📉 NerdWallet's Credit Card Biz gets Crushed in Q1

Cash App's Lending Strategy, How to Win With Direct Mail and Affiliate Marketing

Housekeeping Note

We send a separate jobs edition at the end of the week. You can always view it at thefreetoaster.com or, click here if you want to receive the jobs edition via email

NerdWallet Reports First Quarter 2025 Results

“In Q1, we grew revenue 29% year-over-year to $209 million, led by the strength in our Insurance and banking businesses,” said Tim Chen, Co-Founder and Chief Executive Officer of NerdWallet. “We also saw encouraging signs in mortgages, supported by our acquisition of Next Door Lending, and personal loans. We remain focused on our long-term growth by improving our operational efficiency and investing in vertical integration and user engagement.”

While NerdWallet did report impressive results with their insurance business, they seem to be struggling with their credit card business.

Key Stats

Ended Q1 2025 with over 26 million cumulative Registered Users

Sales and marketing expenses increased $51.8 million, or 48%, for the three months ended March 31, 2025, compared to the three months ended March 31, 2024, primarily due to increases of $43.0 million in performance marketing expenses and $10.4 million in brand marketing expenses. (Remember the beluga whale at the Super Bowl?)

NerdWallet Q1 2025 Shareholder Letter

The Good

Insurance revenue of $74.0 million increased 246% YoY, driven by strong growth in auto insurance products as carriers expanded budgets.

Personal loans saw a return to growth after declining 51% YoY in Q4 2024.

The Not So Good

Credit Card Business Down - Credit card revenue of $38.0 million decreased 24% YoY, primarily due to continued headwinds in organic search traffic that have persisted for multiple quarters.

Monthly Unique Users Down 29% YoY - As reported last quarter, the company is no longer officially disclosing quarterly Monthly Unique Users (MUUs) as it shifts focus from quantity to higher quality relationships. With that said, during the Q&A with analysts, management disclosed that MUUs were up 7% in Q1 compared to Q4 but down 29% year-over-year, with an expectation of continued near-term decline. Management also mentioned a potential normalization and return to growth in early 2026 if search landscape stability persists.

Looking Ahead

NerdWallet's strategy for 2025 and beyond focuses on "relentless improvement" through its three core growth pillars:

Land & Expand by diversifying its top-of-funnel with new organic channels (e.g., TravelNerd newsletter and Smart Travel podcast).

Vertical Integration by pairing its brand and reach with ‘concierge-level’ shopping experiences, like the Next Door Lending mortgage integration, to improve unit economics and user experience.

Registrations & Data-driven Engagement by growing its over 26 million registered user base and leveraging its CRM channel for personalized offers and smart nudges.

Critically, NerdWallet is navigating the rise of AI Search by focusing on quality content and superior user experiences for complex financial decisions, noting early success with a high share of referral traffic from AI sources and anticipating that its core strengths will remain valuable in this evolving landscape.

[NerdWallet Investor Relations] [NerdWallet Earnings Call Transcript]

We couldn’t produce this newsletter without our sponsor (and friends) at Spinwheel (a QED-backed fintech)

Reduce friction in your lending application with only two required fields: phone number and birthdate! Seamlessly access real-time credit data and payment processing, and watch your application rates jump by 20-30%. Get started today!

Block Q1 2025 Update: Focus on Cash App Lending

Last week, Block reported its Q1 2025 results, revealing a mix of positive developments and challenges, particularly concerning its Cash App segment.

While Square showed signs of returning momentum, Cash App's growth decelerated more than anticipated, raising questions about its near-term trajectory, especially its reliance on lending products.

Square Performance and Cash App Strategy

Square Momentum: Positively, Block's Square ecosystem demonstrated resilience in Q1, with Gross Payment Volume (GPV) growth narrowing the gap to peers like Clover to its smallest point in two years, suggesting early returns on product and go-to-market investments. Following 7.2% GPV growth in Q1, management expects further improvement to high single-digit growth in Q2. This relative strength in Square lends some optimism to Cash App's strategic initiatives aimed at network expansion and user banking.

Cash App Deceleration: Cash App's gross profit grew 10% year-over-year to $1.38 billion, a deceleration from the 16% YoY growth seen in Q4 2024 and below expectations. Management attributed this primarily to unexpected shifts in consumer behavior, particularly during the tax refund season (late February/March). Inflows came in lower than anticipated, and discretionary spending on the Cash App Card softened, impacting areas like travel and media.

