So, Upstart Had an "AI Day"... What Actually Mattered?

How they use AI to improve CAC, approvals, and future growth.

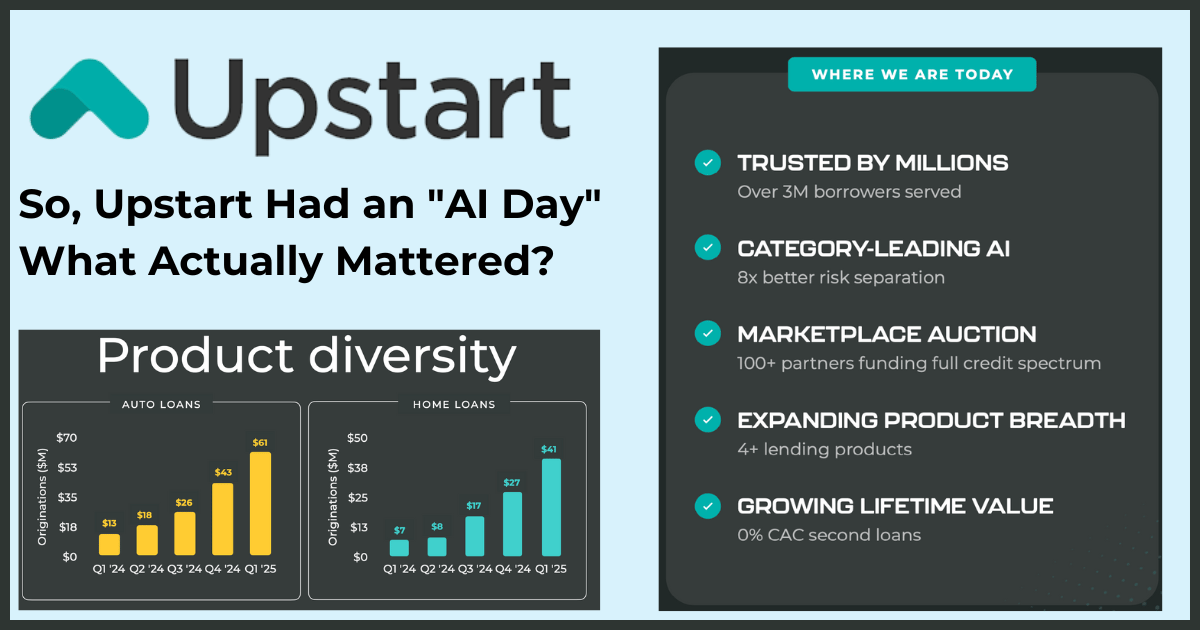

Upstart, the AI-powered lending marketplace, hosted its first-ever “AI Day” on May 14 to outline how it's using machine learning to rethink credit underwriting. Executives highlighted Upstart’s vertically integrated AI model—trained on over 90 million datapoints—and emphasized its ability to deliver faster approvals and more accurate risk assessments. CEO Dave Girouard set ambitious 2025 goals, including a “10X” improvement in AI, a return to GAAP profitability, and building toward becoming the “everything store for credit.” The company also pointed to future revenue streams like subscriptions, revolving credit, and servicing. [Business Wire] [Upstart AI Day Presentation and Webcast]

A quick note from the Toaster Team:

As we get into Upstart's AI Day, we want to acknowledge something upfront. Some of you might approach Upstart's claims with a bit of healthy skepticism, perhaps based on past industry discussions or a feeling that their announcements can sometimes stretch enthusiasm. That’s an understandable perspective.

All that said, we're still intrigued by the scope of their aim and their willingness to put these details out there. That's why it's getting the spotlight in Toaster today.

A Look at Upstart’s AI Day: Insights for Fintech Marketers

Many company "AI Days" can often feel like marketing exercises, focusing more on potential than current demonstrable impact. Upstart's recent AI Day, however, offered a more detailed look into their strategy and operational metrics. Executives, including CEO Dave Girouard, CTO Paul Gu, CMO Chantal Rapport, and CFO Sanjay Datta, presented their approach, supported by specific figures that warrant attention from those involved in customer acquisition and building growth engines in the fintech space.

