Apple Card’s Next Chapter Starts at JPMorgan

JPMorgan takes over Apple Card as Bilt rolls out Card 2.0, private credit expands into cards and BNPL, and agentic commerce advances.

Hey Toaster Readers,

This week is sponsored by our friends at Fintel Connect.

The calendar just flipped, and the news cycle is moving a little slower than usual. Even so, a few developments this week offer a clear view into how consumer finance is changing at the start of 2026.

At the center is JPMorgan Chase’s agreement to take over the Apple Card program, ending Goldman Sachs’s role in one of the largest co-branded card portfolios in the U.S. The deal brings real numbers into focus, including a discounted transfer of roughly $20 billion in balances, and highlights how scale, underwriting discipline, and balance-sheet capacity are shaping who is willing to hold large card portfolios tied to premium brands and elevated credit risk.

From there, Bilt shared new details on its Card 2.0 rollout, outlining a tiered card lineup and a reworked issuing and servicing structure ahead of its February launch. At the same time, private credit firms continue to move in the opposite direction of banks, expanding into cards and BNPL as traditional lenders slow growth and reprice risk. We also look at how AI is moving further into lending and payments, from underwriting automation to Mastercard and Fiserv advancing agentic commerce, alongside updates on PicPay’s IPO filing, holiday spending data, and other notable shifts across credit and payments.

Happy New Year, and welcome to the first issue of 2026.

— Carlos Caro, Founder at New Market Growth

— Nick Madrid, Co-Founder of The Free Toaster and Uncovered Media

PS: To support us, please ask one colleague to subscribe!

JPMorgan Chase (Finally) Reaches Deal to Take Over Apple Card Program

According to the WSJ, JPMorgan Chase has (finally) reached a deal to become the new issuer of the Apple Card, replacing Goldman Sachs in one of the largest co-branded credit-card programs in the U.S., according to people familiar with the matter. JPMorgan will issue Apple credit cards for both new and existing cardholders, assuming a portfolio with approximately $20 billion in outstanding balances.

As part of the transaction, Goldman Sachs is expected to sell the Apple Card balances at a discount of more than $1 billion, an uncommon outcome for a major co-brand program. The discount reflects the portfolio’s higher exposure to subprime borrowers and a delinquency rate that has exceeded the industry average. These factors slowed negotiations and contributed to limited interest from other potential issuers that previously evaluated the program.

The deal also includes changes to Apple’s savings offering. JPMorgan plans to launch a new Apple-branded savings account, while customers with existing Apple savings accounts at Goldman will be able to choose whether to remain there or move to JPMorgan. Goldman, which continues to operate its Marcus platform, may retain some deposits even after the card portfolio transfers. For Goldman Sachs, the transaction represents the final step in exiting consumer lending, following more than $7 billion in pretax losses tied to that business since 2020. (Wall Street Journal)

New Details Emerge About Bilt Card 2.0 Program

Bilt has shared new details about the Bilt Card 2.0, its next-generation credit card program set to launch in early 2026. The company plans to introduce three new card options on January 14, with annual fees of $0, $95, and $495. Applications for the Wells Fargo–issued Bilt Mastercard have ended, and the current card will retire on February 6, 2026, though Bilt memberships, points balances, and access to Bilt services will remain unchanged.

Existing cardholders will be able to upgrade to one of the new cards without a hard credit inquiry and will keep their current card numbers, autopay settings, and digital wallet connections. The new cards will be issued by Column N.A. and serviced by Cardless. Bilt also said Card 2.0 will expand rewards eligibility to include certain residential mortgage payments. Customers who do not upgrade will have their accounts converted to Wells Fargo Autograph cards, which earn Wells Fargo Rewards rather than Bilt Points. As previously reported, this transition builds on Bilt’s earlier decision to end its Wells Fargo partnership after reaching an $11 billion valuation, which we covered in detail in a prior Free Toaster story. (Bilt Rewards)