Block Q1 25 Investor Presentation

Cash App Lending: The Acceleration Engine?

A significant portion of Block's strategy for re-accelerating Cash App growth in the second half of 2025 hinges on its lending products: Cash App Borrow and the newly integrated Afterpay BNPL features.

Cash App Borrow Expansion:

A key milestone driving expected second-half growth for Cash App is the recent FDIC approval for Block's bank, Square Financial Services (SFS), to originate Borrow loans nationwide. This approval effectively doubles Borrow's addressable market by enabling expansion into more states and significantly boosts unit economics through in-house origination and servicing. Management expressed high conviction in scaling Borrow responsibly, citing strong underwriting using real-time machine learning models and rapid feedback loops from short (~30-day) loan durations, allowing for adjustments while maintaining consistent repayment rates and healthy credit quality despite potential macro shifts.

Afterpay/BNPL Integration:

Retroactive BNPL: The launch of "Cash App Afterpay" allows eligible users to retroactively split Cash App Card purchases into installments for a fee. Early adoption and conversion rates in April were reported as strong.

Direct BNPL Use: The integration also allows eligible Cash App users to directly use Afterpay's Pay-in-4 and monthly payment options when shopping online at partner merchants.

BNPL Performance: Afterpay generated $7.9B in GPV, up 13% in Q1, with gross profit up 14%. Loss rates remained low (<1%).

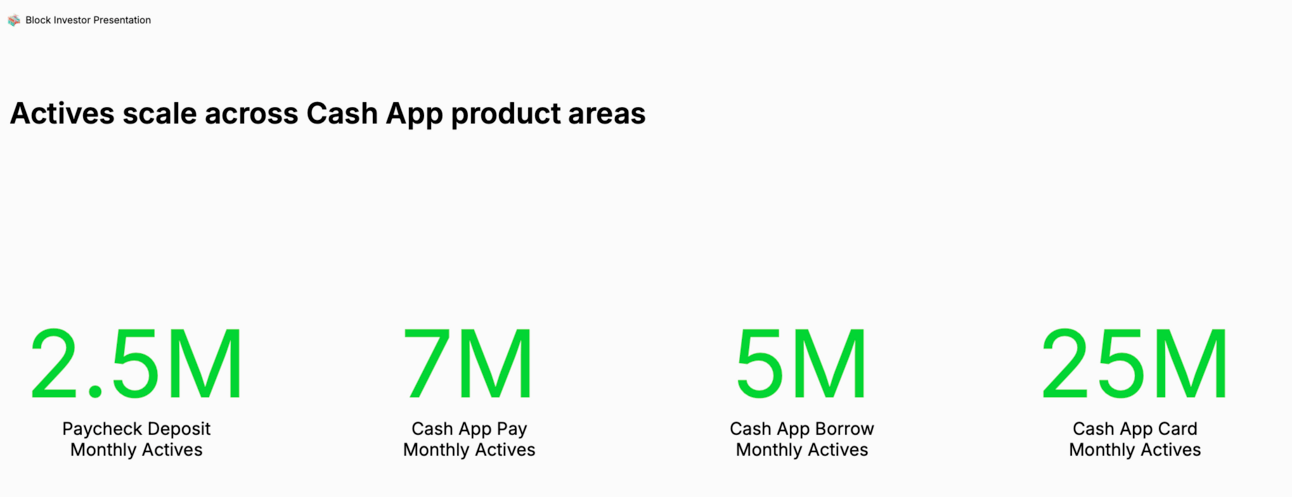

Key Stats

Monthly transacting actives were 57M

Cash App Card actives were 25M

Inflows per active were $1,355 up 8% YoY for total inflows of $77B (up 8% vs. fairly consistent double digit trend in prior quarters).

JP Morgan Research

The Core Challenge: Lending into Consumer Softness

The key challenge highlighted is Block's increasing reliance on lending (Borrow and BNPL) to drive Cash App's growth acceleration, precisely when the target consumer base showed signs of spending pressure. While Block's underwriting models are designed to be adaptive, expanding credit offerings to consumers who just pulled back on discretionary spending carries inherent risk, especially if macroeconomic conditions worsen further. Management acknowledged this by incorporating a more cautious macro outlook into their revised FY25 guidance, even beyond what was observed in April.

