record 4.8% monetization rate and disciplined credit performance. Monthly transacting members rose 17% to 2.77 million, and debit card spend increased 25% to $510 million. CEO Jason Wilk said the company’s CashAI v5.5 rollout is already improving origination quality and delinquency rates, helping drive higher gross profit and sustained growth. Dave raised its 2025 outlook, now guiding for up to $547 million in revenue and $218 million in adjusted EBITDA. [Dave]

Visa reported fiscal Q4 2025 net revenue of $10.7 billion, up 12% year over year, driven by continued strength in payments and cross-border volumes. GAAP net income was $5.1 billion ($2.62 per share), while non-GAAP net income rose 7% to $5.8 billion ($2.98 per share). Payments volume increased 9%, cross-border volume grew 12%, and processed transactions reached 67.7 billion, up 10% from last year. For the full fiscal year, Visa generated $40 billion in revenue, an 11% increase, and $22.5 billion in non-GAAP net income. CEO Ryan McInerney said Visa’s results underscore the durability of its business model and its position to lead as AI, real-time money movement, tokenization, and stablecoins reshape commerce. The company also raised its quarterly dividend by 14% to $0.67 per share and repurchased $4.9 billion in stock during the quarter. [Visa]

PayPal posted third quarter 2025 revenue of $8.4 billion, up 7% from a year ago, as GAAP net income rose 24% to $1.25 billion ($1.30 per share) and non-GAAP earnings reached $1.34 per share. Total payment volume increased 8% to $458 billion, and transaction margin dollars grew 6% to $3.9 billion. The company generated $1.7 billion in free cash flow and $2.3 billion in adjusted free cash flow, reflecting stronger profitability and disciplined cost management. PayPal also announced its first quarterly dividend of $0.14 per share, marking a new capital return milestone. CEO Alex Chriss said growth across branded checkout, Venmo, and payment services along with partnerships with Google, OpenAI, and Perplexity, shows PayPal is building for a new AI-driven phase of digital commerce. [PayPal]

Rocket Companies delivered strong third quarter 2025 results, with adjusted revenue rising 35% year over year to $1.78 billion, above the high end of its guidance. The company reported an adjusted net income of $158 million and adjusted EBITDA of $349 million, offsetting a GAAP net loss of $124 million. Mortgage origination volume increased 14% to $32.4 billion, while rate lock volume grew 20% to $35.8 billion. CEO Varun Krishna said the quarter marked a milestone as Rocket finalized its all-stock acquisition of Mr. Cooper and expanded its use of AI across lending operations, including new automation tools that have cut processing times significantly. Rocket closed the quarter with $9.3 billion in liquidity and projected Q4 adjusted revenue between $2.1 billion and $2.3 billion, reflecting a full quarter of contributions from Redfin and Mr. Cooper. [Rocket Companies]

Looking for your next fintech role?

Stay ahead of where the industry is hiring. The Free Toaster Jobs newsletter curates standout openings in fintech marketing, product, data, and risk each week, along with insights into the trends shaping hiring across leading lenders, neobanks, and fintech startups.

Subscribe to The Free Toaster Jobs to get the latest roles and hiring insights delivered straight to your inbox (Toaster subs that don’t opt-in won’t get the Friday jobs Edition).

Missed last week’s edition? Check out the most recent job listings here.

Other News We’re Reading

(Loyalty) Wells Fargo Welcomes JetBlue as Newest Rewards Points Transfer Partner [Wells Fargo]

(Crypto Cards) Thredd Helps Bybit Launch Crypto-Linked Debit Cards [PYMNTS]

(Crypto Cards) Uphold Relaunches US Debit Cards with 6% Ripple (XRP) Reward [Yahoo Finance]

(Lending) Peak Credit Union Selects Upstart for Personal Lending [Upstart]

(Lending Data) Mortgage Boom, Auto Dip: TruStage Data Show Uneven Recovery In CU Lending [CU Today]

(Partnerships) Venmo and Bilt Aim To Make Their Partnership A Verb [Forbes]

(Cards Partnerships) Klarna Expands European Card Network With Marqeta’s Platform [PYMNTS]

(Digital Banking) Standard Chartered CEO Expects Blockchain to ‘Eventually’ Power Nearly All Global Transactions [CNBC]

(Regulation) Banks Urge Scrutiny of Fintech Trust Charter Applications [American Banker]

(Regulation) Brazil Central Bank Tightens Rules Amid Fintech Crime Crackdown [Bloomberg]

Please support our Newsletter by recommending us to one of your colleagues!

And, please check out our sponsors:

Need an affiliate marketing platform/network? Chat with Fintel Connect

Need to improve application page conversions? Chat with Spinwheel

Need to accelerate your affiliate marketing? Chat with New Market Growth

Need to win on other growth channels? Chat with FIAT Growth

About Us

Welcome to The Free Toaster! The newsletter for marketing pros at fintechs, banks, and lenders.

Inspired by the free toasters banks used to give to each new customer, we’re here to help you acquire more customers at scale. We deliver fresh news, data, and insights to help you acquire more customers, minus the breadcrumbs.

Want to follow the authors on social media?

Carlos Caro is the founder of NMG, an agency that helps lenders build affiliate programs.

Nick Madrid is the co-founder of Uncovered Media and a co-founder of Ghostmode (a media company that builds Newsletters, Podcasts, and communities in high-value B2B niches).