Cash App’s “Invisible” $200 Billion Loan Machine

Block’s data-driven lending wins, the $160B battle over rate caps, and OpenAI enters the ad game.

Hey Toaster Readers,

This week is sponsored by our friends at Fintel Connect.

This week, Block is demonstrating how first-party data can outperform traditional credit scoring, successfully underwriting subprime borrowers with a 97% repayment rate by leveraging real-time cash flow over FICO scores. While Block expands its lending footprint, the broader banking industry is navigating a proposed 10% interest rate cap that threatens a $160 billion revenue stream, and OpenAI is making its first move into in-chat advertising to manage rising costs. Between PayPal’s new DIY tax integration and a 27% jump in global fintech funding, the theme of 2026 is clear: distribution and data are redefining the competitive landscape.

We hope you enjoy this week’s news roundup at the intersection of consumer lending and marketing.

— Carlos Caro, Founder at New Market Growth

— Nick Madrid, Co-Founder of The Free Toaster and Uncovered Media

PS: To support us, please share our Newsletter in your internal Slack channels!

Cash App’s “Invisible” $200 Billion Loan Machine

While the market has been fixated on Block’s (down) stock price, the fintech giant has quietly built a massive consumer lending empire right under the noses of big banks. Block announced that it has surpassed $200 billion in credit extended across its ecosystem—including Cash App Borrow, Afterpay, and Square Loans—validating a model that bypasses traditional credit scoring entirely.

The Signal: This isn’t just about volume; it is a victory for first-party distribution. You won’t find Cash App Borrow on marketplaces like Credit Karma or LendingTree. Block didn’t need to buy these leads; they simply leveraged the millions of users already opening their app every day. By analyzing real-time cash flow data (like direct deposits and spending velocity) rather than relying on delayed FICO scores, Block is successfully underwriting customers that legacy banks deem “un-lendable.”

Why It Matters

The Balance Sheet Shift: The success of this data-driven underwriting has given Block the confidence to change its economics. Instead of just renting bank rails, they are increasingly originating loans through their in-house bank, Square Financial Services. This move to hold more risk on their own balance sheet signals that they view these “subprime” borrowers as a stable, profitable asset class—not just a feature to boost engagement.

Data Beats Dogma: Traditional lenders use credit scores to filter people out; Block uses transaction data to filter people in. The result? They are approving 38% more loans than traditional models would allow, without seeing a spike in defaults.

Gen Z’s “Credit Card”: With nearly half of Gen Z avoiding credit cards, Block’s short-term, fixed-fee structure is becoming the primary liquidity tool for the next generation.

By The Numbers:

70% of Cash App Borrow customers have credit scores below 580, yet the product maintains a 97% repayment rate.

58% of their small business loans went to women-owned businesses, highlighting the gap left by traditional commercial lending.

$20B+ has been originated directly by Square Financial Services since its inception, a number that is accelerating as they move more volume in-house.

(Block) (Quarterly Earnings Reports)

The Free Toaster Podcast takes the biggest fintech, credit, and payments stories of the week and breaks down what they mean for growth, distribution, and product strategy. If you read the newsletter, this is the conversation behind it.

Listen on Apple Podcasts, Spotify, Substack, or wherever you get your podcasts.

Be sure to check out out our latest pod!

Why Banks Are So Worried About a 10% Credit Card Rate Cap

JPMorgan Chase, the nation’s largest credit card lender, and its fellow banks are in a total "tizzy" after President Trump called for a 10% cap on credit card interest rates. This proposed one-year limit targets a "major profit source" for card issuers who raked in a "substantial" $160 billion from interest fees in 2024 alone. While the news caused stocks for companies like Citi and Capital One to tumble, experts say the plan faces a "significant" uphill battle without a nod from Congress. Industry heavyweights warn that such a "massive" shift would force them to slash credit lines. This could potentially hurt the very consumers the policy aims to help. Even with the President’s January 20 target date looming, most analysts believe these worries might be "overblown" since no official legislation has actually moved forward. It looks like the banks are bracing for a "heavy blow" to their bottom lines, but for now, those high-interest balances aren't going anywhere. (NY Times)

Nice Try Bilt, Devil is Always in the Details

Investor Rex Salisbury at Cambrian, a fintech founder community and venture fund, calls out the gap between the "headline" news and the messy reality of proposed rate caps. He points out that even cards claiming a "10% cap" often retain the right to snap back to much higher variable rates, which feels like a potential trap for consumers. This insight explains exactly why banks are so nervous to see their card economics dragged into the political spotlight. The debate forces issuers to publicly defend how they price risk and explain why their disclosures are so complex. Even if the proposal dies, the "scrutiny" on long-term APR structures isn't going away. It seems the industry now has to prove their math makes sense before the politicians do it for them.