It's noteworthy that Cash App Borrow, Block's short-term consumer loan product, had established a substantial user base and loan volume prior to the recent FDIC approval for nationwide origination through Square Financial Services. With 5 million reported monthly actives as of December 2024, this consumer lending activity is reflected in the $771.55 million of consumer loans held for sale in Q1 2025, a figure exceeding the company's Square Loans commercial portfolio.

Block Q1 25 Investor Presentation

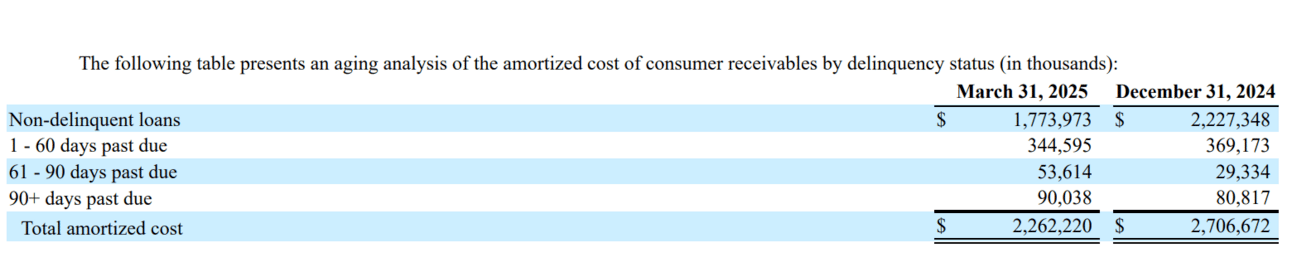

Block reports the information of its BNPL (Afterpay) platform under "consumer receivables." These represent the outstanding, typically interest-free installment payments consumers owe for purchases made using the BNPL service. Block classifies these receivables, generally due within 14 to 56 days, as held for investment on its balance sheet.

Total receivables outstanding on March 31, 2025, were $2.2B, a decrease of 16% from the prior quarter.

Outlook & Conclusion

Block lowered its FY25 gross profit growth guidance to 12% (from "at least 15%") and its Adjusted Operating Income guidance to $1.90 billion (from $2.1B). They still expect growth to accelerate sequentially through the year, forecasting low-double-digit growth in Q3 and mid-teens growth in Q4, driven significantly by the Cash App lending initiatives.

While Square's improved performance is encouraging, Block's near-term success appears heavily tied to executing its Cash App lending expansion effectively amidst potential consumer headwinds.

The ability to profitably scale Borrow and Afterpay integrations while managing credit risk in a potentially softening economy will be critical for achieving the guided acceleration and rebuilding investor confidence.

Toaster Exclusive Content

Direct Mail Partner Diligence: 12 Questions That Reveal Everything

Struggling to find a direct mail partner that delivers real results instead of just empty promises? This guide reveals the 12 critical questions you must ask to cut through the noise and identify a true strategic ally who will proactively drive your campaign success, saving you from costly mistakes and overlooked opportunities.

Affiliate Marketing - Playing the Game in Reverse

Tired of new affiliate partnerships fizzling out before they even get started? If you're struggling to get noticed by publishers and secure those crucial second chances, this piece reveals a counterintuitive strategy to ensure your launches make an unforgettable, revenue-generating impact from day one.

We Need Your Help

If we doubled down on one of these, which should it be?

(Click on one of these and let us know what you think)

Competitive research (e.g., analysis of competitor ads)

Product market research (what lending products are consumers choosing)

Analysis/reviews of AI tools that can make your team more efficient

Benchmarks across channels and product categories (e.g., CACs and conversion rates)

Something else (you'll be able to share details on the next page)

Support The Free Toaster

Need to improve application page conversions? Chat with Spinwheel

Need to accelerate your affiliate marketing? Chat with New Market Growth

Need to win on other growth channels? Chat with FIAT Growth

None of the above? Share our Newsletter in your favorite Slack channel

About Us

Welcome to The Free Toaster! The newsletter for marketing pros at fintechs, banks, and lenders.

Inspired by the free toasters banks used to give to each new customer, we’re here to help you acquire more customers at scale. We deliver fresh news, data, and insights to help you acquire more customers—minus the breadcrumbs.

Want to follow the authors on social media? Find Nick Madrid and Carlos Caro on LinkedIn.