NerdWallet Employs Talking Beluga in Super Bowl Ad 🏈

Philadelphia Fed Finds Consumer Stress. Though, are things really that bad?

Toaster PSAs:

When emails get long, email clients cut them off. The top right of this email has a ‘Read Online’ option.

The Free Toaster Podcast is actively interviewing all experts in Direct Mail Marketing. If you are an expert (or know one), please send them our way.

This week, we lead with the latest edition of THE FREE TOASTER PODCAST

Kevin Bennett, who grew Caribou to a billion-dollar company and recently launched Further to help people afford their first homes, shares insights for early-stage founders on product and distribution, quickly testing marketing strategies, and forming strategic partnerships.

He also provides a simple framework for evaluating marketing channels, emphasizes the importance of speed in decision-making, and underscores how strong partners can fuel business growth.

We think it’s a great episode, but don't just take our word for it:

Listen and let us know what you think!

TL;DR

NerdWallet is bringing a talking beluga whale to the Super Bowl, using the smart sea creature to pitch its personal finance tools in a 30-second spot airing during the third quarter. SoFi Technologies posted a strong Q4, with $734 million in revenue (up 19% YoY) and loan originations hitting $23.2 billion for 2024. Meanwhile, the Philadelphia Fed reports rising credit card stress, with revolving balances hitting $645 billion, while experts say this is more a return to normal than a crisis. Citigroup is pushing deeper into BNPL with Citi Pay Installments, gaining traction among 195 U.S. merchants, while Affirm Holdings secured $750 million from Liberty Mutual to fuel its lending ambitions, aiming for $34 billion in loans this year.

Top News

(1/27) NerdWallet is diving into Super Bowl Sunday with a 30-second ad featuring a talking beluga whale—one of the world's smartest animals. The personal finance platform, known for guiding people to smarter money decisions, says the clever sea creature is the perfect fit. The spot, created by Deutsch, will air during the third quarter of the Feb. 9 game on Fox. [AdAge] [Teaser video on YouTube]

