Wells Fargo hires former JPMorgan exec to run its card business

Capital One tops spend on podcasts, Ally Financial cuts jobs and halts mortgage originations, Klarna partners with Stripe ahead of their expected IPO, and more...

We had a huge jump in subscribers over the last week. We see many of you sharing this newsletter with your colleagues. Thank you for that!

We view this space as a community, and we welcome everyone who joined recently joined. Check out our sponsor page, which includes a list of companies that you all are from.

And speaking of sponsors, we want to welcome (and thank) our newest supporter.

SPONSORED BY SPINWHEEL

Streamline your lending application pages with 2-fields.

If you’re anything like us, friction on application pages makes you nauseous.

It makes your CACs go up. It makes your volumes drop. It causes your CFO and CEO to say mean things.

The trouble is, application friction isn’t easy to fix. Your prod/eng is busy. We get it.

Spinwheel’s APIs streamline a lending application form with just a phone number and a birthdate - like magic (but it’s really just smart tech)! Then you get a 20-30% lift in your approval rate.

Additionally, they can give you real-time, verified consumer credit data and seamless payment processing, which can help you serve customers beyond the initial application.

To see a demo, click below to connect with their Head of Growth and see this thing in action.

Schedule a free 15-minute demo

TL;DR

Wells Fargo hired former JPMorgan Chase exec Ed Olebe to lead its credit card division, signaling a push to revamp its offerings and close the gap with top competitors. Capital One dominated podcast ad spending in 2024, showcasing the financial sector's growing reliance on this booming medium. Ally Financial is scaling back, cutting jobs, halting mortgages, and exploring a credit-card business sale to address rising credit risks. Klarna partnered with Stripe to expand its BNPL reach globally, while gearing up for a U.S. IPO as fintech listings, including Chime and eToro, make a cautious comeback. Despite fintech's appeal to younger audiences, past IPO volatility urges investors to proceed with care.

Top News

(01/13) Wells Fargo hired former JPMorgan Chase executive Ed Olebe to lead its credit-card division, replacing Ray Fischer, who will retire but remain as a consultant. Olebe spent about eight years at JPMorgan, most recently as president of its branded credit-card business, which includes the Chase Sapphire and Freedom cards. JPMorgan is the largest general-purpose credit-card issuer in the U.S. by purchase volume, according to the Nilson Report, while Wells Fargo ranks eighth. CEO Charlie Scharf is focused on expanding the bank’s credit-card offerings and reevaluating co-branded programs like Bilt to drive growth. [WSJ]

Toaster Team’s (Hot) Take:

In 2018, Wells Fargo tried to innovate in the Credit Card space with their Propel product launch. With no annual fee, it gave 3X points on categories they thought would appeal to a younger, affluent audience (dining, ride-share, flights, hotels, homestays, and streaming). The product ultimately flopped and was discontinued.

Their products today are middle-of-the road value props that many other large banks offer. They lack an Amex Platinum or Chase Sapphire Reserve type product that can stand as a flagship for the brand.

We wouldn’t be surprised if the new head of cards (coming from Chase) will be tasked with addressing that strategic gap.

In October 2024, Charlie Scharf spoke with Jim Cramer, marking five years as CEO of Wells Fargo, and shared an optimistic outlook on the bank's credit card business.

“Listen, our credit card business is doing extraordinarily well. We've launched nine new products since I've been here, when you look at our point of sales on cards, it's up well over 50%. We're doing a great job growing organically, and that's where we think the opportunity is. It's not about buying portfolios or looking at other things at this point. When you look at what your opportunity is, if you don't think you've got the organic opportunities, you do need to look elsewhere. That's not how we feel about where we are today.”

[our emphasis added in bold]

Charlie Scharf Speaking with Jim Cramer (October 2024)

Wells Fargo CEO Charles Scharf talks credit cards

In late November 2024, Reuters reported that Wells Fargo’s asset cap, imposed in 2018 after the fake accounts scandal, will likely be lifted in the first half of 2025. This cap has significantly constrained the bank's growth, though Scharf noted that credit cards have been less impacted by the restriction. [WSJ]

Wells Fargo’s 2023 Annual Report further emphasized the strategic importance of its credit card business:

“We continue to believe that a broader credit card platform is important strategically for the company. Providing credit for our customers is a core strategy for us, but being involved in payments has grown in importance. Though our card business is smaller than some of our competitors, it operates with necessary scale and we have been working to introduce attractive new products over the last few years. These include Active Cash®, which offers customers 2% cash rewards on purchases with no limits and no annual fees; Autograph℠, which offers three-times points on certain purchases; Reflect®, which offers 0% intro APR for 21 months; and, most recently, new co-branded cards with Choice Hotels.”