The core message wasn't just about future possibilities, but about how Upstart is currently applying AI to what they see as fundamental business levers: price, process, and distribution. Analysts from Bank of America, for instance, noted they "came away with a better understanding of [Upstart’s] differentiated model and its long-term vision."

Price and Process: Core Tenets of Upstart's Value Proposition

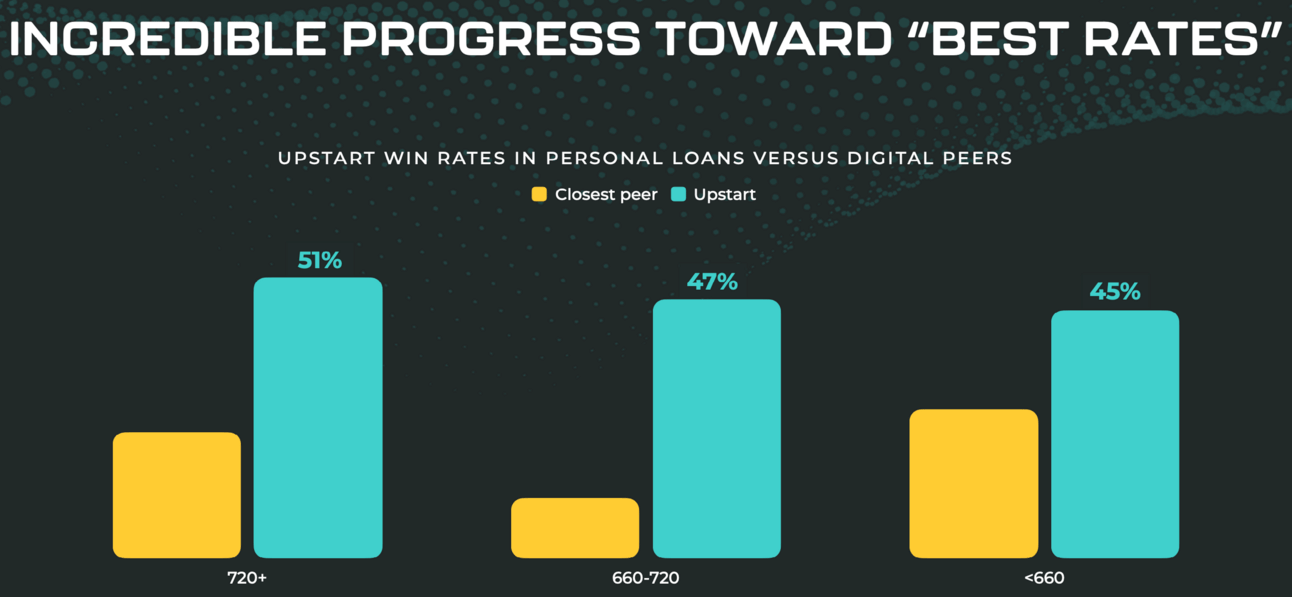

Upstart CEO Dave Girouard stated that consumers prioritize two main factors: the price of a loan and the ease of obtaining it. According to the company, AI allows them to address both. Chantal Rapport, SVP of Growth and CMO, reinforced this, stating Upstart's goal is to offer a "radically better product," defined as "best rates, it means best process, and it means a product that is available to everyone."

