Bilt Hits $11B Valuation, Ends Partnership With Wells Fargo

Plus: what critics get wrong about BNPL, JPM to start charging for data, and more...

Hey Toaster Readers,

You’ve got to hear about Bilt. The points-on-rent startup just raised a massive $250 million, rocketing its valuation to nearly $11 billion. We dive into its impressive ecosystem, why Wells Fargo was losing up to $10 million a month on their partnership, and Bilt’s big plans with Cardless and the mortgage market.

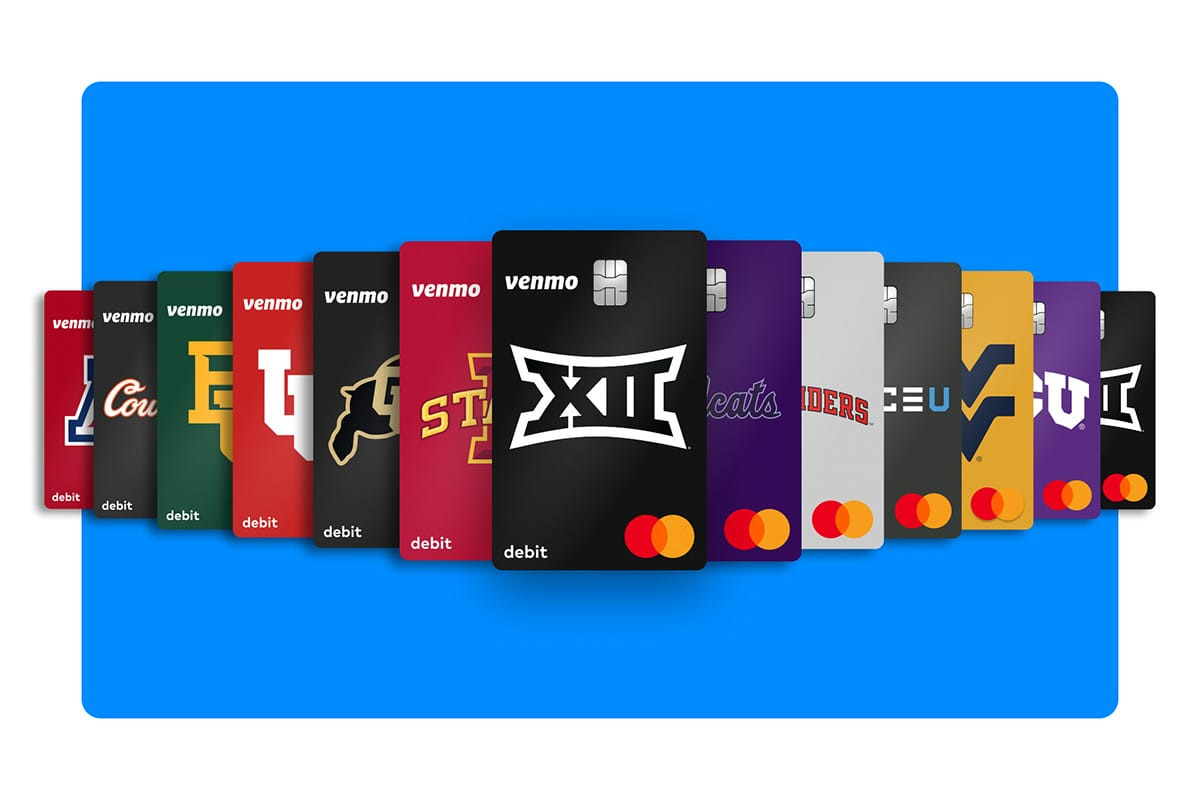

But the battle for your wallet doesn't stop there. JPMorgan is shaking up the fintech world by planning to charge for customer data access, a move that could hit apps like Venmo.

Speaking of Venmo, they're making a play for the college crowd with new Big 12-branded debit cards.

And if you’ve ever wondered if people are judging you at checkout, we’ve got a story that says they are—and your phone might be the new platinum card.

There's a lot to break down. Let's get to it!

Bilt announces new rewards credit cards with Cardless and a $250 million funding round. Now valued at ~ $11 billion.

Points-on-rent startup Bilt just announced a $250 million funding round, more than doubling its valuation to $10.75 billion. The company, which lets tenants earn rewards on their largest monthly expense. Bilt is ending its partnership with Wells Fargo on the Bilt Rewards Mastercard and launching a handful of new cards. The company is now teaming up with Cardless to launch a new trio of credit cards next year, which will include no-fee and premium options. [Fast Company]

Behind the Unraveling of Wells Fargo’s Rewards-for-Rent Credit-Card Partnership

Wells Fargo is pulling the plug on its "flashy" credit-card partnership with Bilt after the deal turned into a money-losing venture, costing the bank up to $10 million a month. The bank's revenue projections were "off the mark" because it had to pay Bilt a fee for each rent transaction. At the same time, the expected interest income never materialized as cardholders consistently paid their bills in full. [WSJ]

The Toaster Team has been watching Bilt for a while and is incredibly impressed with this latest announcement. At first glance, it might seem odd that a company offering rewards on rent could become an almost $11 billion business. But when you look under the hood, it's easy to see why.

Bilt isn't just a credit card; it's a sophisticated ecosystem. They are smart to use fee-free rent rewards, something no one else offers, as a powerful hook to attract millions of renters. From there, Bilt builds a multi-sided platform. It partners with the nation's largest property managers (the "Bilt Alliance"), who pay Bilt to offer the rewards program as a premium amenity to attract and retain tenants.