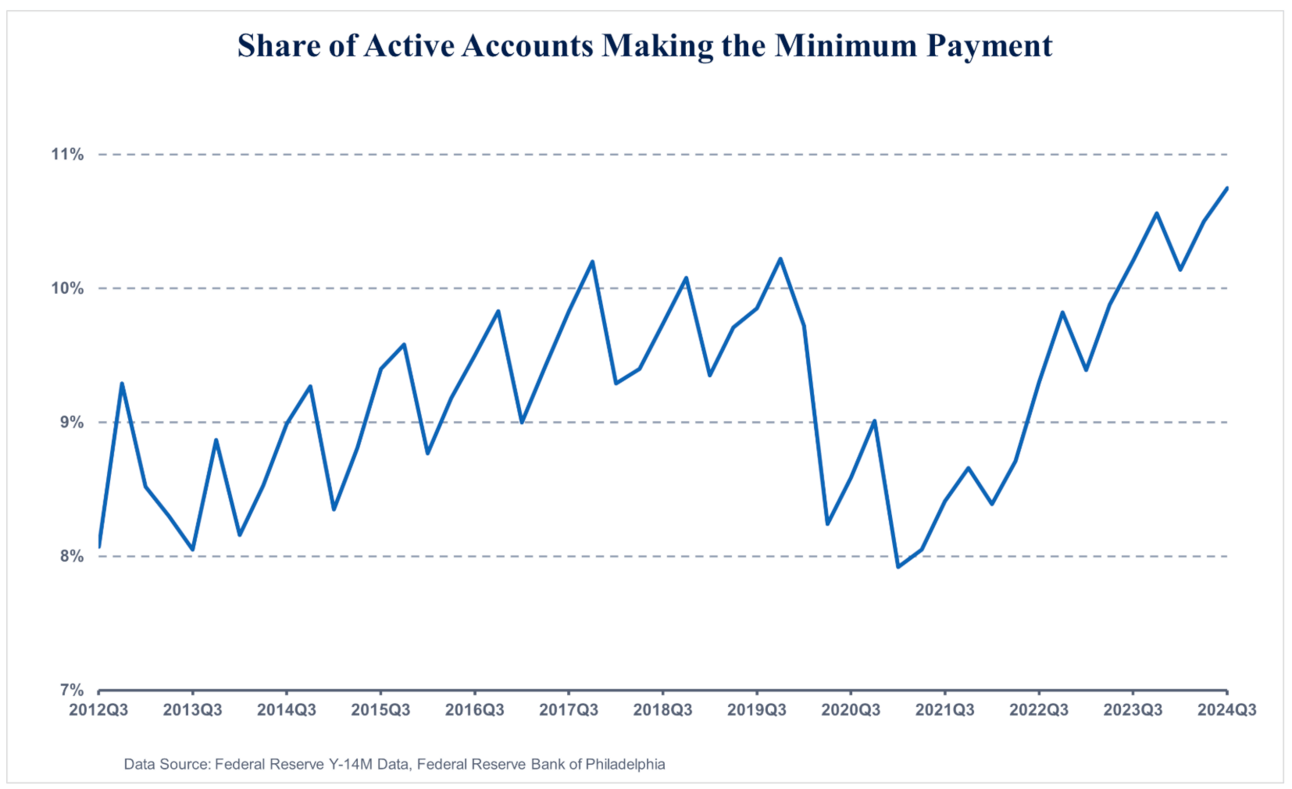

(1/22) The Federal Reserve Bank of Philadelphia’s Q3 2024 report shows credit card stress rising, with revolving balances hitting $645 billion and minimum payments at a 12-year high (10.75%). Meanwhile, mortgage originations remain at 12-year lows, stuck at $55 billion per quarter, as high rates and affordability challenges dampen demand. [Philadelphia Fed]

Toaster Team’s Take:

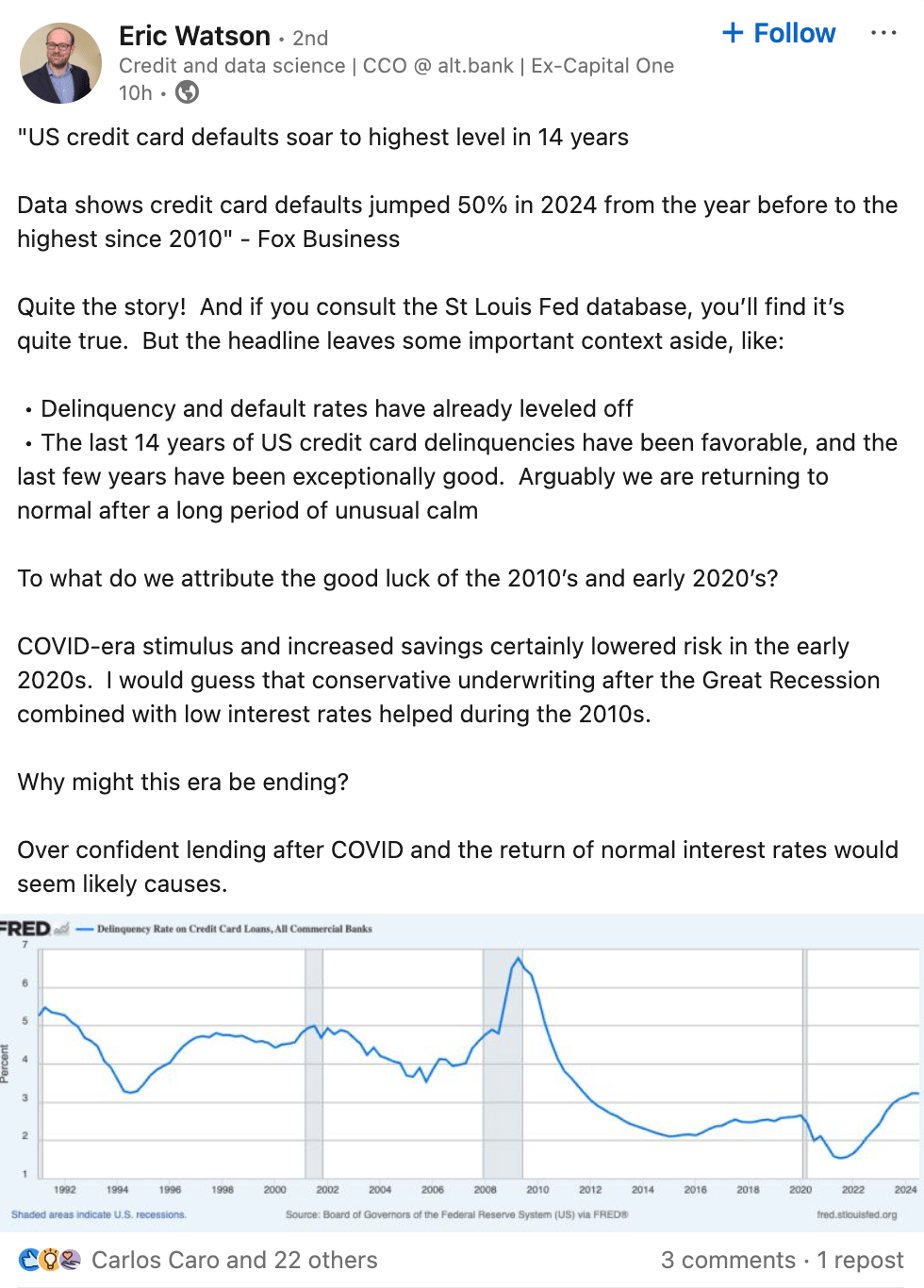

It’s easy to get caught up in headlines about ‘consumer stress’ in credit card performance. The Toaster Team, however, likes to dig deeper to understand the real story. This week, we’re lucky to have Eric Watson (see below) shed light on the data, putting sensational claims into proper perspective.

(1/28) Credit card defaults in the U.S. surged 50% in 2024, hitting the highest levels since 2010, according to Fox Business. But as Eric Watson, CCO at alt.bank, points out, context is key: defaults have recently leveled off, and the 2010s through early 2020s were unusually stable, thanks to COVID-era stimulus, increased savings, and cautious lending practices. The current spike could reflect post-COVID overconfidence in lending and the return of normal interest rates. [Eric Watson on LinkedIn]