Upstart AI Day Presentation and Webcast

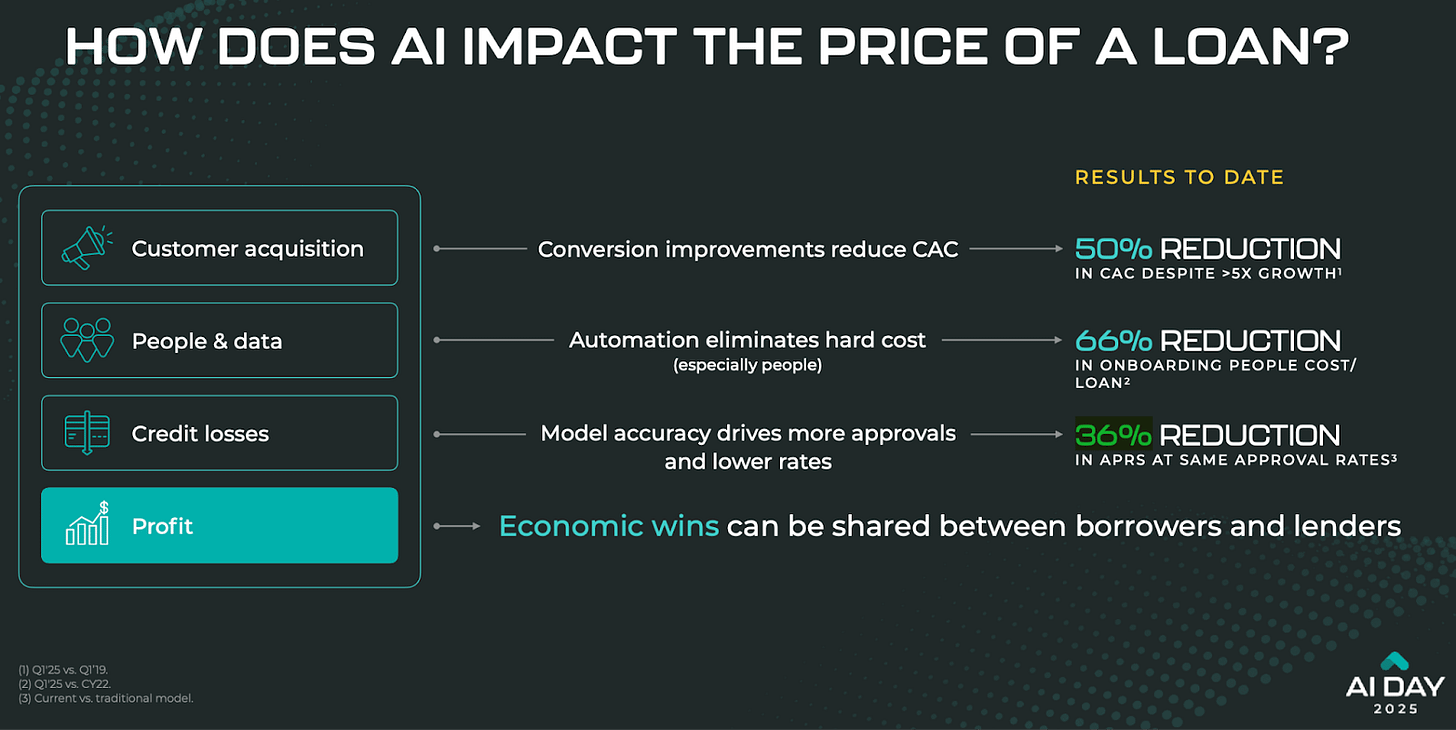

Price: Upstart indicates its underwriting models aim to reduce costs and credit losses. The company claims these models can result in a 36% reduction in APRs at comparable approval rates versus traditional methods. Rapport suggested that such differentiation can lead to "pricing power" and "positive selection," attracting lower-risk borrowers by offering competitive rates.

