Klar bags $190m in new funding to capture a big credit opportunity

Plus: a $253B crypto threat to Visa and Mastercard, the battle for credit and payments is on.

Hey Toaster Readers,

Happy July 4th!

This week, the battle for your wallet is heating up from every angle. In Mexico, the fintech scene is exploding, with Klar pulling in a massive $190 million in funding at a reported $800 million valuation. We’ll look at why investors are so bullish on a market where five big banks still control 85% of loans.

Meanwhile, the very nature of credit is being reshaped. In the U.S., lenders are finding a booming market in foreign grad students, betting on future salaries up to 15 times higher than their current income. But it's not all smooth sailing; a new study reveals one in three Canadian households are carrying credit card balances.

The biggest disruption, however, might be coming from crypto. Visa and Mastercard are racing to tame a $253 billion stablecoin threat that could completely bypass their networks. We'll also explore how the fallout from the Wells Fargo scandal is still pushing borrowers toward fintechs and how AI is now making 99.6% of some lending decisions in just two seconds.

There's a lot to break down. Let's get to it!

Mexico's Klar bags $190m in new funding at reported $800m valuation

Mexican fintech Klar just bagged $190 million in new funding, pushing its valuation to a reported "$800 million". The credit services provider, which serves more than two million users in Mexico, raised "$170 million in equity and $20 million in venture debt" to fuel product development and further expansion. The round was led by returning investor General Atlantic, with participation from new backers like Santander Group and Grupo Televisa. [Fintech Futures] [Bloomberg]

Back in November 2024, Bloomberg reported that the company was gearing up for a 2026 IPO, setting a target to hit a "$500 million" annual revenue run rate before it takes the plunge. At the time, the company had recently hit its "break-even point" and targets for gross margins of "above 50%" by H1 2025. Despite a (then) tricky IPO market, Klar's leadership remained "confident" that Mexico's new administration could provide the certainty needed for such a move. [Bloomberg]

The opportunity in Mexico should be no surprise to Toaster readers. Back in January, we reported on TransUnion's plans to expand in Latin America by acquiring a 68% stake in Mexico's Buró de Crédito consumer credit business for $560 million, boosting its ownership to 94%. Then, a BofA Securities report painted a picture of a market ripe for the picking: cash is still king, accounting for 80% of consumption, and there's only one credit card for every two adults. To put that in perspective, Brazil boasts a whopping 2.7 cards per adult. While five big banks hold a tight grip on 85% of the loan book, fintechs like Klar, Nubank, and Stori are disrupting the market, attracting millions of users to challenge the old guard.

Klar is a digital financial services platform in Mexico that provides a simple and secure alternative to traditional banking. Through its mobile app, users can open an account that has no fees or minimum balance requirements. The platform offers a Mastercard that gives cashback on purchases and provides access to credit products, such as loans and overdrafts, often without relying on traditional credit scores. Klar's primary goal is to make financial services more accessible, particularly for people in Mexico who have been underserved by conventional banks.

From balances to behaviors: insights into credit card repayment patterns among Canadian households

A new study from the University of British Columbia shows Canadian credit card habits reveal a lot about household financial health: one in three carry balances, and over two-thirds of those miss payments due to money troubles. Researchers found education packs a punch—households with a university degree were “13% more likely” to pay off balances and “19% less likely” to skip payments than those without high school diplomas. Meanwhile, payday loans and mortgages drag repayment down, while savings and stocks boost it. The authors call for better financial education and stronger rules on costly credit to help vulnerable groups as reliance on plastic keeps climbing. [University of British Columbia] [Link to Paper]

Lenders Find a Fast-Growing Market in Foreign Grad Students

(Some startups take a broader view of grads’ ability to repay, looking to job prospects as support for lending.)