[our emphasis added in bold]

In its Q3 2024 earnings report, Wells Fargo highlighted additional growth:

“we launched two new co-branded credit cards and announced a multi-year co-branded agreement for auto financing.”

To understand the scale of Wells Fargo’s credit card operations, we reviewed the last five annual reports. Between 2019 and 2023, the bank demonstrated steady growth across key metrics:

Average balances: Increased from $38.9B to $48.2B.

Unfunded credit commitments: Rose from $114.9B to $156B.

New accounts: Reached 2.55M in 2023.

Interest income: Grew significantly to $6.25B.

Point-of-sale volume: Surged from $88.2B to $136.4B, reflecting strong consumer activity.

Delinquency rate: Declined through 2021 but rose to 2.89% by 2023, suggesting a potential increase in credit risk despite overall growth.

At the end of the day, we welcome more choice for consumers. With Wells Fargo's broader operational improvements in recent years, it will be interesting to see if they can deliver a truly competitive credit card offering.

(01/14) Capital One topped podcast advertising spend for financial services last year, leading a wave of brands banking on the "media of the year" prediction by Scott Galloway. Podcasts, now more popular than ever, are seeing a "tsunami of revenue," and bold marketers like Capital One and the Apple Card from Goldman Sachs are pioneering in the space. Even smaller players like Atlantic Union Bank, ranked 77th in assets, punched above their weight to claim 6th place in podcast ads—setting the stage for a podcast ad boom in 2025. [Andrew Davidson from Mintel]

(1/8) Ally Financial is taking tough steps to address rising credit challenges by cutting less than 5% of its workforce and halting mortgage originations. The Detroit-based lender, known for its auto-financing operations, is also exploring a sale of its credit-card business as borrowers struggle with mounting debt in a high-interest rate environment. Ally remains optimistic that stricter loan approval criteria will help curb future losses. [Bloomberg]

(1/8) TransUnion revealed that 70% of marketing leaders struggle to connect with audiences due to fragmented martech systems and identity challenges, with two-thirds managing 16+ martech tools. The Forrester survey shows brands using identity resolution tools to unify their data see big wins: 93% meet customer experience goals, while 88% improve insights. The takeaway? It’s not about overhauling your stack—connecting the dots is what drives results. [TransUnion]

(1/7) Ad Age highlights the dynamic duo of AI and human creativity in marketing, where AI powers efficiency, data analysis, and trendspotting, but human imagination remains the driving force behind meaningful, authentic campaigns. While AI optimizes workflows and helps brands address inclusivity and accessibility gaps, it can’t replace the cultural understanding and originality that humans bring. The takeaway? Let AI handle the grunt work, but keep humans at the creative helm. [Ad Age]

Macro & Markets

((1/8) Revolving credit balances fell 12% in November, the sharpest drop in over four years, per the Federal Reserve's G.19 report. With credit card APRs averaging 21.4% and inflation still a factor, consumers seem focused on paying down debt instead of borrowing, even as retail spending rose 0.7%. Meanwhile, PYMNTS Intelligence notes a shift toward installment options like card-linked plans and buy now, pay later services, signaling changing borrowing habits. Whether this is a trend or a blip will become clearer with December’s data. [PYMNTS]

(1/14) Klarna, the Swedish buy now, pay later (BNPL) fintech, partnered with payments giant Stripe to expand its reach ahead of a highly anticipated U.S. IPO. This deal enables Klarna's BNPL service to integrate with Stripe’s tools in 26 countries, boosting merchant access and offering features like real-time conversion tracking. Klarna, recently valued around $15 billion, aims to regain momentum after its peak $46 billion valuation in 2021, while Stripe benefits from BNPL’s "172% growth" on its platform last year. [CNBC]

(1/11) Fintech IPOs are making a comeback in 2025, with Klarna, Chime, and others like eToro leading the charge in the U.S., while Ebury and Zopa eye UK listings. These companies have succeeded in attracting younger consumers and businesses, but past fintech IPOs—like Affirm and Robinhood—show how volatile these debuts can be. Investors should tread carefully, as private backers aim to recoup pandemic-era valuations, potentially leading to overpriced deals. [FT]