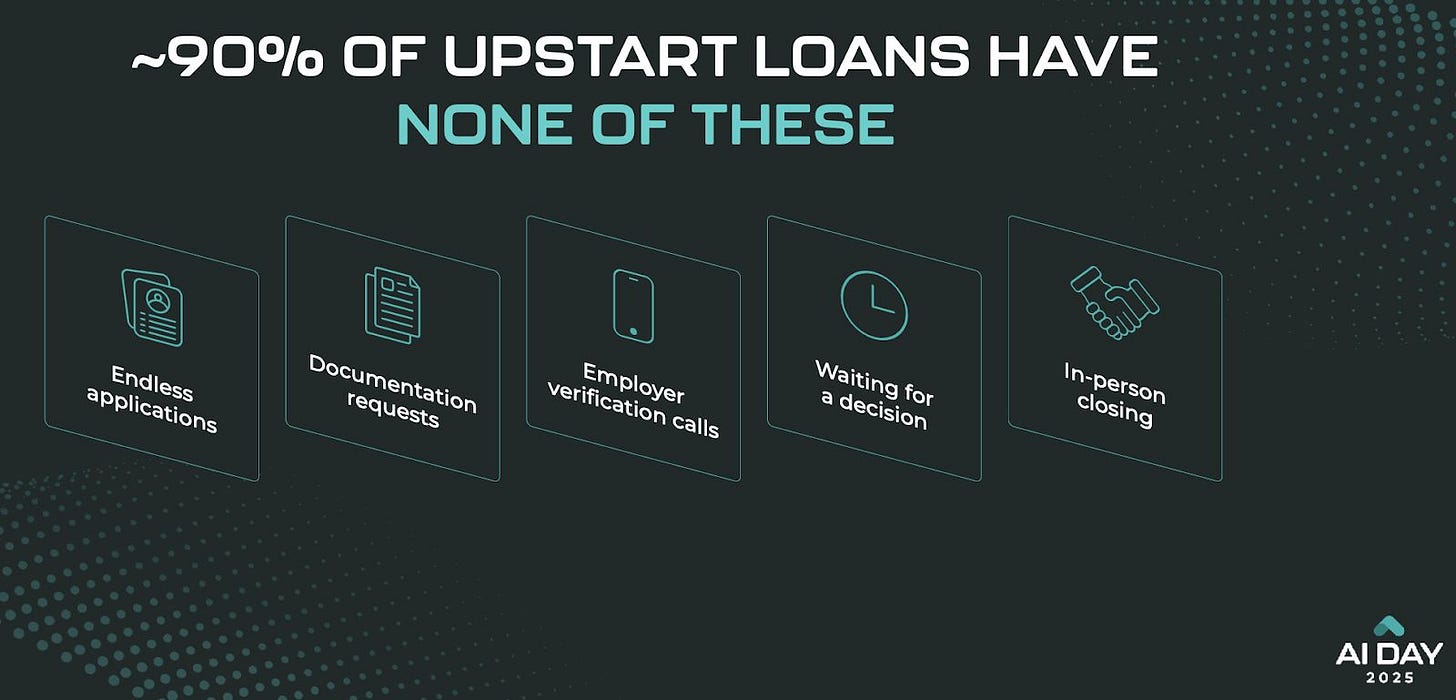

Process: Upstart reports that over 90% of its loans are fully automated. Girouard highlighted a statistic: each additional document requested can decrease the applicant pool by 15%. Streamlining these points, he suggested, can positively impact customer acquisition cost (CAC). Rapport described the Upstart borrowing experience as aiming to be simple, personalized, and "very, very fast," citing the "Upstart FastTrack" where 90% of personal loans are reportedly approved automatically without requiring paperwork.

Upstart AI Day Presentation and Webcast

Girouard characterized Upstart's approach as "improving access to credit" with a system less "archaic and dated" than traditional lending. Rapport added that the traditional lending space "hadn't been innovated on in decades" because effective lending is "extremely difficult to do it well."

AI's Role in Customer Acquisition Cost (CAC) Efficiency

Upstart claims a 50% reduction in CAC since 2019, alongside a 5x growth in customer numbers. The company attributes this not to increased marketing spend, but to improved funnel efficiency driven by AI. Factors cited include higher approval rates, reduced drop-offs due to a streamlined process, and more precise targeting. Girouard stated, “We’re not aiming for $0 CAC, we’re aiming for a bigger borrower base.” This suggests a strategy of investing where efficiency gains compound, referencing conversion improvements that reduced CAC despite significant growth (Q1'25 vs Q1'19). Rapport emphasized that "AI isn't just our moat, but it's also a constant accelerant for our business," contributing to efficiency, cost reduction, and margin improvement.