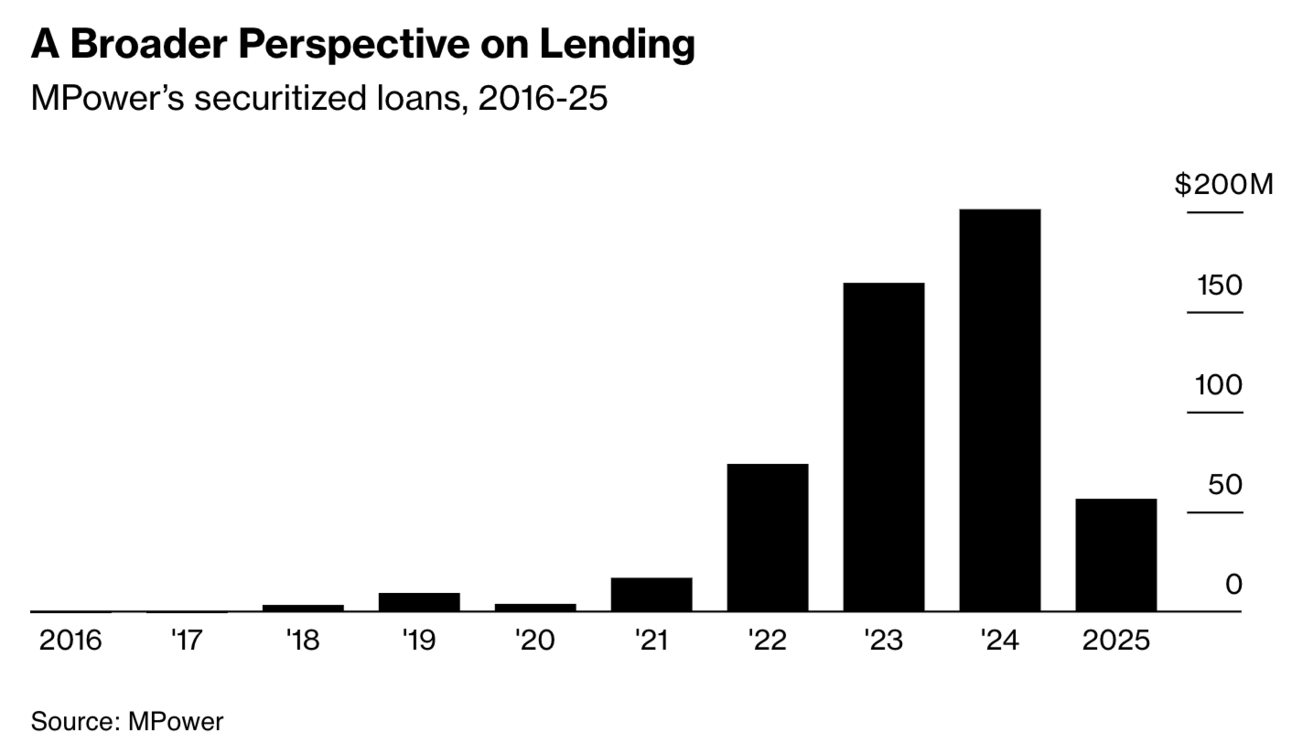

Lenders like MPower Financing and Prodigy Finance are tapping into a booming market by offering loans to foreign grad students in the US—no collateral or US cosigner required—betting on future salaries of up to “15 times” higher than borrowers’ pre-grad income. MPower alone lent at least $200 million last year, with Africans emerging as a fast-growing segment. These fintechs use students’ academic trajectories and job prospects to approve loans, charging rates of 12% to 15%—far cheaper than loans in many home countries but still pricey. Despite Trump administration efforts to curb international student programs, lenders expect demand for a US degree to remain strong. [Bloomberg]

Visa, Mastercard Race to Tame a $253 Billion Crypto Threat

Visa and Mastercard, the credit card giants handling most US card payments, are scrambling to fend off a "substantial" $253 billion stablecoin threat that promises merchants lower fees and faster settlement by bypassing traditional networks. Tech firms and crypto startups like Coinbase and Stripe are fueling the charge, letting retailers accept stablecoins like USDC directly, while mega players such as Shopify are sweetening the pot with crypto rewards. Both card networks are racing to integrate stablecoins into their own ecosystems, highlighting global reach, fraud protection, and brand trust to stay relevant as stablecoins gear up for potential explosive growth toward a projected $2 trillion market. Still, they argue stablecoins will expand payment options rather than dethrone existing systems, especially given perks like consumer rewards and fraud safeguards that crypto hasn’t yet matched. [Bloomberg]