Private Credit Firms Pile Into Consumer Debt as Risk-taking Mounts

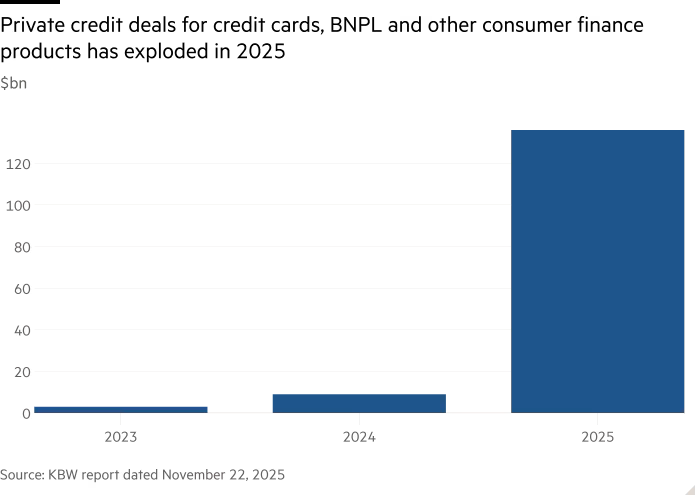

Private credit firms sharply expanded their exposure to consumer debt in 2025, moving aggressively into credit cards and buy now, pay later. According to the data, private credit purchases and forward-flow agreements tied to consumer loans jumped to about $136 billion in 2025, up from roughly $10 billion in 2024 and only a few billion dollars in 2023. Large managers including KKR, Blue Owl, and Sixth Street are driving the shift as banks remain cautious on unsecured lending.

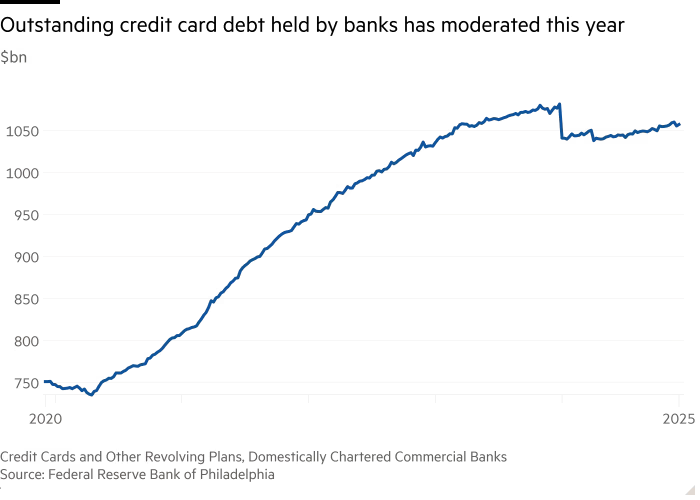

The data above shows outstanding credit card and revolving balances at U.S. banks rising steadily from 2020 through 2024, then flattening and dipping slightly in 2025 to just above $1 trillion. Analysts cited in the report note that banks have slowed credit card growth as delinquencies rise in auto loans and student debt, creating space for private capital to step in where regulated lenders are pulling back.

Affirm has used forward-flow agreements and loan sales to firms including Sixth Street, Prudential, and New York Life to fund growth. Private credit managers are also expanding into asset-based finance across consumer products, while new specialists such as Fidem Financial have accumulated about $15 billion in credit card receivables and launched co-branded card platforms in partnership with Blue Owl. Supporters point to strong historical returns in card lending, including a recent 35% annualized return on equity reported by JPMorgan Chase’s card unit, even as others caution that capital requirements and late-cycle risks are pushing more unsecured credit outside the traditional banking system. (Financial Times)

Enjoying this week’s issue?

If you’ve been enjoying The Free Toaster, help us spread the word. Forward it to someone who lives and breathes consumer lending, marketing, or fintech like you do.

Your shares help us reach more builders in consumer lending, and help us make the Newsletter & Podcast better every day.