Upstart AI Day Presentation and Webcast

The Significance of Approval Rates

A key statistic highlighted by Upstart is that instantly approved loans convert three times more effectively than those requiring manual review. This suggests that delays in the approval process can significantly impact conversion volume. Upstart claims that a 1% improvement in model accuracy can lead to a 13% gain in conversion, a figure Rapport described as an "incredible return on our accuracy gains." Their reported conversion rate was trending upwards as of Q1 2025.

Cross-Selling as a Central Strategy

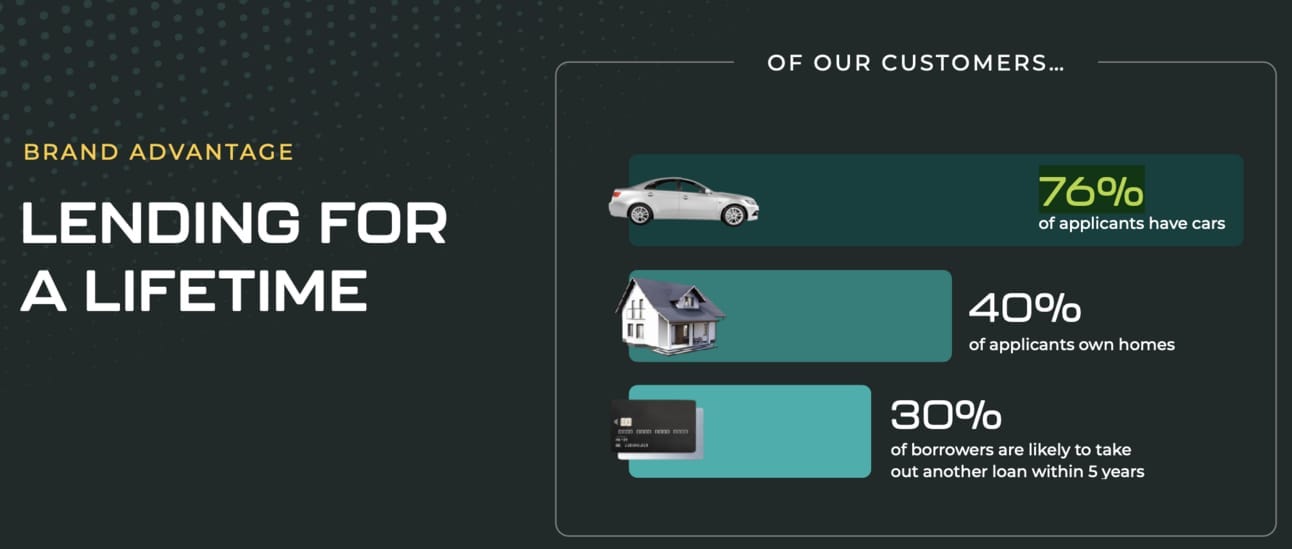

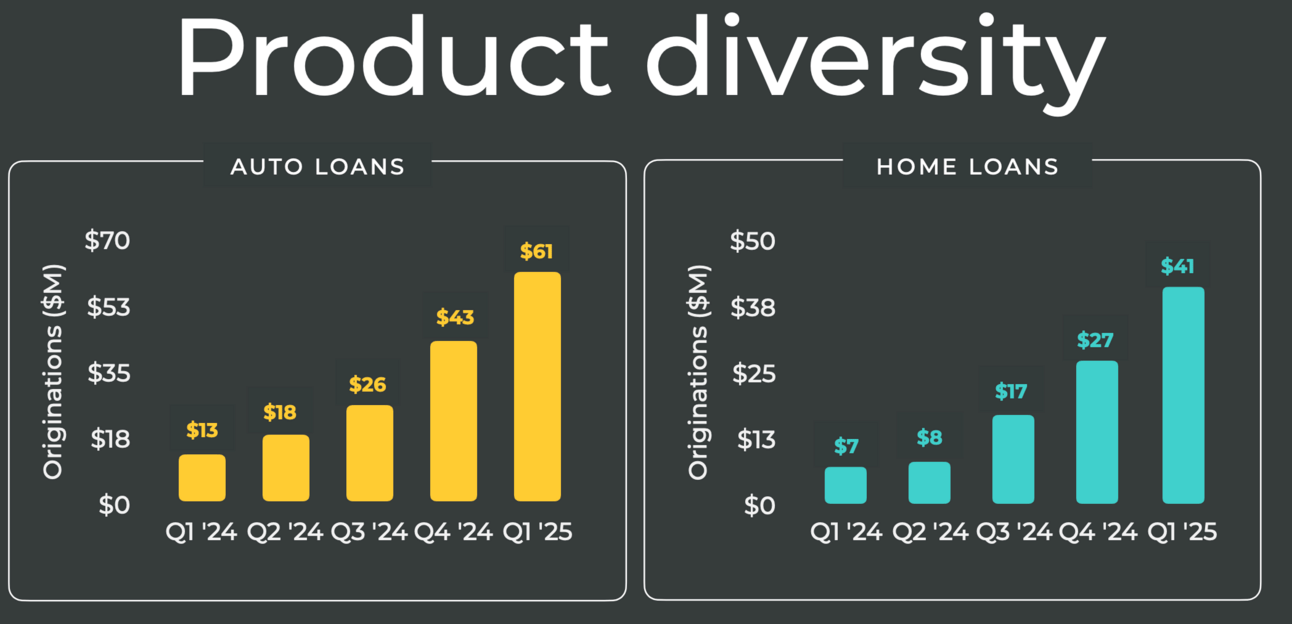

Upstart’s stated ambition is to become a comprehensive platform for various credit products, including personal loans, automotive retail and refinance loans, home equity lines of credit (HELOCs), and small-dollar "relief" loans.

Rapport provided insights into their existing user base relevant to this strategy:

76% of Upstart applicants own a car.

40% of applicants own homes.

30% of borrowers are likely to take out "a second personal loan" within 5 years.