[FT]

Launches & Partnerships

(1/8) doxo launched doxoBILLS™, a next-gen bill payment platform designed to tackle the complexities of household bill management. Built on its Bill Pay OS™, the app bundles six essential features like all-in-one bill pay, a private pay wallet, real-time bank balance, credit score tracking, $1M identity theft protection, and financial insights. By simplifying payments to over 120,000 billers and reducing hidden costs—$196 billion annually for U.S. households—doxoBILLS puts users in control of their financial health, offering free services with premium add-ons for $5.99/month. [doxo]

(1/7) Tradition Capital Bank, a $2.6 billion commercial-focused bank operating in Minneapolis and Scottsdale, is teaming up with CorServ, a payments solutions provider, to launch a credit card program. This partnership will let Tradition offer features like virtual cards, ghost cards, advanced spend controls, and self-service administration—all powered by CorServ's Account Issuer Program. The move aims to give Tradition clients the benefits of big-bank credit card programs but with the personalized service of a local bank. [PR Newswire]

(1/13) Wisetack, an embedded financing platform for home services, partnered with U.S. Bank to offer pay-over-time options for home improvement projects. Through Wisetack’s network of thousands of merchants, qualified borrowers can access U.S. Bank financing with flexible monthly payment plans, completing transactions in under a minute while merchants get paid the next business day. This partnership strengthens Wisetack's mission to provide "borrower-friendly" options while expanding its impact in the home services space. [Business Wire]

CFPB

(01/08) CFPB to regulate large participants in personal loan market [American Banker]

(01/09) CFPB approves Financial Data Exchange as first “standard setting body” under new US open banking rule [Fintech Futures]

(01/10) CFPB issues new fintech sandbox and no-action letter policy [American Banker]

Credit Unions

(1/7) Union Credit Partners with MeridianLink to Simplify Lending and Grow Credit Union Membership. [Business Wire]

(1/8) Sandia Area Federal Credit Union Selects Upstart for Personal Lending. [Business Wire]

(1/10) Credit Union Delinquencies Accelerate. Trade group revises fall delinquency rates upward, including a big spike for November. [CU Times]

Canada

(1/7) Eltropy acquires Canada’s Lexop to modernise collections for credit unions. [Fintech Futures]

(1/8) Canadian start-up LottoLend launches to offer a “safe, fair and rewarding alternative to traditional payday loans”. [Fintech Futures]

(1/13) Float Financial, which aims to be the Brex of Canada, lands US$48.5M Series B. [TechCrunch]

UK

(1/7) ClearScore expands into embedded finance through Aro acquisition. This is the second acquisition made by ClearScore following its 2022 purchase of Money Dashboard. [UK Tech News]

(1/9) ReFi™ from Paylink Solutions Becomes Part of Experian to Enhance Debt Support for Millions Stuck in Revolving Debt Trap. [FF News]

(1/10) From Paymentz to PAIO: a British fintech company underwent a significant global brand refresh. [StreetInsider]

Jobs

Spotlight of the week:

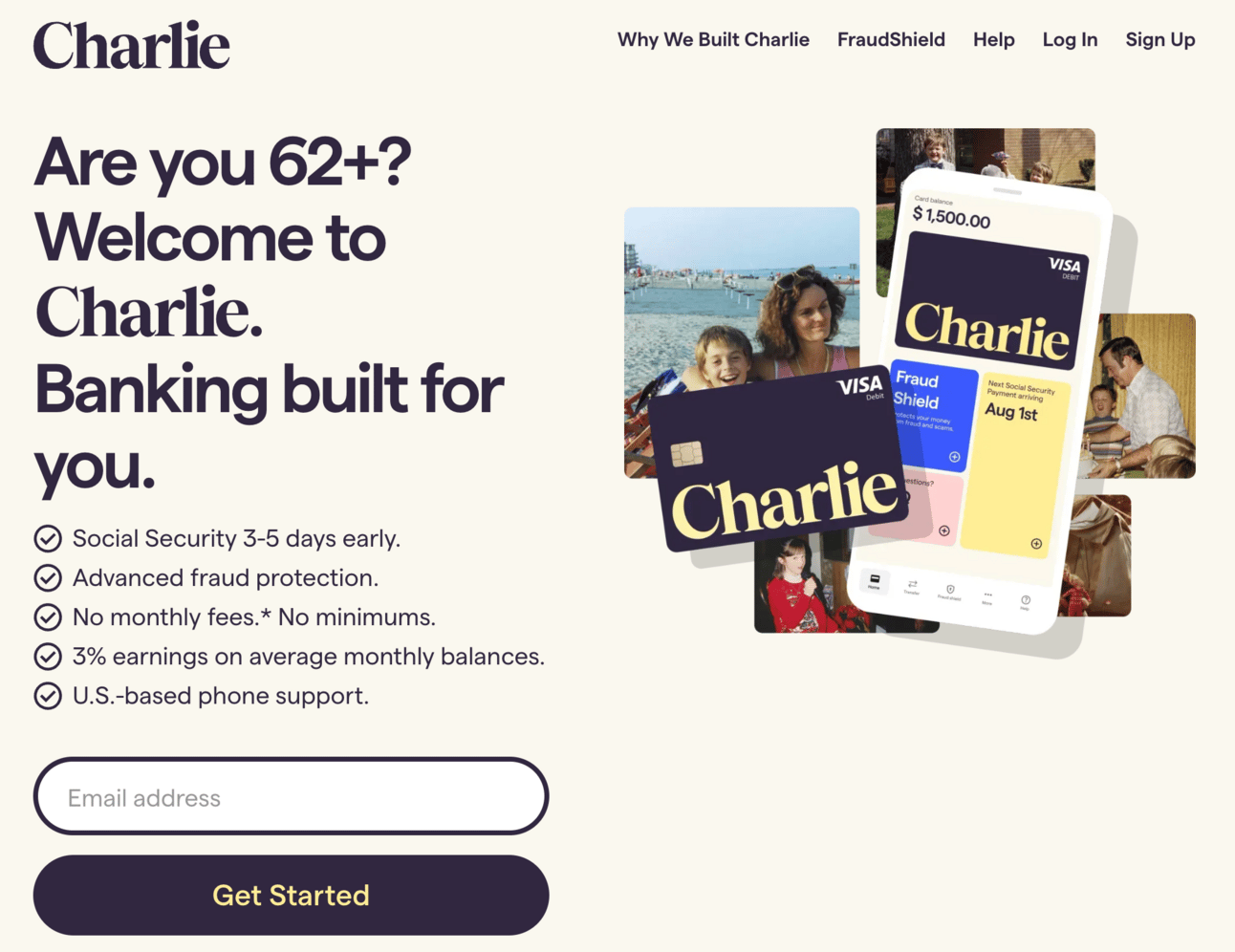

Head of Direct to Consumer Marketing (Charlie)

What We're Looking For

Are you an energetic self-starter who wants to build something big and impactful from the ground up? Do you get excited by taking on a big challenge? Charlie is building the future of banking for the coming wave of millions of tech-comfortable retirees who deserve a bank built from the ground up for their unique needs, a bank they don’t have to get in line for, a bank that comes to them.

We are seeking a highly skilled Head of Direct to Consumer Marketing to join our team. This role will be responsible for managing a seven-figure paid acquisition program.

You’d be joining a highly experienced group of founders including our CEO Kevin Nazemi, who served as the Co-Founder and Co-CEO of Oscar Health (NYSE: OSCR), and a company financially supported by some of the most respected FinTech Investors.

Other jobs:

Sr. Director, Performance Marketing (MoneyLion)

Senior Embedded Partnerships Manager (Credit Karma)

Performance Marketing Manager, International (Robinhood)

Customer Communications Strategist (Guideline)

Marketing Director, SaaS Product (Altos)

Director, Performance Marketing (Addepar)

Director, Brand Marketing (Novo)

Director, Account-Based Marketing (Global Payments)

Partnership Associate (UK) (Allica Bank)

Regional SVP, GTM EMEA (UK) (Payoneer)

Head of Growth Partner Acquisition (UK) (GoCardless)

Marketing Operations Analyst (CDI) (Paris) (iBanFirst)

About Us

Welcome to The Free Toaster! The newsletter for marketing pros at banks and lenders.

Inspired by the free toasters banks used to give to each new customer, we’re here to help you acquire more customers at scale. We deliver fresh news, data, and insights to help you acquire more customers—minus the breadcrumbs.

Want to follow the authors on social media? Find Nick Madrid and Carlos Caro on LinkedIn.

Have an idea for a newsletter?

Ghostmode built this newsletter and can build yours, too.

(click here or reply to this email to learn more)