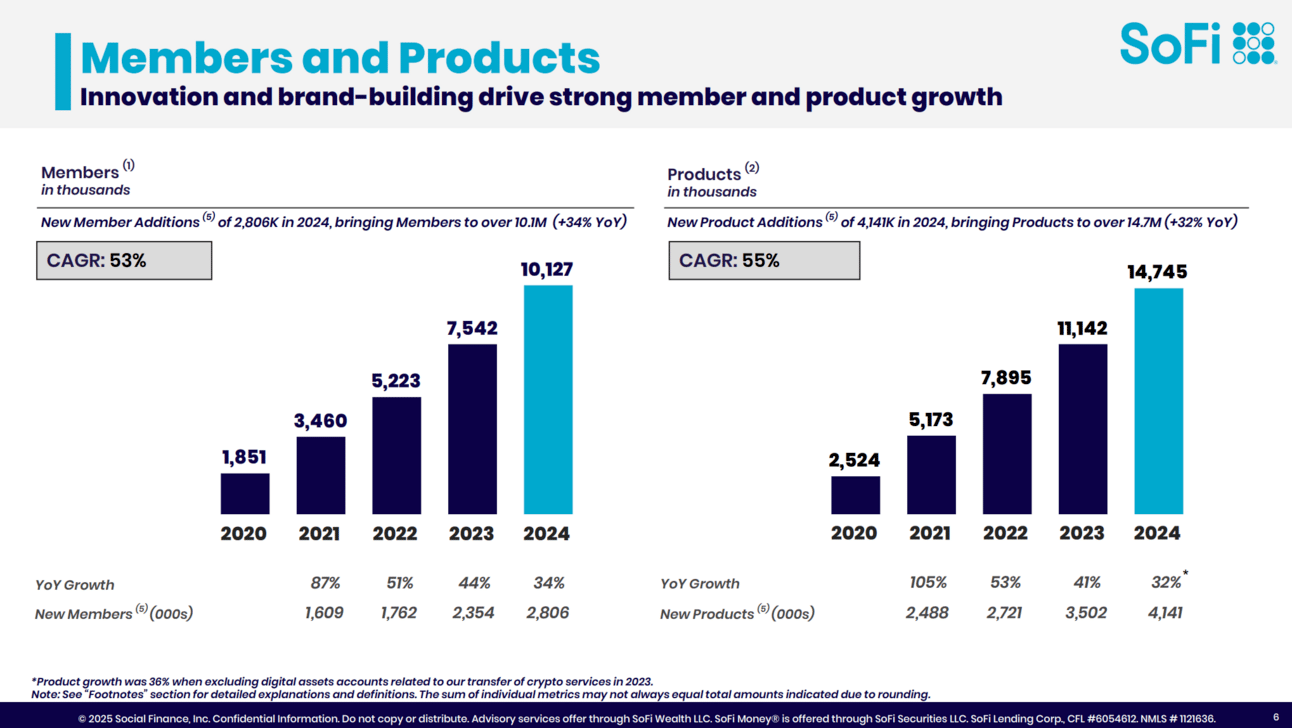

(1/27) SoFi Technologies reported a strong Q4 2024, with net revenue hitting $734 million (up 19% YoY) and net income reaching $332 million. Key wins include a 34% increase in members (now over 10.1 million) and a 32% jump in products to 14.7 million.

SoFi’s Loan Platform Business originated $1.1 billion in personal loans for third parties in Q4, contributing $63.2 million in fees. Total 2024 loan originations reached $23.2 billion, with personal loans surging 28% YoY. Credit performance remained solid, with the personal loan 90-day delinquency rate improving to 0.55%, and annualized charge-off rates dropping to 3.37%. SoFi continues to pivot toward capital-light, higher-ROE fee-based revenue streams, with fee-based revenue up 63% in Q4. [SoFI] [Morningstar]

(1/22) Citigroup is ramping up its installment lending game with Citi Pay Installments, launched in late 2023 to compete with BNPL giants like Klarna and Affirm. The product has gained traction with 195 U.S. merchants, seeing sales grow by 20% monthly. While Citi leans on its vast network of 86 million accounts and retail partnerships to scale, it faces tough competition from fintechs and other banks offering BNPL options. Citi is banking on its trusted brand, robust credit decisioning, and merchant insights to stand out in the crowded space. [American Banker]