Upstart AI Day Presentation and Webcast

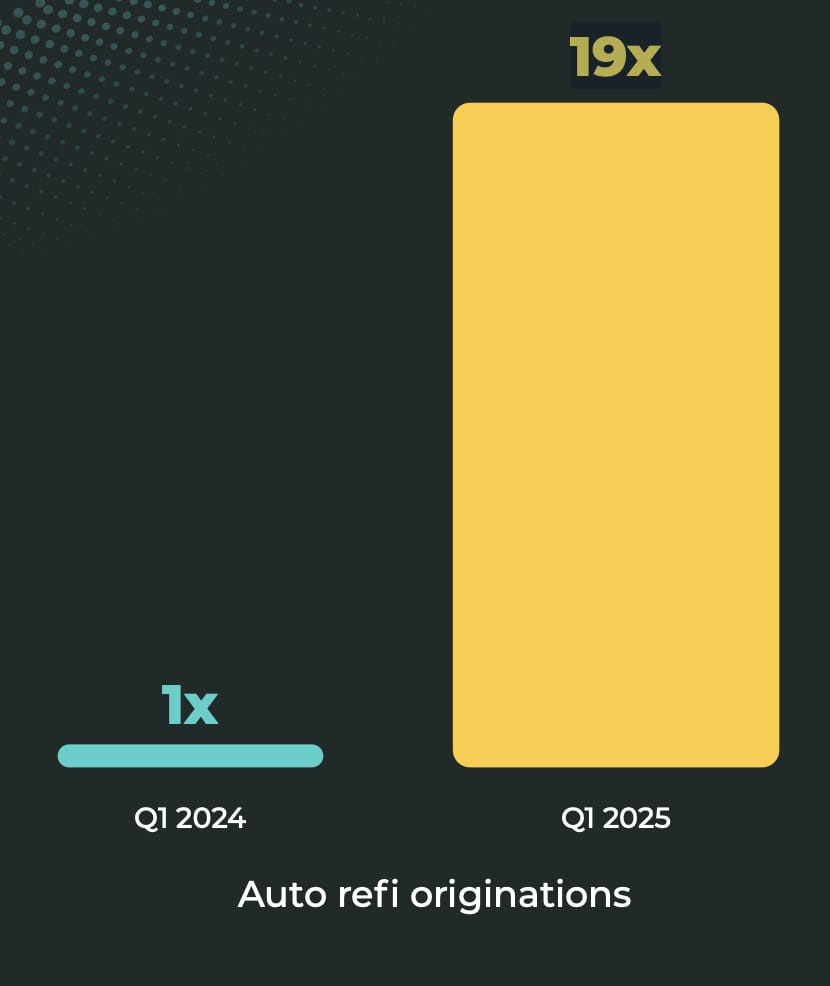

The company notes that the CAC for a second loan to an existing customer is effectively $0. Rapport cited the "Fran" example: a customer who took a personal loan and subsequently refinanced her car through a personalized offer, saving $420 annually. This second loan was reportedly originated at "0% CAC." This product-led growth strategy focusing on existing users contributed to "almost 20X growth year over year" in auto refi, according to Rapport. Auto refinance volume was up 19x year-over-year as of Q1 2025, and their HELOC product is reportedly more than twice as fast as the industry average.

Rapport mentioned their home lending product is "twice as fast as the industry standard." She explained their auto refi strategy shifted from broad marketing to focusing on existing customers, allocating marketing budget "into the product, passed the savings onto the consumer."

Upstart AI Day Presentation and Webcast

Upstart AI Day Presentation and Webcast

Brand Building Through Product Delivery

Chantal Rapport discussed Upstart's aim to build a “category of one” business. She argued this is achievable if a company can consistently deliver better rates and a frictionless process. Rapport attributes this potential status to:

Proprietary AI and Deep Technology: Aiming for demonstrably better risk separation (what Paul Gu called an "incredible moat").

A Productized Marketplace for Capital: Described as an efficient, resilient, "many-to-many marketplace" with numerous diverse capital providers, intended to allow Upstart to be "scalable," "efficient," and "flexible."

A Strong Consumer Brand Built on Product Experience: Based on the trust of millions of users.

“And we believe that building a great brand doesn't come from just having a great Super Bowl commercial. Awareness is important, we'll also do that as we continue to build our brand. But ultimately, we believe a great brand, a generational brand, comes from having a fundamentally better product.”

