SMBC Ends Jenius Bank’s U.S. Operations

Jenius Bank shuts down as SMBC exits U.S. consumer banking, Fanatics moves into cards, OnePay’s valuation climbs, credit unions adopt AI lending, and regulators rattle card issuers.

Hey Toaster Readers,

This week is sponsored by our friends at Spinwheel.

This week starts with SMBC winding down Jenius Bank, ending its U.S. digital consumer banking push just two and a half years after launch. Despite strong early deposit growth, the business never aligned with the profitability timeline its parent expected, reinforcing the broader pullback from bank-led, digital-only consumer models. Elsewhere, Fanatics is preparing to launch a credit card tied to merchandise, tickets, and betting, while Walmart-backed OnePay quietly crossed a $4 billion valuation, underscoring how embedded retail distribution can drive fintech scale without a new funding round.

Also, MyPoint Credit Union is using Upstart to expand personal lending beyond its traditional footprint, while DailyPay secured new capital to support earned wage access as a retention lever for employers. International players like bunq and Checkout.com are moving forward with concrete steps to deepen their U.S. presence.

We hope you enjoy this week’s news roundup at the intersection of consumer lending and marketing.

— Carlos Caro, Founder at New Market Growth

— Nick Madrid, Co-Founder of The Free Toaster and Uncovered Media

PS: To support us, please share our Newsletter in your internal Slack channels!

With a single call to our simple, dev-friendly APIs, Spinwheel offers the only comprehensive connection to your consumers’ financial accounts.

Spinwheel delivers PII, real-time, verified account data, and the ability to make payments across all major debt categories – all within your brand’s experience.

With many happy customers, including:

SMBC to Wind Down Jenius Bank, Ending Its U.S. Digital Consumer Banking Push

Jenius Bank, the U.S. digital banking unit backed by Japan’s Sumitomo Mitsui Banking Corp., is winding down operations, according to regulatory filings and confirmation from its parent. The move will impact roughly 160 to 170 employees, with layoffs expected to take effect around March 10 following the required notice period. The wind down includes suspending new account openings and new loan originations, effectively ending Jenius Bank’s U.S. consumer business.

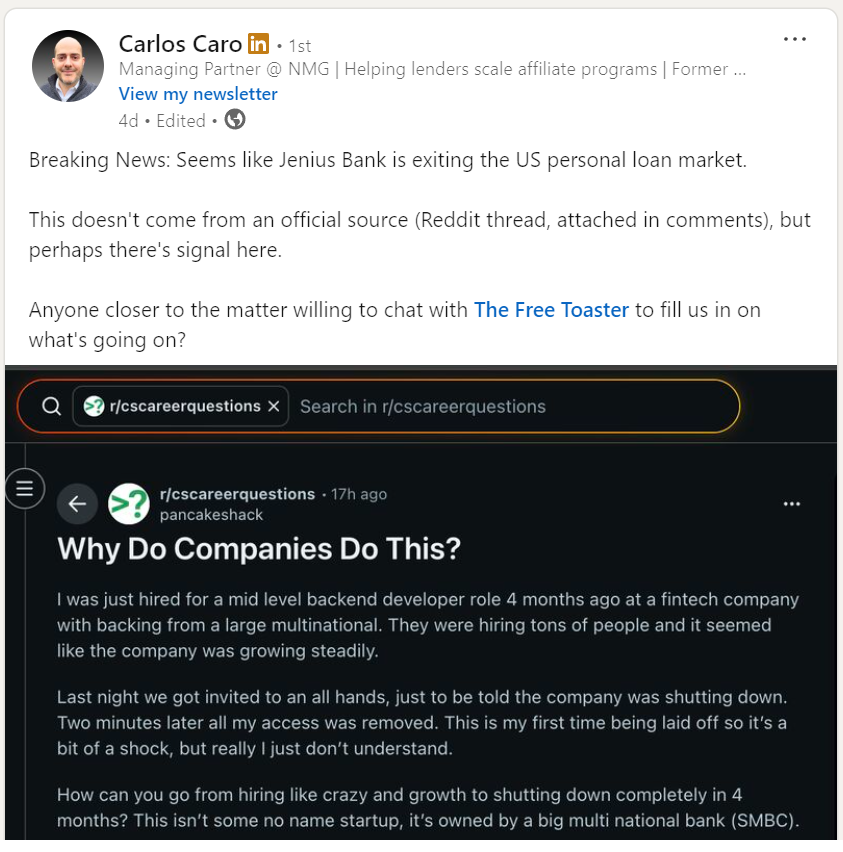

The closure did not come out of nowhere. Our own Carlos Caro flagged the risk and broke the news as early signals emerged, well before the formal filings surfaced.