GHS Federal Credit Union selects Scienaptic AI to Enable Smarter Lending

Scienaptic AI said GHS Federal Credit Union has selected its AI-powered credit decisioning platform to automate underwriting, speed loan approvals, and expand access to credit across its lending portfolio. The Binghamton-based credit union plans to use the platform to assess member creditworthiness using a broader range of data as borrower profiles and lending complexity increase. Founded in 2014, Scienaptic AI supports more than 150 lenders and processes over 3 million credit decisions each month, applying machine learning with built-in risk and fair lending monitoring to help financial institutions scale lending without increasing portfolio risk. (Business Wire)

Fiserv and Mastercard Partner to Advance Trusted Agentic Commerce For Merchants

Fiserv and Mastercard said they are expanding their partnership to support agentic commerce for merchants, with Fiserv set to deploy Mastercard’s Agent Pay Acceptance Framework at scale. As part of the integration, Fiserv will act as a network token requestor using Mastercard’s Secure Card on File capabilities, enabling AI agents to transact on behalf of consumers with tokenization, authentication, fraud controls, and governance built in. The companies said the framework is designed to help merchants participate in AI-driven payments while maintaining control over customer relationships, improving transaction security, and supporting new commerce models tied to automated and programmable payments. (Fiserv)

Brazil FinTech PicPay Files for US IPO as Profits Surge

PicPay has filed for a U.S. initial public offering, positioning itself as one of the most significant Brazil-linked fintech listings since Nubank’s debut and renewing attention on how Pix continues to reshape payments in Brazil. The Amsterdam-incorporated company reported net income of 270.4 million reais on revenue of 7.26 billion reais for the nine months ended Sept. 30, up from 150.8 million reais on revenue of 3.78 billion reais a year earlier, reflecting a sharp improvement in profitability. Bloomberg reported that Bicycle, a fund led by former SoftBank executives including Marcelo Claure, plans to invest up to $75 million in the offering, with PicPay targeting a Nasdaq Global Select Market listing under the symbol PICS and Citigroup, Bank of America, and Royal Bank of Canada leading the deal. (PYMNTS)

Cobalt Credit Union Deploys Eltropy AI Voice, Achieving 83% Session Containment Rate

Cobalt Credit Union said it has deployed Eltropy’s AI Voice solution, reporting an 83% session containment rate as the system handles routine member inquiries without live staff involvement. The credit union, which serves military members and their families nationwide, rolled out AI Voice as part of a phased automation strategy that began with video, chat, and text channels, and now provides 24/7 voice support integrated with its DNA core system. Cobalt said the AI assistant manages common tasks such as balance checks and transfers while reducing abandonment rates and allowing contact center staff to focus on more complex member needs. (Herald Mail Media)