Chantal Rapport, SVP of Growth and CMO of Upstart

To Rapport, "a great brand, a generational brand, comes from having a fundamentally better product." This involves delivering "best rates," "best process," and making credit "available to everyone." The perceived ease of the process is presented as a key differentiator. Examples included the "Upstart FastTrack," being the only instant auto refinance product on the market ("a product that typically takes weeks to close"), and a home lending process "twice as fast as the industry standard." This speed, she noted, is "radically different" from common consumer expectations.

Upstart AI Day Presentation and Webcast

Upstart points to over 3 million borrowers served and tens of thousands of five-star reviews as evidence of product performance. Rapport highlighted that reviews often praise the speed, low rates, and competitiveness, suggesting this delivery builds brand trust.

Underlying Technology

CTO Paul Gu detailed the development of Upstart's vertically integrated AI model, trained on over 90 million datapoints (up from 65.7 million noted for 2024 and 43.8 million for 2023). He explained that the models incorporate techniques like proprietary loss functions, embeddings, and dynamic macro modeling to adapt to economic shifts and user behavior. Upstart claims its AI achieves 8x better risk separation than traditional models.

Funding, Partnerships, and Scalability

CFO Sanjay Datta highlighted improvements in funding resilience, with 65% of funding reportedly committed for 2025, compared to 0% in 2022. A new $1.2 billion forward flow agreement with Fortress was also mentioned as a factor in enabling scaling and preparing funding supply for growth, a stated priority for 2025. Rapport contrasted Upstart’s "many-to-many marketplace for our capital" with fintechs reliant on "one capital source," suggesting Upstart's model offers greater scalability, efficiency, and flexibility.