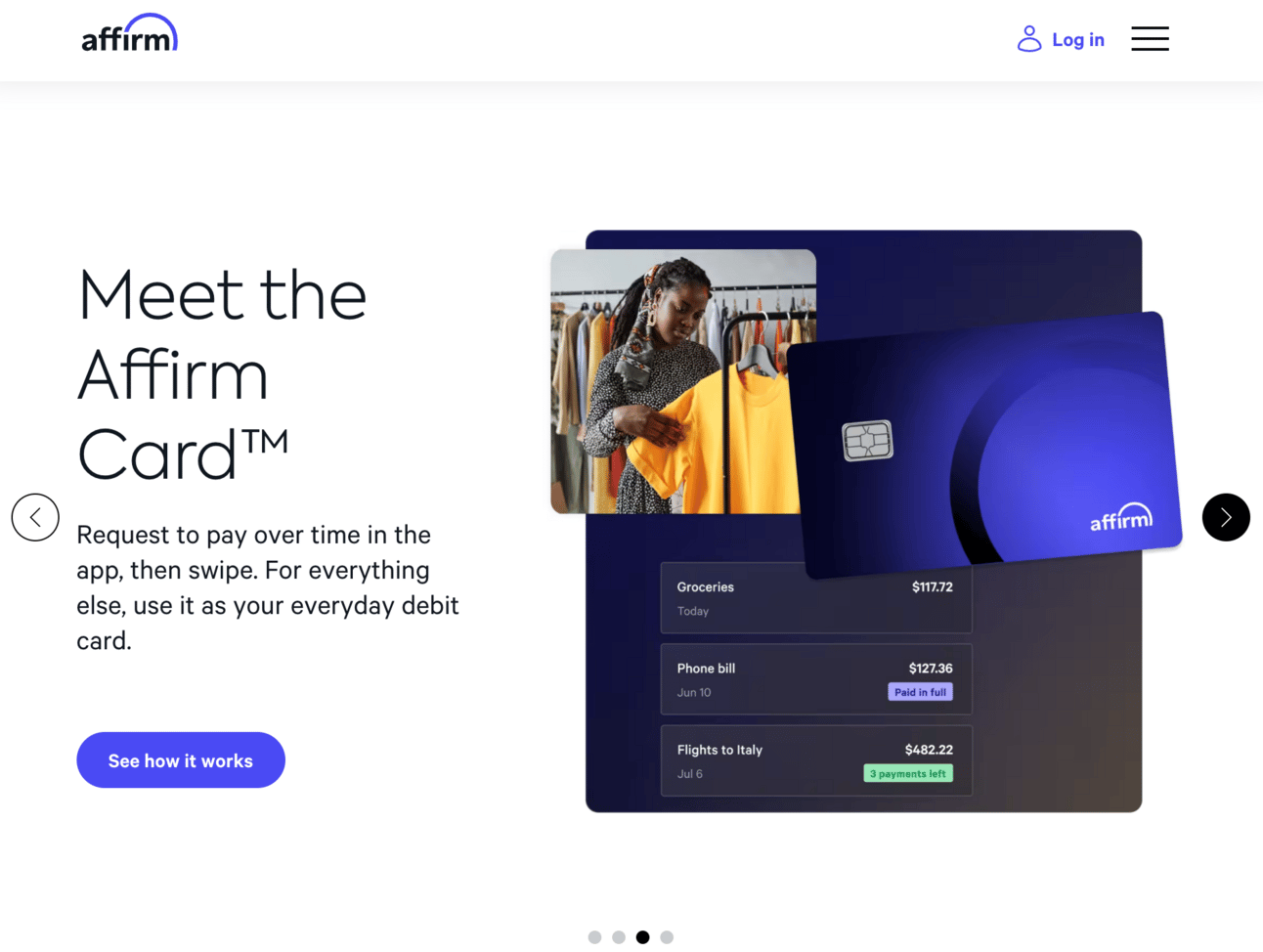

(1/24) Affirm Holdings secured $750 million in funding from Liberty Mutual to boost its consumer lending. This deal, part of Affirm’s push to hit a $34 billion lending target in 2025 (a 25% increase from last year), builds on financing deals with Sixth Street Partners ($4 billion) and Prudential Financial ($500 million). Affirm’s loans, backed by AI-driven decision-making, attract private investors like Liberty due to their high yields and short repayment cycles. [WSJ]

Fundraising

(1/27) Credit union tech provider Clutch raises $65m Series B. [FinTech Futures]

(1/24) UK-based Aslan secures USD 5 mln seed funding The Paypers

(1/22) Embedded payments platform Highnote lands $90m Series B, debuts new acquiring solution. [FinTech Futures]

(1/23) Method Raises $41.5 Million Series B Led by Emergence Capital to Expand Financial Account Connectivity. [Business Wire]

(1/21) Qomodo raises $13.9M to expand BNPL for Italy’s main-street retailers. [TechCrunch]

UK

(1/24) HSBC axes fintech app Zing — rival to Revolut and Wise — 12 months after launching. [Sifted]

(1/24) Neonomics buys open banking firm Ordo. [Retail Banker International]

(1/22) Tandem Bank partners with Sikoia to streamline income verification processes. [FinTech Futures]

Launches & Partnerships

(1/27) KlariVis Launches New Transactional Intelligence Features in Partnership with FinGoal. [FinTech Futures]

