MoneyLion’s 40% Growth Outpaces Gen Digital’s Core Business

Plus, Mr. Beast's Purchase of Fintech App Step

Hey Toaster Readers,

This week is sponsored by our friends at Spinwheel.

MoneyLion reported 40% year-over-year revenue growth this quarter , largely driven by its Engine marketplace even as its parent company, Gen Digital, saw its core business grow at a lower rate. In the creator space, MrBeast’s Beast Industries acquired the fintech app Step, which currently serves 7 million users, to test if large-scale social media reach can be converted into a banking customer base. Meanwhile, Affirm reached a profitability milestone and reported a 36% increase in Gross Merchandise Volume while simultaneously applying for a bank charter to gain more regulatory autonomy.

Lots to break down. Let’s get toasting!

— Carlos Caro, Founder at New Market Growth

— Nick Madrid, Co-Founder of The Free Toaster and Uncovered Media

PS: To support us, please share our Newsletter in your internal Slack channels!

With a single call to our simple, dev-friendly APIs, Spinwheel offers the only comprehensive connection to your consumers’ financial accounts.

Spinwheel delivers PII, real-time, verified account data, and the ability to make payments across all major debt categories – all within your brand’s experience.

With many happy customers, including:

MoneyLion’s 40% Growth Outpaces Gen Digital’s Core Business

MoneyLion, tucked inside Gen Digital’s portfolio, pulled in roughly 40% year-over-year revenue growth this quarter. The platform bundles banking, credit, and investment tools in one place. That growth helped the Trust-Based Solutions segment hit $421 million, while the core Cyber Safety business plugged along at its usual 3% to 4%. MoneyLion’s staying profitable as some competitors struggle with margins.

The interesting part is what’s happening with their Engine marketplace, which is actually outpacing the consumer app right now. Revenue splits about 60/40 between personal finance products like InstaCash and RoarMoney versus the Engine marketplace.

On the partnership front, MoneyLion teamed up with Equifax to add financial advice features to myEquifax.com. They’re also testing Money One, a subscription that packages financial services with Norton and LifeLock identity protection.

CEO Vincent Pilette positioned it as a response to how AI is changing both security and finance: “As AI transforms digital life and the threat landscape, consumers need protection and guidance they can trust. By uniting advanced intelligence and signals across security, identity and financial wellness at unmatched scale, we’re delivering personalized protection and contextual recommendations for our customers at the moments that matter the most.” The is essentially turning customer data into personalized recommendations across an integrated financial platform. (Gen Digital)

Toaster’s Take

Word in the industry is that Engine’s traffic has historically skewed towards subprime consumers. With Gen Digital’s footprint in security and ID theft brands, we think Gen has an opportunity to diversify the traffic mix more towards prime, which should attract more business from the big prime lenders in the category like SoFi, Lending Club, and many other fintech lenders.

The Free Toaster Podcast takes the biggest fintech, credit, and payments stories of the week and breaks down what they mean for growth, distribution, and product strategy. If you read the newsletter, this is the conversation behind it.

Listen on Apple Podcasts, Spotify, Substack, or wherever you get your podcasts.

Be sure to check out out our latest pod!

(And if you have a strong opinion on anything in today’s Edition and would like to be on the show - we record at 12pm ET on Fridays - let us know!)

MrBeast’s Company Buys Gen Z-focused Fintech App Step

YouTube creator MrBeast is moving into the financial services sector through the acquisition of Step, a banking app that provides credit-building and money management tools for younger users. Operating through Beast Industries, the 27-year-old aims to offer the financial education he says he lacked during his own youth. Step previously raised half a billion in funding and reports a user base of over 7 million people who use the platform to save and invest. This acquisition follows a leaked pitch deck from last year that identified financial services as a target area for his holding company. While his food brands like Lunchly have faced operational difficulties, his chocolate company Feastables currently serves as a primary revenue driver for these new ventures. By integrating Step into an ecosystem of 466 million subscribers, the company is testing whether influencer reach can convert fans into long-term banking customers. (Tech Crunch)

Toaster’s Take

Consumer lending and finance businesses are harder than they look. Plugging in influencer distribution (while very smart!) does not guarantee success because managing regulatory requirements, credit risk, and unit economics is a different game than drumming up views on YouTube videos. Other creator-led ventures have struggled once the initial novelty faded and the realities of financial operations took over. If Beast Industries wants this to be more than a headline, they must prove they can handle the challenges of building a consumer finance business.

Affirm Hits Profitability Milestone as it Charts a Path Toward Banking

Affirm, a buy-now-pay-later company that provides installment loans and digital payment services, reported that its Gross Merchandise Volume grew by 36% year-over-year. The company is emphasizing 0% APR offers as a primary strategy, which CEO Max Levchin claims is a deliberate move toward simpler terms. Levchin stated, “When Affirm says no interest, we actually mean no interest. There’s no asterisk. There’s no explanation as to what might happen if you are a penny short or a day late.” Despite the high volume of interest-free loans, the company maintained its revenue margins while expanding its merchant network.

