🔥 SoFi Q1: Record $7.2B Loan Originations!

And yet, lenders feel the squeeze: profits dip below expectations and credit tightens amid economic uncertainty.

We Want to Hear From You! 👂👂👂

If we doubled down on one of these, which should it be?

(Click on one of these and let us know what you think)

Competitive research (e.g., analysis of competitor ads)

Product market research (what lending products are consumers choosing)

Analysis/reviews of AI tools that can make your team more efficient

Benchmarks across channels and product categories (e.g., CACs and conversion rates)

Something else (you'll be able to share details on the next page)

Earnings SoFi reports strong performance in first quarter 2025 earnings

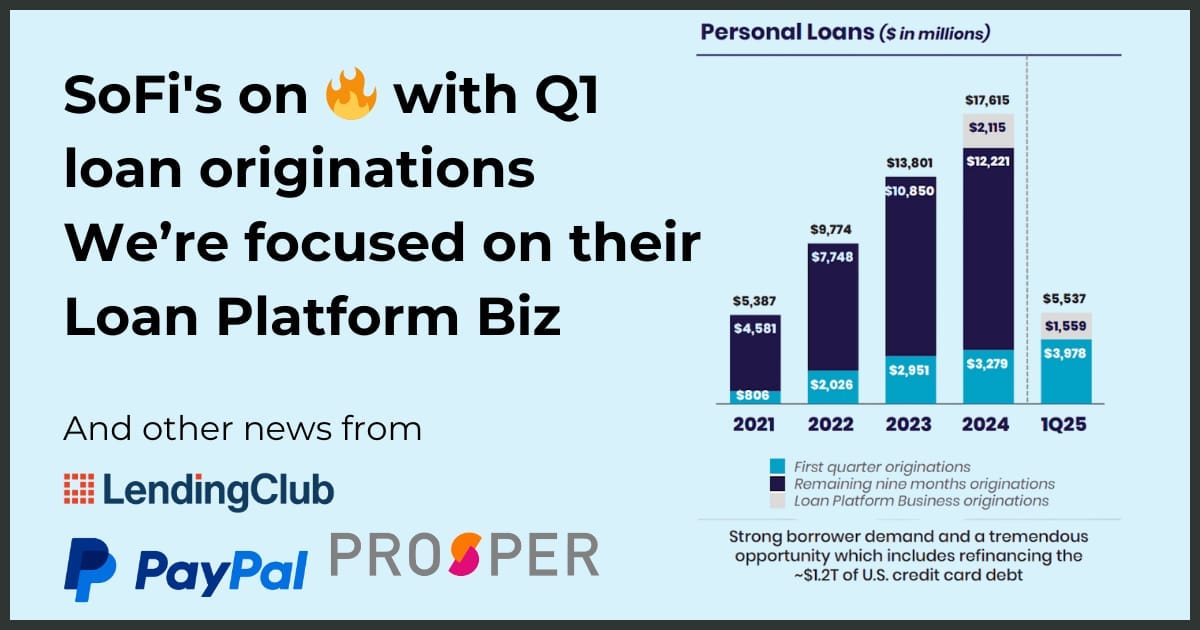

SoFi reported Q1 results yesterday, and we were impressed, particularly with their Loan Originations (and the Loan Platform Business in particular).