With a captive audience of high-value renters, Bilt then creates a "Neighborhood Rewards" program, where over 40,000 local businesses pay Bilt a commission to drive new customers to their doorsteps. This creates a self-reinforcing flywheel: landlords pay for access to renters, merchants pay for access to local customers, and all of it subsidizes the points renters get on their single biggest expense.

However, this ambitious model is not without risks. The core transaction of rewarding rent is inherently unprofitable. Bilt's entire business relies on its ability to generate enough high-margin revenue from other sources, like interchange fees on non-rent spending and commissions from merchants, to cover those losses.

Looking ahead, Bilt is making bold moves to solidify its market position and grow into its massive valuation. The company is strategically shifting its credit card program from Wells Fargo to the fintech firm Cardless, a move designed to give it greater economic control and the agility to innovate with its upcoming "Bilt Card 2.0".

Even more significant is its aggressive expansion into the mortgage market through a partnership with United Wholesale Mortgage (UWM). This creates a direct path to transition its members from renting to homeownership, dramatically increasing the potential lifetime value of each customer.

Zip U.S. CEO: Here's what BNPL critics get wrong

Zip Co.'s U.S. CEO, Joe Heck, is defending the Buy Now, Pay Later industry as its market share continues to climb. With BNPL accounting for $342 billion, or 5%, of global e-commerce in 2024 and projected to hit $580 billion by 2030, Heck argues critics are wrong to judge consumers for using it on everyday items or splurges. He insists that for many Americans with "lumpy" incomes, BNPL is a more straightforward and manageable option than traditional credit cards, placing the onus on the financial sector to create simpler, more user-friendly products. [American Banker]

JPMorgan Tells Fintechs They Have to Pay Up for Customer Data

JPMorgan Chase & Co. plans to charge fintech firms for access to customer bank data, a move that could "drastically reshape" the industry. The largest US bank has sent pricing sheets to data aggregators like Plaid Inc. and MX, the plumbing between banks and fintechs, with fees that could ultimately be passed on to consumers. While JPMorgan says it invested "significant resources" in security, the charges threaten platforms like Venmo and Robinhood, which historically got this data for free. Talks between the aggregator firms and the bank are reportedly "constructive and ongoing," with the new fees depending on the fate of a Biden-era regulation. [Bloomberg]

Venmo Launches Big 12 Debit Cards for Students and Fans to Score More Across Campus and on Gameday

Venmo is going back to college by teaming up with the Big 12 Conference to launch school-branded debit cards for students, alumni, and fans. The social payments platform will offer cardholders cashback rewards and exclusive perks like ticket giveaways and gameday upgrades. Venmo is also signing NIL deals with student-athletes to serve as brand ambassadors, helping them manage their earnings while promoting the new cards across campus. [PRNewswire]

Card, cash or mobile app? People judge your status by how you pay

Just as the American Express "Do you know me?" campaign made its card a status symbol in the 1970s, new research from Cornell University finds that your payment choice still sends a powerful social signal. The study suggests the "tap" of a phone has become the modern equivalent of swiping a platinum card, with mobile payment users being perceived as having higher status than those using cash or credit. Today's status is marked not by a physical card, but by the absence of one altogether. [American Banker]

In Other News

(Lending) Capital One confirms Discover home equity shutdown [American Banker]

(Underwriting) How Experian scores thin-file borrowers with cash-flow data [American Banker]

(Fintech) Neobank Revolut seeks $65B valuation, a year after its $45B deal [TechCrunch]

(AI + Payments) Behind Visa's AI Commerce Platform to Transform Fintech [AI Magazine]

(EWA) Instacart Adds Earned Wage Access to Shoppers Rewards Program [PYMNTS]

(EWA) DailyPay sells bonds tied to fees on wages that workers tap instantly [American Banker]

(Macro) Credit Card Performance Improves Despite ‘Historically High’ Interest Rates [PYMNTS]

(Macro) Wells Fargo Says Economy ‘Appears to Be Losing Some Steam’ [PYMNTS]

(Regulation) Gould confirmed as OCC head [American Banker]

(Embedded Finance) Community banks view embedded finance as key to longevity: report [Banking Dive]

(Embedded Finance) Visa partners with Weavr for embedded card solutions [The Paypers]

(Tech) MANTL Becomes First Fintech to Offer Plaid Layer [PR Newswire]

(Venture Capital) Propel Venture Partners Closes $100M Fund V to Expand its Global Investments in Technologies Transforming the Financial Services Ecosystem [Business Wire]

(AI + Credit Union) Exclusive: BECU acquires EarnUp's generative AI unit [American Banker]

Support The Free Toaster

Need an affiliate marketing platform/network? Chat with Fintel Connect

Need help hiring key roles? Email Connie Buehler and mention TOASTER

Need to improve application page conversions? Chat with Spinwheel

Need to accelerate your affiliate marketing? Chat with New Market Growth

Need to win on other growth channels? Chat with FIAT Growth

None of the above? Share our Newsletter in your favorite Slack channel

About Us

Welcome to The Free Toaster! The newsletter for marketing pros at fintechs, banks, and lenders.

Inspired by the free toasters banks used to give to each new customer, we’re here to help you acquire more customers at scale. We deliver fresh news, data, and insights to help you acquire more customers, minus the breadcrumbs.

Want to follow the authors on social media? Find Nick Madrid and Carlos Caro on LinkedIn.