Jenius Bank launched in 2023 as a digital only division of SMBC Manubank, targeting U.S. consumers with personal loans and later high yield savings accounts. Built as a cloud native, branchless operation, the bank was positioned as a long-term effort to establish a full service consumer banking presence in the U.S., with plans to expand into checking accounts, credit cards, and additional lending products. Jenius surpassed $1 billion in deposits within six months and originated hundreds of millions of dollars in loans.

Despite that growth, profitability remained elusive. According to employee accounts and public disclosures referenced in the filings, the decision to shut down was driven largely by financial performance and extended profitability timelines. Jenius had not reached break even and was not expected to do so as quickly as its parent anticipated. SMBC Manubank reported losses exceeding $38 million in early 2024, largely tied to staffing, technology, and the cost of operating a standalone digital bank. (American Banker) (Banking Drive)

We’ll keep our eye on this one and dig to see if there’s more to the story than what’s being shared in the headlines.

Fanatics CEO Targets $50 Billion In Sales, Announces Credit Card Launch

Fanatics plans to launch a branded credit card later this spring as part of a broader push to deepen its relationship with sports fans, according to comments from CEO Michael Rubin at the National Retail Federation’s Big Show in New York. Rubin said the card will be integrated across the Fanatics ecosystem, with rewards tied to merchandise, event tickets, and sports betting, positioning it as a loyalty-driven product rather than a standalone financial offering. The move comes as Fanatics targets long-term growth and projects its revenue could reach $30 billion to $50 billion within the next decade.

Fanatics is currently valued at roughly $13 billion and operates across licensed sports merchandise, trading cards, and online sports betting. The company generates the majority of its revenue through direct-to-consumer channels and has expanded through acquisitions and partnerships, including ownership of the Lids retail chain and official online stores for major sports leagues. The planned credit card adds another layer to Fanatics’ strategy of linking commerce, media, and gaming into a single platform built around fan engagement, even as the company says it feels no pressure to pursue an initial public offering in the near term. (Forbes)

Walmart-Backed ‘Super App’ OnePay Hits $4 Billion Valuation

Walmart-backed fintech OnePay has reached a valuation of more than $4 billion following a recent employee share repurchase, according to people familiar with the matter. The valuation marks a sharp increase from the roughly $2.5 billion level OnePay reached in 2024 after a $300 million funding round led by Walmart and Ribbit Capital. The company, formally known as One Finance Inc., declined to comment on the latest valuation, which reflects internal transactions rather than a new external raise. We have covered OnePay’s trajectory before, including how its exclusive distribution partnership with Walmart has fueled rapid scale and product expansion.

OnePay was formed through the merger of two smaller fintech firms with the goal of building an all-in-one financial app, and it has grown quickly by embedding itself inside Walmart’s ecosystem. The app now counts more than 3 million monthly active users and has expanded well beyond basic banking into credit cards, buy now pay later, investing, and cryptocurrency trading.

More recently, OnePay has positioned itself within emerging agentic commerce infrastructure, joining Google’s Agent Payments Protocol as Walmart continues to more tightly integrate financial services, payments, and artificial intelligence into its core retail experience. (Bloomberg)

Enjoying this week’s issue?

If you’ve been enjoying The Free Toaster, help us spread the word. Forward it to someone who lives and breathes consumer lending, marketing, or fintech like you do.

Your shares help us reach more builders in consumer lending, and help us make the Newsletter & Podcast better every day.