(1/23) Synchrony Renews 30-Year Relationship Dedicated to Enhancing Credit and Shopping Experiences with Sam's Club. [Synchrony]

(1/22) Auto Link Announces New Partnership with RepairPal to Enhance Auto-Lending Success for Financial Institutions. [PR Newswire]

(1/22) Pelican State Credit Union Selects Upstart for Personal Lending. [Business Wire]

(1/14) Ratehub, a Toronto-based financial comparison platform, launched a new personal loans marketplace to simplify borrowing for Canadians. At the core of this expansion is LoanFinder, a tool that helps users compare and secure pre-approved loan offers without affecting their credit scores. Ratehub has partnered with Fig Financial and Spring Financial to provide competitive loan options, aiming to help users refinance debt, lower payments, or fund major expenses. The company plans to expand beyond personal loans, reinforcing its mission to be a “one-stop shop” for Canadians’ financial needs. [Fintech.ca]

Toaster Team’s Ask: Enjoying this (free) newsletter? Support us by subscribing here and getting our posts in your inbox weekly.

Canada

(1/27) Central 1 is selling their digital banking products to Indian firm Intellect Design Arena, a few months after announcing that the products were winding down. [Canadian Fintech]

(1/22) MuchBetter Brings Card and Wearable Tech Offerings to Canada, in Partnership With Peoples Group. [The Fintech Times]

(1/21) Travel App Hopper Eyes Long-Term IPO Plan, $10 Billion Valuation. [BNN Bloomberg]

Other stuff we’re reading and listening to

Quick note from this week’s sponsor

FinCopy Solutions: Access top finance writers on demand

Finding exceptional writers who leverage your brand voice, connect with your audience, and deeply understand your industry is hard.

And, financial companies may have it the worst.

FinCopy connects you with expert finance writers who can handle requests immediately.

They write blogs, lead magnets, case studies, email campaigns, and more. They’re flexible with requests. No long-term contracts are required.

Check out their portfolio and kick off your content efforts today

Jobs

Spotlight of the week:

Director, Consumer Product Marketing at Affirm

About the Role

As a Product Marketing Director at Affirm, you will understand, drive, and execute against all aspects of the Consumer, Card, Marketplace, and implicitly, Wallet business, with a focus on understanding the consumer, taking products to market, and rapid iteration among existing products and channels, with measurable outputs against business unit goals. You always start with the consumer, understand our products and business deeply, and can guide our end-to-end product and marketing experiences.

USA Pacific base pay range (CA, WA, NY, NJ, CT): $230,000 - $310,000

USA Sapphire base pay range (all other U.S. states): $203,000 - $283,000

Other jobs:

VP of Marketing (Yieldstreet)

Head of Marketing (Credit Genie)

Director of Card Marketing (Sunbit)

Senior Director, Media (Credit Karma)

Senior Director, US Consumer Credit (PayPal)

Product Marketing Manager (Rocket Money)

Principal Associate, Market Research (Brand Insights team) (Capital One)

Sr Director, Lifecycle Marketing (Self Financial)

Director of Marketing (January)

Senior Product Marketing Manager (Robinhood)

Direct Marketing Operations Manager (Possible Finance)

Head of Growth (Tendy)

Marketing Director (SWBC)

Director of Marketing (Smartleaf)

Associate Director, Product Marketing (Fitch Solutions)

Finance Operations Executive (UK) (Lendable)

Customer Success Executive (UK) (Allica Bank)

Enterprise Risk Program Manager (Lead Bank)

Fair Lending Manager - Oversight (Cross River)

Senior Product Manager, Financial Management (Rocket Money)

About Us

Welcome to The Free Toaster! The newsletter for marketing pros at banks and lenders.

Inspired by the free toasters banks used to give to each new customer, we’re here to help you acquire more customers at scale. We deliver fresh news, data, and insights to help you acquire more customers—minus the breadcrumbs.

Want to follow the authors on social media? Find Nick Madrid and Carlos Caro on LinkedIn.

Have an idea for a newsletter?

Ghostmode built this newsletter and can build yours, too.

(click here or reply to this email to learn more)