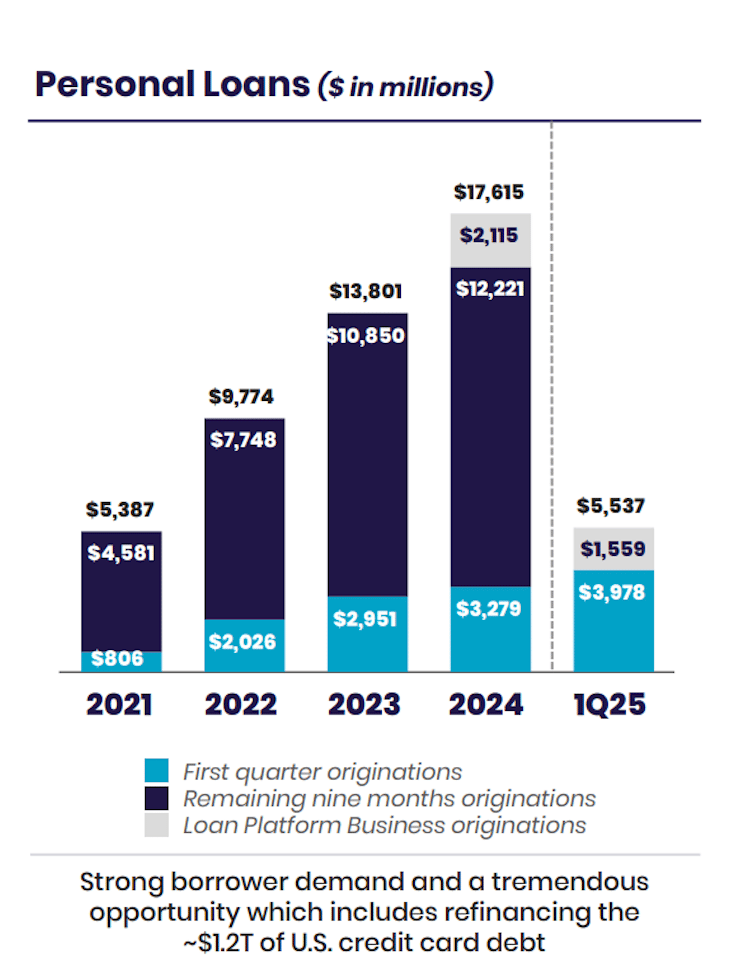

SoFi's Q1 performance showcased significant momentum, especially within its Loan Platform Business (LPB), where the company originates loans for third-party partners. Total originations hit a record $7.2 billion, fueled by a standout $5.5 billion in personal loans – a 69% year-over-year surge. Notably, $1.6 billion of this personal loan volume came directly from the LPB, demonstrating its growing scale.

This "game changer," as CEO Anthony Noto called it, allows SoFi to monetize a wider applicant pool (including the 70-80% typically rejected for balance sheet loans) in a capital-light way. The LPB generated $96.1 million in high-margin (~50%) fee revenue in Q1 alone, significantly boosting SoFi's shift towards fee-based income, which now constitutes 41% of adjusted net revenue.

Demand for SoFi's Loan Platform Business (LPB) from partners is robust, evidenced by $8.3 billion in new funding secured this year through partnerships with Blue Owl ($5B), Fortress ($2B), and a Fortress-Edge Focus joint venture ($1.2B). This robust pipeline supported $1.6 billion in LPB loan originations in Q1 alone, with additional volume expected in Q2. Reflecting this potential, SoFi management anticipates the LPB will become the company's third $1 billion revenue business.

Beyond direct revenue, the LPB strengthens SoFi's ecosystem by keeping members engaged through loan servicing, reinforcing the Financial Services Productivity Loop. While facing the typical risks of the lending market, the LPB's growth, strong partner demand, and strategic fit highlight its increasing importance to SoFi's future success and profitability.

Other key takeaways (as noted by BofA Global Research and in SoFi’s 8K)