Fintech Bolt progresses its turnaround by landing Klarna as a partner

Bolt, the one-click checkout fintech, just scored a major win by teaming up with Klarna, bringing Klarna’s Pay in 4 and monthly financing options directly into Bolt’s checkout system for in-store shoppers. This integration, launching in the U.S. later this year, gives Bolt merchants a seamless way to offer Klarna’s buy now, pay later choices without extra contracts or technical headaches. For Bolt, still rebounding from investor drama and legal troubles, partnering with Klarna — and recently with Palantir for AI-powered checkout — signals serious momentum in its turnaround efforts as it eyes a fresh funding round. [TechCrunch]

Sezzle Unveils Smarter Shopping Tools to Meet Rising Consumer Expectations

Amid rising financial pressures, Sezzle is launching new tools to create a more "intuitive" shopping experience from start to finish. The digital payment platform's price comparison tool is already helping shoppers save, with 49% of users finding deals of $5 or more by selecting the lowest-priced option. By combining features like a pre-loadable wallet and Express Checkout, Sezzle aims to deliver everyday value that extends beyond just payment flexibility. [Sezzle]

Wells Fargo Scandal Drove Borrowers to Fintech Lenders, UC Davis Study Suggests

A new study from UC Davis shows the 2016 Wells Fargo scandal shook consumer trust so badly that many homebuyers turned to fintech lenders for mortgages instead of traditional banks. Using massive datasets and a difference-in-differences analysis, the research found a “4.1% increase” in the probability of choosing fintech lenders in counties with high Wells Fargo exposure. Interestingly, rates and fees stayed the same — proving it was lost “trust,” not cost, that pushed borrowers away from banks. The scandal’s fallout highlights how breaches of trust can reshape entire markets, accelerating fintech adoption as wary consumers seek alternatives. [Journal of Financial Economics]

Meet the AI lending officer: How algorithms are taking over credit decisions

With a single call to our simple, dev-friendly APIs, Spinwheel offers the only comprehensive connection to your consumers' financial accounts. Spinwheel delivers PII, real-time, verified account data, and the ability to make payments across all major debt categories – all within your brand's experience.

With many happy customers, including:

In Other News

(Banking) Wise Files Application to Create National Trust Bank in US [PYMNTS]

(Banking) How a 'Circle bank' could compete with traditional banks [American Banker]

(Banking) Ripple joins other crypto firms seeking trust bank charters [American Banker]

(Banking) Stripe’s first employee, the founder of fintech Increase, sort of bought a bank [TechCrunch]

(Macro) Better-than-expected jobs report backs Fed's rate stance [American Banker]

(Regulation) The shifting landscape for US financial regulatory enforcement [Financier Worldwide]

(Embedded Lending) How to get started with embedded lending and drive revenue [Tearsheet]

(Crypto) Bitget and Mastercard partner on crypto card letting users pay directly from their digital wallet [The Block]

(AI) Banks Adopting AI Agents After Seeing Benefits of AI Chatbots [PYMNTS]

(Embedded Payments) Why embedded fintech will help small businesses grow [Fast Company]

(Super App) Robinhood’s Super App Ambition: From Zero Commission To Fintech Titan [Seeking Alpha]

Support The Free Toaster

Need an affiliate marketing platform/network? Chat with Fintel Connect

Need help hiring key roles? Email Connie Buehler and mention TOASTER

Need to improve application page conversions? Chat with Spinwheel

Need to accelerate your affiliate marketing? Chat with New Market Growth

Need to win on other growth channels? Chat with FIAT Growth

None of the above? Share our Newsletter in your favorite Slack channel

About Us

Welcome to The Free Toaster! The newsletter for marketing pros at fintechs, banks, and lenders.

Inspired by the free toasters banks used to give to each new customer, we’re here to help you acquire more customers at scale. We deliver fresh news, data, and insights to help you acquire more customers, minus the breadcrumbs.

Want to follow the authors on social media? Find Nick Madrid and Carlos Caro on LinkedIn.