Partnerships, such as with Walmart’s OnePay to market lending products, are positioned as distribution engines.

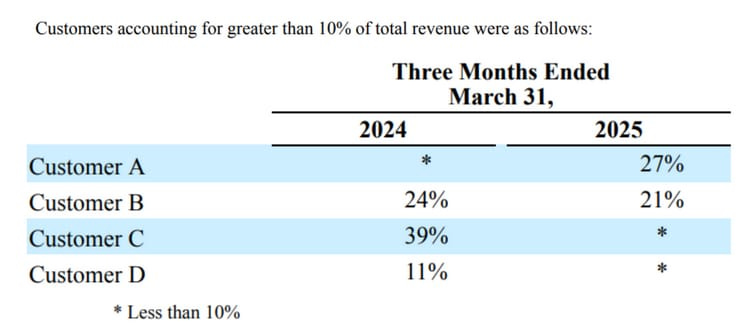

And expanding these partnerships is particularly important to Upstart. As of March 31, 2025, there were two customers (Customer “A” and “B”) that accounted for 48% of their revenue. A material improvement from the year before, where 74% of revenue came from just 3 customers.

Future Outlook: Personalized, Always-On Credit

CEO Dave Girouard reiterated Upstart's vision to become the "'everything store for credit' in the 21st century," offering "always-on credit" for all Americans. Chantal Rapport described a similar future where credit for Upstart members is "always on, always available at the lowest cost of capital, for any loan you need...always available to you as an Upstart member in your pocket, and always priced with precision." CFO Sanjay Datta also indicated potential future revenue streams beyond fees, such as ratable fee revenue, subscriptions, revolving credit, and servicing.

Girouard’s stated goals for 2025 include making "giant leaps toward best rates, best process for all" and returning to GAAP profitability in the second half of the year. This signals a shift from primarily transactional conversions to building long-term customer relationships.

Key Takeaways for Marketers from Upstart's Presentation:

Funnel Efficiency: Emphasis was placed on how process friction (e.g., requesting an unnecessary document potentially causing a 15% drop-off) can compound CAC. Streamlining the user experience is key.

Approval Rate Impact: The claim that instantly approved loans convert 3x better highlights the importance of rapid, accurate decisioning. The metric of a 1% accuracy lift potentially yielding a 13% conversion gain was noted.

Cross-Sell Focus: Targeting existing customers for new products (like the $0 CAC example for a second loan) was presented as a highly efficient growth strategy.

Brand as a Product Outcome: The argument made was that brand strength is primarily derived from delivering on product promises (e.g., faster processes, competitive rates) rather than just marketing campaigns.

Strategic Distribution: Building scalable distribution, including via partnerships and a flexible capital model, is considered crucial.

Upstart's AI Day provided a look into their playbook. While their specific AI infrastructure (trained on over 90 million datapoints) and capital marketplace model may be unique, their strategic focus on the interplay of AI, capital structure, and brand built on product differentiation offers points for consideration. The discussion suggests a focus on marketing that is deeply integrated with operational realities and efficiency gains, rather than solely on surface-level campaign metrics.

We couldn’t produce this newsletter without our sponsor (and friends) at Spinwheel (a QED-backed fintech)

Reduce friction in your lending application with only two required fields: phone number and birthdate! Seamlessly access real-time credit data and payment processing, and watch your application rates jump by 20-30%. Get started today!

Housekeeping Note

We send a separate jobs edition every 1-2 weeks. You can always view it at thefreetoaster.com or, click here if you want to receive the jobs edition via email

Support The Free Toaster

About Us

Welcome to The Free Toaster! The newsletter for marketing pros at fintechs, banks, and lenders.

Inspired by the free toasters banks used to give to each new customer, we’re here to help you acquire more customers at scale. We deliver fresh news, data, and insights to help you acquire more customers, minus the breadcrumbs.

Want to follow the authors on social media? Find Nick Madrid and Carlos Caro on LinkedIn.