OpenAI Brings Ads To ChatGPT As Costs Mount

OpenAI just decided to invite some uninvited guests to the chat: advertisers. The AI research lab, which develops the ubiquitous ChatGPT chatbot, is rolling out ads at the bottom of responses for free users and those on the new "Go" tier to help offset "mounting" financial pressure. While CEO Sam Altman once called the idea of mixing ads with AI "uniquely unsettling," a projected $14 billion loss by 2026 makes for a very effective mind-changer. The company is currently "burning through" cash to build out a massive $1.4 trillion infrastructure, so they’re betting you won’t mind a sponsored link while you’re asking for a lasagna recipe. They promise ads won't influence the actual answers, but with a potential IPO looming, the pressure to turn a profit is definitely "soaring." It turns out even the smartest AI in the room still needs someone to foot the bill. (Forbes)

Enjoying this week’s issue?

If you’ve been enjoying The Free Toaster, help us spread the word. Forward it to someone who lives and breathes consumer lending, marketing, or fintech like you do.

Your shares help us reach more builders in consumer lending, and help us make the Newsletter & Podcast better every day.

Pagaya Launches A Revolving Asset-Backed Funding Structure Backed by Personal Loans with Investment from 26North

Pagaya has launched its first revolving asset-backed securitization backed by personal loans, closing a $350 million PAID 2025-REV1 transaction with investment from affiliates of 26North. The hybrid public-private structure introduces a 24-month revolving period that allows capital to be redeployed as loans repay, effectively creating up to $700 million in total funding capacity over the life of the deal. Designed for insurance capital and asset managers, the structure expands Pagaya’s funding toolkit beyond traditional term ABS and mirrors revolving formats it introduced in point-of-sale lending in 2025. The deal adds long-term, flexible capital to support Pagaya’s expected expansion across personal, auto, and point-of-sale loans in 2026, reinforcing its strategy to diversify funding sources while scaling loan originations through its partner network. (Pagaya)

Durbin, Marshall Reintroduce The Credit Card Competition Act

Senators Dick Durbin and Roger Marshall just reintroduced the Credit Card Competition Act to shake up the “Visa-Mastercard duopoly” that currently controls about 85% of the market. This legislation targets the “exorbitant prices” small businesses face by requiring giant banks with over $100 billion in assets to offer at least two different routing networks for credit card transactions. Currently, these fees cost the average American family nearly $1,200 a year, while big banks rake in $111.2 billion in “swipe fees” annually. By forcing giants like Visa and Mastercard to actually compete for business, the bill aims to “level the playing field” and lower costs for everything from gas to groceries. President Trump even gave the bill an early morning shout-out, adding some serious political fuel to the fire. It’s a classic “Main Street” versus “Big Banks” showdown, and the sponsors are betting that a little healthy competition will finally stop the “ripped off” feeling at the checkout counter (Senate.gov)

PayPal Introduces Free DIY Tax Filing for PayPal Debit Card Customers

PayPal is adding tax filing to its financial ecosystem through a partnership with april, giving U.S. PayPal Debit Card customers a new way to file federal and state taxes directly inside PayPal. The integration lets users complete tax filing in under 20 minutes using april’s AI-powered tax engine, which prefills information from uploaded documents, supports electronic filing with the IRS, and offers chatbot assistance or paid live support. Customers can pay taxes using PayPal Credit, debit, or cashback cards, receive federal refunds up to five days early via direct deposit, and route refunds into PayPal Savings, a high-yield account provided by Synchrony Bank. The move extends PayPal’s strategy of consolidating earning, spending, saving, and now tax filing into a single destination, while april gains distribution inside a major consumer payments platform as it positions embedded tax services as a recurring financial workflow rather than a once-a-year task. (PR Newswire)