The Affirm Card is seeing increased use, with card-related volume rising by approximately 160%. This growth suggests the product is shifting from a niche offering to a more significant part of the company’s business model. To further drive volume, the company introduced Boost AI, a tool that allows merchants to allocate specific budgets toward automated promotions. Levchin described the shift by saying the tool “looks more and more like an advertising model versus a cost-of-acceptance model.”

On the financial side, Affirm is seeing improved conditions in the capital markets, which helps fund its 0% interest offers. The company is also pursuing a bank charter, though management describes this as a long-term plan for regulatory stability rather than a tool for immediate growth.

This shift toward becoming a fully integrated financial institution aligns with several developments previously covered by The Free Toaster. The company recently began reporting more data to Experian to help users build credit histories which served as a precursor to their current bank charter bid. By moving into new areas like home improvement and auto repair, the company is steadily positioning itself as a broad alternative to traditional revolving credit. (Affirm)

Wells Fargo Launches Ad with Comedian and Actor Marcello Hernández

Wells Fargo, a financial services firm holding about $2.1 trillion in assets, is returning to the Big Game with a new ad campaign featuring comedian Marcello Hernández. The Celebrating Every Win spots show how the company's mobile app tracks personal financial tasks like growing a savings account or managing a budget. Hernández appears in the ads with music and confetti to mark these small financial milestones. This campaign uses humor to highlight the various steps that contribute to long-term financial health. A teaser for the campaign arrived on February 2, with the full 30-second commercial airing during the Big Game in regional markets and on Telemundo. The national rollout continues on February 8 across streaming platforms and social media, aiming to show that basic financial progress is worth acknowledging. (Wells Fargo)

Want To Reach Our Readers In Person?

The Free Toaster is betting big on live events in 2026.

If you’d like to sponsor or host an event in the consumer lending community in 2026, we’d like to hear from you. Think coffee meetups, lunches, dinners, 1-day events, golf outings, wine tastings.

Our events team can help you bring it to life. Contact amanda@thefreetoaster.com for more information.

Chase and Disney Launch the Disney® Inspire Visa® Card Featuring Exclusive Benefits for Cardmembers

Chase and Disney just launched the Disney Inspire Visa Card, a new credit card option that provides rewards for theme park visits and streaming services. Chase functions as the consumer and commercial banking wing of JPMorgan Chase, offering financial services like mortgages and auto financing to millions of customers. Disney operates as a global entertainment company with major segments in media, sports, and theme park experiences. This new card carries a $149 annual fee and offers new members a $300 gift card plus a $300 statement credit after they spend $1,000 in the first three months. Cardmembers earn rewards on purchases at gas stations, grocery stores, and restaurants, with higher earning rates for Disney streaming services and most domestic Disney locations. The card also includes an annual $120 credit for services like Disney+ and Hulu, along with 0% interest for six months on certain vacation packages. Users can choose from several card designs featuring characters like Mickey Mouse or Stitch. Additional perks include discounts on select dining and merchandise at domestic theme parks and resorts. (Chase)

Bilt Users Get Surprise Wells Fargo Cards as Partnership Ends

Wells Fargo, a global financial services firm, and Bilt, a loyalty platform that allows renters to earn points on housing payments, ended their four year partnership on February 7. The transition took a messy turn as many customers who opted to close their accounts still received new Wells Fargo Autograph cards in the mail. The bank reportedly began mailing these cards on January 26 to ensure delivery by the deadline, even though Bilt users had until February 1 to choose a different provider. Both companies are now advising confused recipients to simply destroy the cards because they are inactive and cannot be used. This awkward exit follows previous reports that the arrangement was souring, with Wells Fargo allegedly losing 10 million per month on the deal. Bilt has already launched three new cards with 10% interest rates for the first year, following political calls to cap rates at that level. Meanwhile, data shows consumer credit balances recently saw a nearly $200 monthly increase, suggesting a tighter financial landscape for many cardholders. (PYMNTS)

Industrial Loan Charters Take Center Stage as De Novo Banking Makes a Comeback

Maybe we all just need to ask if banking is finally getting its groove back because de novo banking is making a primary comeback through a clever side door. PYMNTS reports that Industrial Loan Companies (ILCs) are the new star of the show, letting non-banks like Ford Motor Company and General Motors play banker without all the traditional red tape. These ILCs, which provide state-chartered and FDIC-insured services, allow firms to take deposits and hunt for loans while skipping traditional bank holding company status. This gives companies direct control over their customers' wallets and underwriting. PayPal is even jumping into the ring with its own bank application, proving that even the biggest payment giants want to own core banking infrastructure instead of just renting it. Of course, old-school banking groups are throwing political heat at the idea, worried that these loophole banks create an unfair advantage and dodge Federal Reserve oversight. Treasury Secretary Scott Bessent is cheering for more new banks to save our disappearing community institutions, but regulators still have to figure out how to keep things safe without killing the fun. It’s a classic showdown between legacy giants and digital disruptors, and the ILC path is currently the hottest ticket in town. (PYMNTS)