MyPoint Credit Union Selects Upstart for Personal Lending

MyPoint Credit Union has partnered with Upstart to expand its personal lending offerings, using Upstart’s AI-powered platform to reach borrowers beyond its traditional channels. The San Diego-based credit union began lending through the Upstart Referral Network in September 2025, allowing qualified applicants on Upstart.com to receive MyPoint-branded loan offers and complete the application and closing process digitally. According to MyPoint, the partnership is intended to support growth while delivering a faster, more streamlined borrowing experience for members and new customers across the region. (Upstart)

DailyPay Announces New $195 Million Senior Secured Revolving Credit Facility

EWA provider DailyPay has closed a new $195 million senior secured revolving credit facility, strengthening its capital position and adding flexibility to support long-term growth. The facility, which closed on December 30, 2025, is led by JPMorgan Chase Bank as administrative agent and sole bookrunner. DailyPay said the financing will support continued investment in its on-demand pay and financial wellness platform as employers increasingly look to earned wage access as a tool for employee retention and engagement. (DailyPay)

bunq Files For U.S. Banking License

European neobank bunq has filed for a U.S. de novo banking license with the Office of the Comptroller of the Currency, moving closer to a full launch in the American market. The filing follows the company’s recent approval as a U.S. broker-dealer and reflects its strategy to serve digital nomads and globally mobile customers who split their lives between Europe and the U.S., offering features such as cross-border accounts, credit-building tied to European financial histories, and AI-driven fraud detection. bunq said it plans to begin in U.S. metropolitan areas with large expat populations, building on its existing footprint across more than 30 European markets and a user base that recently surpassed 20 million. (bunq)

Checkout.com Secures Approval For Georgia Bank Charter, Accelerating US Expansion

Payments provider Checkout.com has received approval for a Merchant Acquirer Limited Purpose Bank charter from the Georgia Department of Banking and Finance, clearing a key regulatory step toward operating as its own acquirer in the U.S. The charter positions the company to pursue direct U.S. card network integration and begin charter banking operations in 2026, a move Checkout.com said will support faster product development, improved acceptance rates, and greater control over payment performance for enterprise merchants. The approval comes as U.S. volumes grew nearly 70% in 2025, making North America the company’s fastest-growing revenue region, with Atlanta set to serve as a central hub alongside existing offices in New York and San Francisco. (Checkout.com)

Please support our Newsletter by recommending us to one of your colleagues!

And, please check out our sponsors:

Need an affiliate marketing platform/network? Chat with Fintel Connect

Need to improve application page conversions? Chat with Spinwheel

Need help with performance marketing? Chat with Bulldog Media Group

Need to accelerate your affiliate marketing? Chat with New Market Growth

Need to win on other growth channels? Chat with FIAT Growth

Other News We’re Reading

(Industry News) Capital One, Amex Shares Sink on Trump’s Credit-Card Threat (Bloomberg)

(Commerce) New Tech and Tools for Retailers to Succeed in an Agentic Shopping Era (Google)

(Cards) Banks Balk as Trump Pushes for 1-Year, 10% Cap on Credit Card Interest Rates (PBS)

(Commerce) FIS Launches Industry-First Offering Enabling Banks to Lead and Scale in Agentic Commerce (FIS Global)

(Commerce) Microsoft Propels Retail Forward With Agentic AI Capabilities That Power Intelligent Automation for Every Retail Function (Microsoft)

(Banking) Magnifi Financial Partners with Greenlight(R) to Help Parents Raise Financially Smart Kids and Teens (Newswire)

(Banking) CU*SOUTH Partners with Posh to Bring Responsible, Human-Like AI to Credit Unions (Posh)

(Payments) Modulr Expands to U.S. with FIS Partnership to Power Real-Time Payments for Banks (Modulr)

(Crypto) Wyoming Launches First State-Backed Stablecoin on Solana Blockchain (CoinMarketCap)

(Cards) Explainer: How Trump’s Proposed Cap on Credit Card Rates Could Reshape Consumer Lending (Reuters)

Spot something worth sharing with your team? Drop this week’s edition in their inbox:

https://www.thefreetoaster.com/p/smbc-ends-jenius-banks-us-operations

Happy New Year!

Catch you next week,

The Free Toaster Team

P.S.: If you’d like to sponsor or host an event in the consumer lending community in 2026, we’d like to hear from you. The Free Toaster will be organizing & hosting curated events this year, and we’d love to work with you as a sponsor.