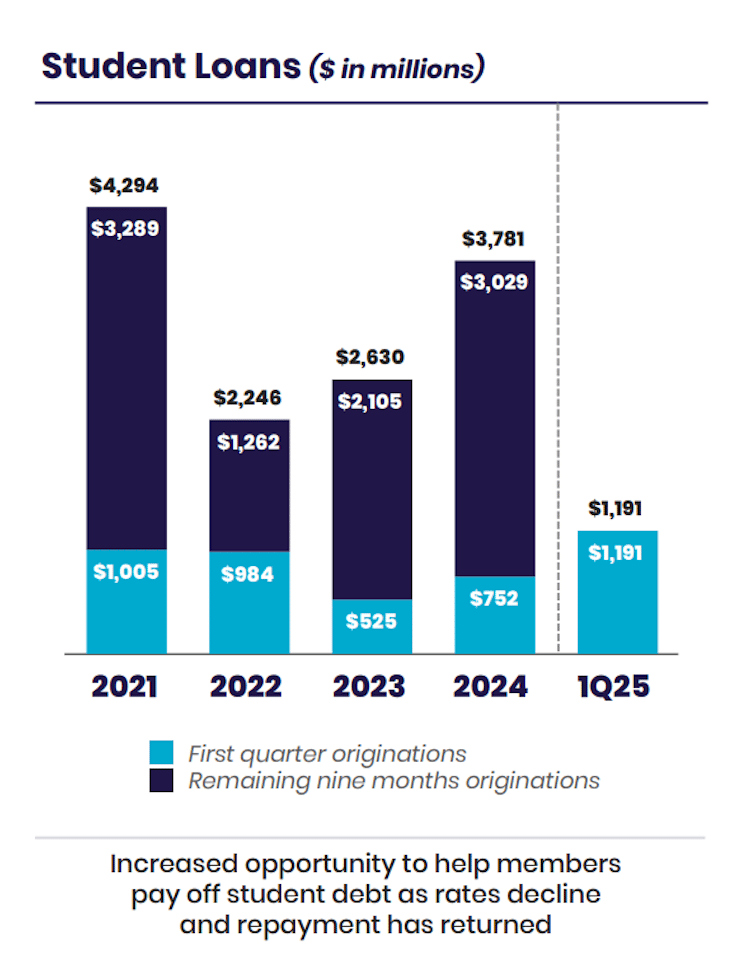

Borrowers remain high-income and of high credit quality. Average personal loan user income of $158k and a FICO score of 758, while student loan borrowers average $134k of income and a FICO of 769. Credit trends also improved q/q for both personal and student loans.

Cross-buying remains strong, with 32% of new products in the quarter being adopted by existing SoFi members. Additionally, 90% of SoFi+ members were existing members.

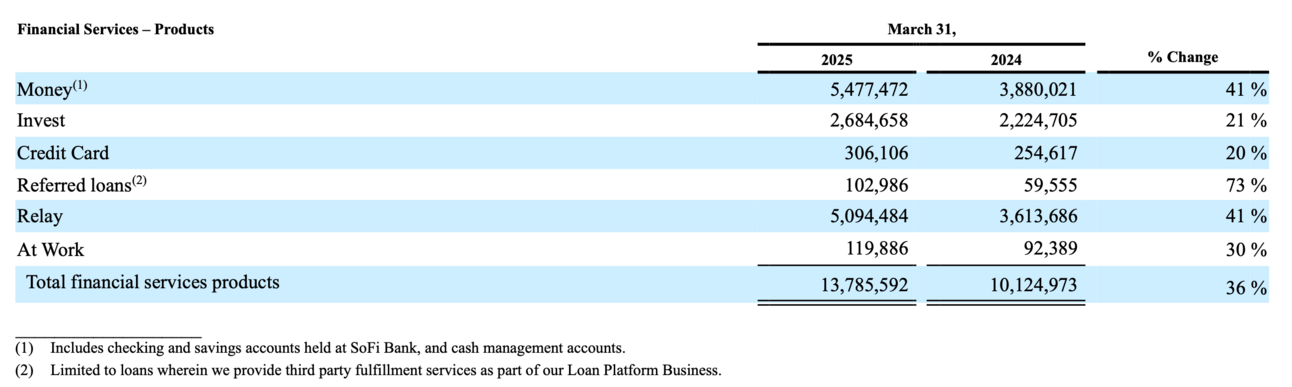

Credit Cards up 20% YoY

Referred Loans up 73% YoY (this is the Loan Platform Business)

Checking & Savings up 41% YoY

[SoFi] [BofA Global Research] [American Banker]

LendingClub's profits get hit by macroeconomic uncertainty

LendingClub, the online lender known for its personal loans and digital banking services, saw Q1 profits fall short due to "macroeconomic uncertainty" and a significant increase in loan loss provisions, at $58.1 million, up from $31.9 million a year ago. Net income landed at $11.7 million and earnings per share at 10 cents, both under analyst expectations. Still, revenue climbed to $217.7 million. The company also announced the acquisition of Cushion, an AI-powered financial assistant that helps customers track bills, make payments, and monitor loans. LendingClub also doubled down on its Bay Area roots with a $74.5 million real estate deal in San Francisco. [American Banker]

Credit-Card Companies Brace for a Downturn

Credit card giants like JPMorgan Chase, Citigroup, and Synchrony are bracing for a potential downturn by tightening lending, beefing up reserves, and shifting focus to wealthier customers. Despite steady spending in early 2025, delinquencies are creeping back to pre-COVID levels, and signs like more consumers making only minimum payments are making lenders nervous. “The focus right now is on the future, which is obviously unusually uncertain,” JPMorgan Chase finance chief Jeremy Barnum told analysts. U.S. Bancorp said it’s revamping its card strategy to prioritize premium offerings and target more affluent households — a smart bet, given the top 10% of earners now account for roughly half of all U.S. spending, according to government data. Meanwhile, American Express is cruising ahead, buoyed by high-income cardholders and a 7% bump in Q1 U.S. spending. [WSJ]

We couldn’t produce this newsletter without our sponsor (and friends) at Spinwheel (a QED-backed fintech)

Reduce friction in your lending application with only two required fields: phone number and birthdate! Seamlessly access real-time credit data and payment processing, and watch your application rates jump by 20-30%. Get started today!