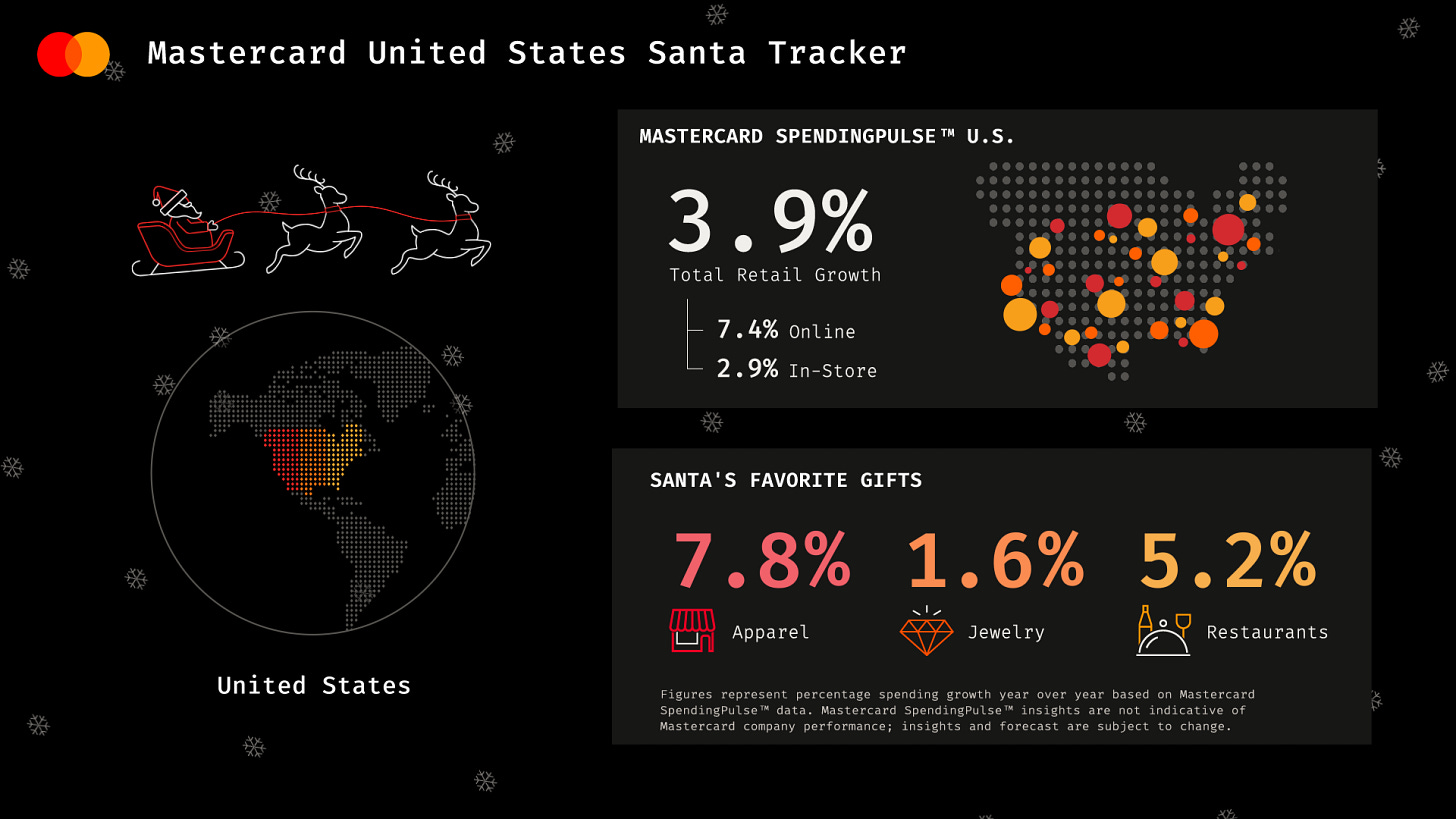

U.S. Holiday Retail Sales Rise 3.9% as Online Spending Outpaces Stores

Mastercard said U.S. holiday retail sales excluding automotive rose 3.9% year over year from Nov. 1 through Dec. 21, according to preliminary data from Mastercard SpendingPulse, reflecting stronger e-commerce and steady in-store demand. Online sales increased 7.4% while in-store sales grew 2.9%, pointing to continued omnichannel shopping behavior, with apparel spending up 7.8%, restaurant sales rising 5.2%, and jewelry up 1.6%. The data shows consumers shopping earlier, using promotions, and balancing goods with experiences, as retailers leaned on digital channels and operational efficiency to meet demand during the 2025 holiday season. (Mastercard)

Please support our Newsletter by recommending us to one of your colleagues!

And, please check out our sponsors:

Need an affiliate marketing platform/network? Chat with Fintel Connect

Need to improve application page conversions? Chat with Spinwheel

Need help with performance marketing? Chat with Bulldog Media Group

Need to accelerate your affiliate marketing? Chat with New Market Growth

Need to win on other growth channels? Chat with FIAT Growth

Other News We’re Reading

(Financial Planning) Survey: Men More Financially Confident in the New Year (NerdWallet)

(Open Banking) Flutterwave Expands Payments Infrastructure With Acquisition of Open Banking Firm Mono (PR Newswire)

(AI/Lending) How AI is helping Dallas-based Yendo bridge the gap of financial inequality (The Dallas Morning News)

(Legal/Fintech) Mayor Brandon M. Scott Announces Baltimore City’s Lawsuit Against Dave, Inc. For Unfair and Deceptive Practices (Baltimore City)

(Security) Marquis breach toll rises to 80 banks, 824,000 consumers (American Banker)

(Advertising/Payments) PayPal Leverages Massive Data Trove to Challenge Advertising Giants (PYMNTS)

(E-commerce/AI) Who Controls Checkout? Price.com Pushes AI From Recommendation to Execution (PYMNTS)

(Lending/AI) Pluto debuts AI-driven lending platform for private assets (Fintech Global)

Spot something worth sharing with your team? Drop this week’s edition in their inbox:

https://www.thefreetoaster.com/p/apple-cards-next-chapter-starts-at

Happy New Year!

Catch you next week,

The Free Toaster Team

p.s. If you’re working on anything new in acquisition or credit, we’re always curious to hear about it.