Why Businesses Are Replacing Checks With Virtual Cards and ACH

American Express, a global financial services company that operates payment networks and issues credit cards, is seeing a shift as more businesses transition from paper checks to virtual cards and ACH. While corporate back offices previously relied on manual paperwork and mail-in checks, new digital tools from AmEx, Visa, and Truist are increasing the rate of supplier acceptance. Visa, a major global payments processor, recently introduced a platform for small business capital and digital tools, while Truist Financial launched an AI-driven system to automate business receivables. Waiting for a physical check is becoming less common now that finance teams can access real-time status updates and automated approvals. These digital methods allow companies to route payments based on specific needs for speed, cost, or control. By reducing the time it takes to process cash, businesses are finding that digital payments help stabilize their balance sheets. It appears that simplifying the payment process leads to a more efficient experience for both buyers and vendors. (PYMNTS)

STAR Financial Bank Partners with CorServ to Meet Demand for Enhanced Commercial Credit Cards

STAR Financial Bank, a community bank with $3 billion in assets and an 80-year history in Indiana, is updating its commercial service offerings. By partnering with CorServ, a company that provides credit card issuing technology for banks and fintechs, the bank is launching a new credit card program for its business clients. STAR Financial Bank is providing its commercial customers with more flexibility and control by moving away from traditional referral models to keep more margin for itself. The new program introduces purchasing cards, including virtual and ghost card options that integrate into ePayables for vendors. Business owners can now set employee spend limits and access automated, customized rebates, allowing the community bank to offer features similar to those of national banks. CorServ manages the backend technology so STAR Financial Bank can provide modern issuing tools without adding significant internal staff. This setup allows local businesses to access specialized spending tools while the bank maintains its existing service model and increases its direct revenue. It is a practical move for a local bank looking to keep pace with modern payment technology. (PR Newswire)

Super Bowl 2026: The 11 Fintech Companies That Paid $8 Million or More for an Ad

While the Seattle Seahawks secured a 29–13 win on the field, eleven fintech brands paid an $8 million average for a 30-second spot to reach viewers during Super Bowl LX. Rocket Companies, a mortgage and personal finance lender, and Redfin, a tech-driven real estate brokerage, shared an ad featuring Lady Gaga to focus on community themes. Coinbase, a cryptocurrency exchange platform, returned to the game with a 60-second karaoke-style commercial. We also saw Ramp use Brian Baumgartner to demonstrate their expense management software, while Rippling hired comedian Tim Robinson to show the operational failures of a company's onboarding and payroll systems. Intuit TurboTax, a tax preparation service, featured Adrien Brody in their ad and used the surrounding events to promote financial literacy programs for students. Even AI companies like OpenAI and Anthropic’s Claude appeared, highlighting their efforts to provide automated tools and analytics for the financial sector. The price for these spots reached record levels, with some advertisers paying $10 million or more due to high demand. (Finextra)

Please support our Newsletter by recommending us to one of your colleagues!

And, please check out our sponsors:

Need an affiliate marketing platform/network? Chat with Fintel Connect

Need to improve application page conversions? Chat with Spinwheel

Need help with performance marketing? Chat with Bulldog Media Group

Need to accelerate your affiliate marketing? Chat with New Market Growth

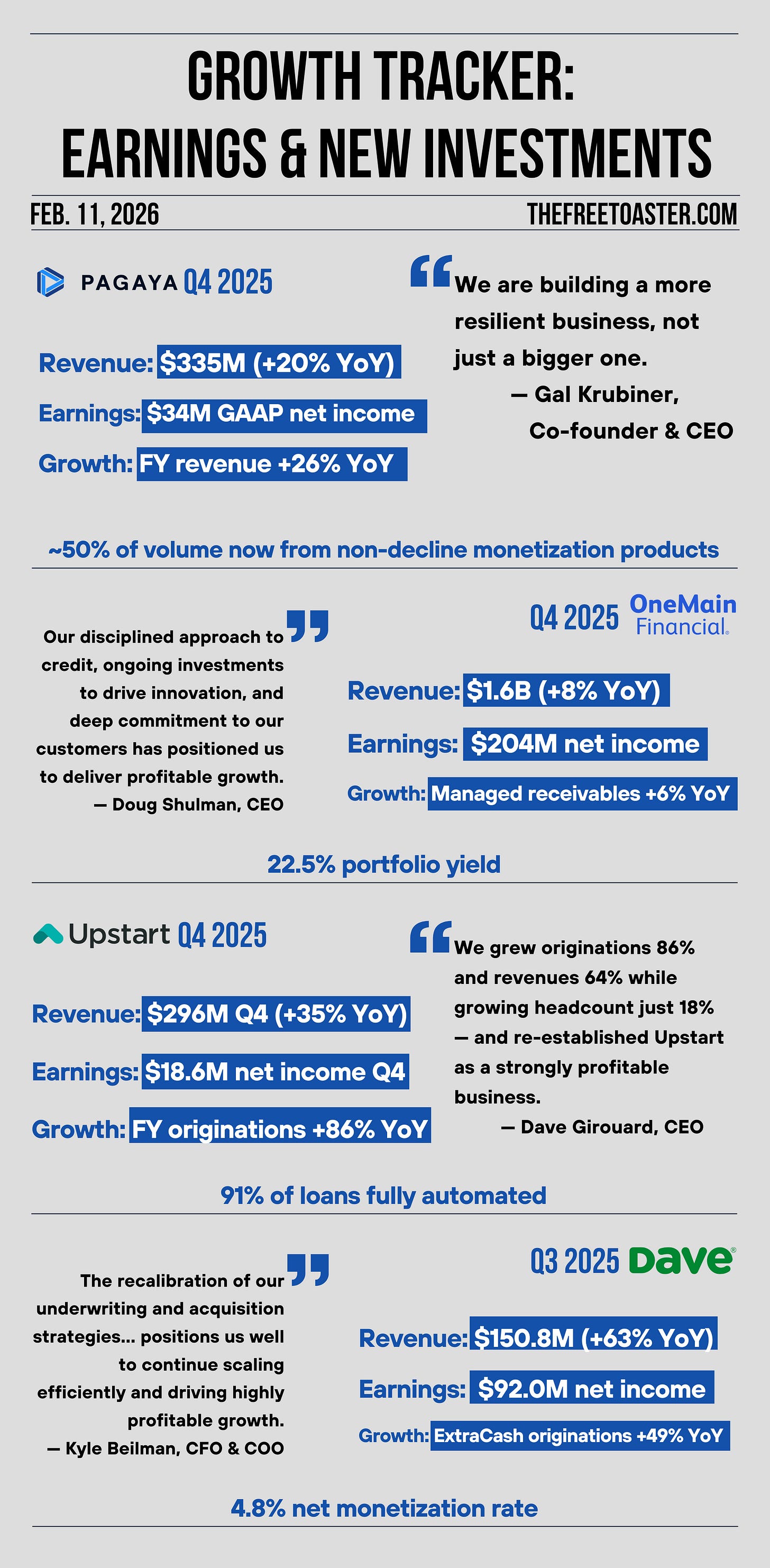

Sources: Pagaya, OneMain Financial, Upstart, Dave

Looking for a new role?

The Free Toaster Jobs Edition tracks where fintech teams are actually investing across marketing, product, data, credit, risk, and partnerships.

Other News We’re Reading

(M&A) TransUnion Announces Definitive Agreement To Acquire Mobile Division Of RealNetworks To Enhance Voice And Messaging Solutions (TransUnion)

(Crypto/Rewards) Fold Launches Unified App Experience To Bring Bitcoin Rewards And Everyday Spending Into One Financial Home (GlobeNewswire)

(Payments) Checkout.com Announces Strategic Partnership With Spotify To Power Efficient, Scalable Payments Globally (Checkout.com)

(Fintech Policy) Blank Rome Joins American Fintech Council (AFC) To Support Fintech Policy And Regulatory Dialogue (Fintech Council)

(Financial Wellness) BMG Money Reinforces Its Mission To Advance Financial Wellness With Sqwire Partnership (Business Wire)

(Workforce/Payments) Papaya Global Launches Global Workforce Wallet Powered By Fireblocks (PR Newswire)

(Creator Economy) TerraPay Enters Creator Economy With MilX Partnership To Power Global Payouts (The Fintech Times)

(Insurtech) Compare Car Insurance Quotes Using Insurify — Without Leaving ChatGPT (Insurify)

(BNPL) Intuit Partners With Affirm To Provide Pay-Over-Time Offering For QuickBooks Online (Intuit)

(Corporate) Block Lays Off 10% Of Staff As Jack Dorsey Reshapes The Company (Reuters)

Spot something worth sharing with your team? Drop this week’s edition in their inbox:

https://www.thefreetoaster.com/p/moneylions-40-growth-outpaces-gen

Catch you next week,

The Free Toaster Team

P.S.: If you’d like to sponsor or host an event in the consumer lending community in 2026, we’d like to hear from you. The Free Toaster will be organizing & hosting curated events this year, and we’d love to work with you as a sponsor.