Other stuff we’re reading and listening to

PayPal kicks off fintech earnings as investors fear impact of Trump tariffs on consumer spending [CNBC]

Prosper Announces New $500 Million Forward Flow Agreement with Fortress and Edge Focus to Expand Its Personal Loan Marketplace [PR Newswire]

Lake Trust Credit Union Selects Upstart for Personal Lending [Upstart]

🎧 Credit Union launches impactful storytelling podcast, Banking on You [CUInsight]

🎧 The AI Revolution in Banking: Paolo Sironi on What’s Coming in 2025 [Audacy]

🎧 The Future of Payment Cards: Metal, Personalization, and the Power of Design [PaymentsJournal]

Coatue’s former fintech head targets $400m for Marathon [Venture Capital Journal]

Upstart offers $320 million from consumer loan assets [American Banker]

Flex acquires a16z-backed Maza for $40M as fintech M&A heats up [TechCrunch]

Exclusive: Better.com, Biz2Credit partner on small-business HELOCs [American Banker]

Appeals Court to CFPB: No layoffs before May hearing [American Banker]

Former NCUA members sue Trump over firings [American Banker]

Revolut’s Revenue Soars 72% as Fintech Eyes Global Growth [Bloomberg]

Nubank's Mexican arm secures banking licence approval from CNBV [FinTech Futures]

Thiel-Backed Fintech N26 to Offer Mobile Service to Boost Growth [Bloomberg]

NEW TOASTER PODCAST Playing the Game in Reverse

In this solopodcast, Carlos argues that lenders launching new affiliate partnerships, especially smaller or newer players, should abandon the slow, iterative approach used for ad campaigns and instead "play the game in reverse." Because affiliates are partners with limited patience, rather than algorithms, lenders must make a powerful first impression by initially offering their most compelling terms—highest payout, best funnel, fastest payment—even if unsustainable long-term. The goal is to immediately buy the affiliate's conviction and secure their commitment before optimizing for sustainability, as underdogs rarely get a second chance to prove their worth.

Find the show here:

Spotify // Apple // Audible // Podbean // iHeart

Open Jobs

Click here if you want to see our jobs edition from last week.

Click here if you want to receive the jobs edition via email

CTB1 Exclusive Roles

Chief Marketing Officer

We're seeking a growth leader with a proven track record in scaling user acquisition, optimizing channels, and driving revenue. You have deep experience in product-led growth, thrive on data-driven experimentation, and work seamlessly with product and cross-functional teams. Experience with IPO readiness is a plus. Experience in B2C/D2C products preferred Hybrid role based in Mountain View, CA

To learn more or apply, email connect@CTB1LLC.com and mention Toaster

VP, Product Marketing

10+ years in B2B SaaS product marketing, with leadership experience in scaling high-performing teams; HealthTech background a plus

Expert in uncovering deep customer and market insights, driving strategic positioning in crowded, complex markets

Led brand narrative and GTM strategy across multiple products, creating messaging that

Skilled in enterprise sales dynamics, particularly within healthcare, and comfortable navigating ambiguity in fast-evolving categories

To learn more or apply, email connect@CTB1LLC.com and mention Toaster

Support The Free Toaster

Need to improve application page conversions? Chat with Spinwheel

Need to accelerate your affiliate marketing? Chat with New Market Growth

Need to win on other growth channels? Chat with FIAT Growth

Attend CardCon (May 6-8) with discount code TOASTER. Register here

None of the above? Share our Newsletter in your favorite Slack channel

About Us

Welcome to The Free Toaster! The newsletter for marketing pros at fintechs, banks, and lenders.

Inspired by the free toasters banks used to give to each new customer, we’re here to help you acquire more customers at scale. We deliver fresh news, data, and insights to help you acquire more customers—minus the breadcrumbs.

Want to follow the authors on social media? Find Nick Madrid and Carlos Caro on LinkedIn.