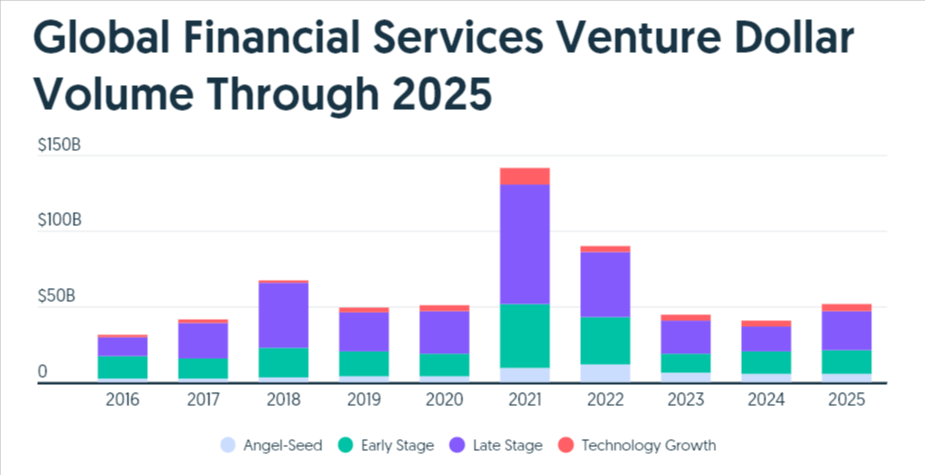

Fintech Funding Jumped 27% In 2025 With Fewer Deals But Bigger Check

Global venture funding to fintech startups rebounded in 2025, with total investment reaching $51.8 billion, a 27% increase from 2024, according to Crunchbase. While deal volume fell 23% year over year to 3,457 transactions, the funding increase was driven by fewer but significantly larger late-stage rounds, particularly in crypto, blockchain, and adjacent markets such as prediction platforms. Mega-deals included $2 billion raises by Polymarket and Binance, $1 billion rounds for Kalshi, and large financings for Ramp, Rapyd, and Rippling. Investors describe the environment as a “flight to quality,” with capital concentrating on scaled companies showing clear traction, while early-stage activity remains selective but active in areas like AI and stablecoins. The result is a healthier, more disciplined funding market that sits above pre-pandemic levels, even as it remains well below the highs of 2021 and 2022. (Crunchbase)

Please support our Newsletter by recommending us to one of your colleagues!

And, please check out our sponsors:

Need an affiliate marketing platform/network? Chat with Fintel Connect

Need to improve application page conversions? Chat with Spinwheel

Need help with performance marketing? Chat with Bulldog Media Group

Need to accelerate your affiliate marketing? Chat with New Market Growth

Need to win on other growth channels? Chat with FIAT Growth

Other News We’re Reading

(Fintech) Revolut to Enable Frictionless Checkout Across All Agentic Commerce Platforms for the UK and EEA (Revolut)

(Regulation) OCC Proposes Clarifying Amendments to National Trust Bank Chartering Rule (Consumer Finance and Fintech Blog)

(Payments) BVNK Powers Stablecoin Payments for Visa Direct (BVNK)

(Partnerships) Suncoast Credit Union Unveils Enhanced Student Loan Program Through Partnership with College Ave (PR Newswire)

(IPO) Brazilian Fintech Agibank Files for US IPO (Reuters)

(Crypto) K33 Launches Lending with Crypto‑Backed Collateral and Deploys Its Own Bitcoin Treasury (Kaupr)

(Trading) NYSE-Parent Intercontinental Exchange Develops Platform for 24/7 Tokenized Securities Trading (Reuters)

(Partnerships) Audi Revolut F1 Team Welcomes Nexo as Official Digital Asset Partner (Nexo)

(Banking) Klarna Expands Digital Bank Offer with Peer-to-Peer Payments (Klarna)

(Banking) Inter Gains Federal Reserve Approval to Establish U.S. Banking Branch (GlobeNewswire)

(M&A) Coastal Financial Buys ‘Climate-Friendly’ Fintech GreenFi (Banking Dive)

(Partnerships) Stripe Helps Power a New Shopping Experience in Microsoft Copilot (Stripe)

Spot something worth sharing with your team? Drop this week’s edition in their inbox:

https://www.thefreetoaster.com/p/cash-apps-invisible-200-billion-loan

Catch you next week,

The Free Toaster Team

P.S.: If you’d like to sponsor or host an event in the consumer lending community in 2026, we’d like to hear from you. The Free Toaster will be organizing & hosting curated events this year, and we’d love to work with you as a sponsor.

The 97% repayment rate with sub-580 credit scores is wild. Real-time transaction data crushes static FICO models becuase it captures actual behavior patterns instead of backwards-looking snapshots. Have watched similar approaches work in small busness lending where cashflow visibility matters way more than balance sheets.