OnePay, Affirm, and PayPal Declare War on Your Wallet

Walmart-backed OnePay and PayPal launch new Mastercard programs with Synchrony, as Affirm's COO declares they are "reinventing credit" to win over consumers.

OnePay and Synchrony to launch new industry-leading credit card program with Walmart; credit card to be powered by Mastercard and set to go live this fall

OnePay, the Walmart-backed fintech offering digital banking and payment tools, is teaming up with Synchrony, a consumer financial services company, to launch a new credit card program with Walmart this fall. The cards, powered by Mastercard, will live inside the OnePay app and include a general-purpose version and a Walmart-only private label card. The move folds credit into OnePay’s "growing" financial ecosystem, aiming to make managing money more seamless for millions of users. Synchrony expects the program to boost customer loyalty and deliver "attractive risk-adjusted returns." [Mastercard]

Affirm at William Blair Conference: Reinventing Consumer Credit

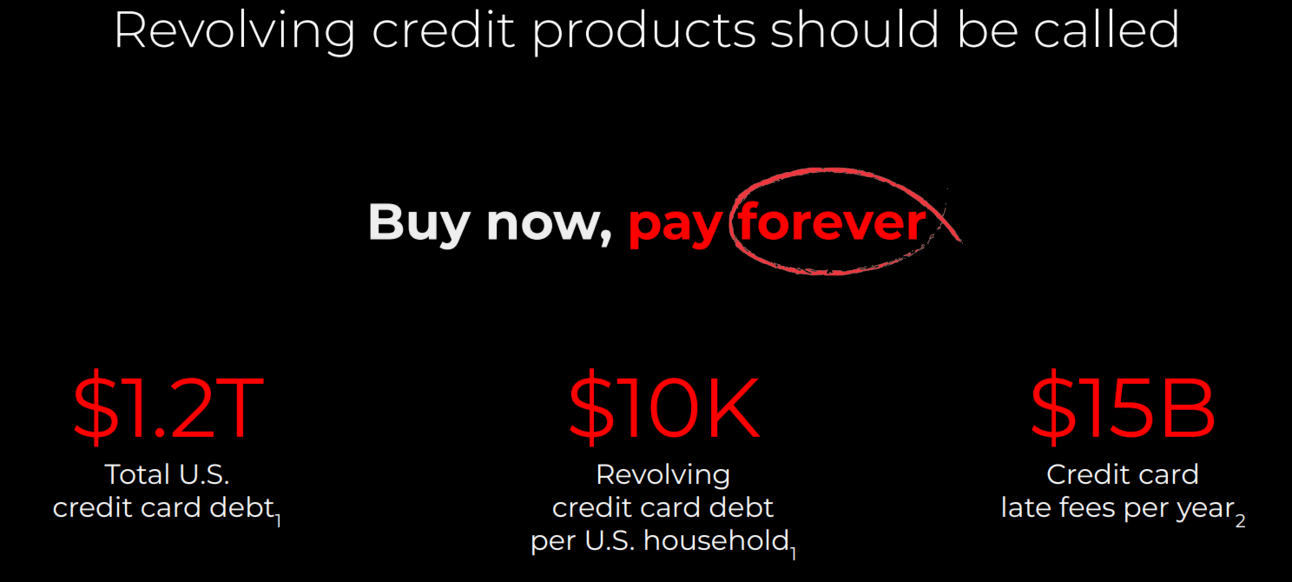

Affirm’s COO Michael Linford told investors at the William Blair Conference that the company is “reinventing credit”—ditching revolving debt and late fees for fixed, transparent BNPL loans. The fintech now has over 22 million active users, with 94% of transactions from repeat customers and GMV growth running over 40%. Its new Affirm Card, already in 2 million wallets, is driving offline adoption. Affirm sees itself as a modern alternative to credit cards, aiming for “3-4%” net margins on transactions and planning expansion to Europe and Australia. [Affirm]

PayPal Enhances Popular Online Credit Offering with New Physical Card for In-Store Use

PayPal just gave its popular online credit product a real-world upgrade with a new physical PayPal Credit card, issued by Synchrony, letting users tap into flexible financing in stores and anywhere Mastercard is accepted. The card launches with a limited-time travel perk—six months of promotional financing with no minimum spend. The move brings PayPal’s digital credit to the checkout line, answering customer calls for more flexibility and on-the-go use. It's one more tool in PayPal’s growing set of payment options, alongside BNPL and cashback cards. [PayPal]

Consumer lending roared back in Q1 2025, with a surge in loan originations and renewed investor appetite.

Consumer lenders kicked off 2025 with a bang, reporting "robust" origination growth across personal loans, BNPL, cash advances, and higher-APR products, thanks to a strong labor market and looser credit standards. Upstart led the charge with an eye-popping +88.7% YoY jump, while SoFi, Oportun, and Affirm also posted big wins. Delinquencies stayed mostly in check, especially for short-term and secured loans, and deposit growth picked up for names like SoFi and Synchrony. Meanwhile, the consumer MPL market saw a "soaring" +51.2% YoY jump in new issue volume, signaling strong investor demand for consumer credit-backed deals. [Cole Gottlieb from Cross River Bank]

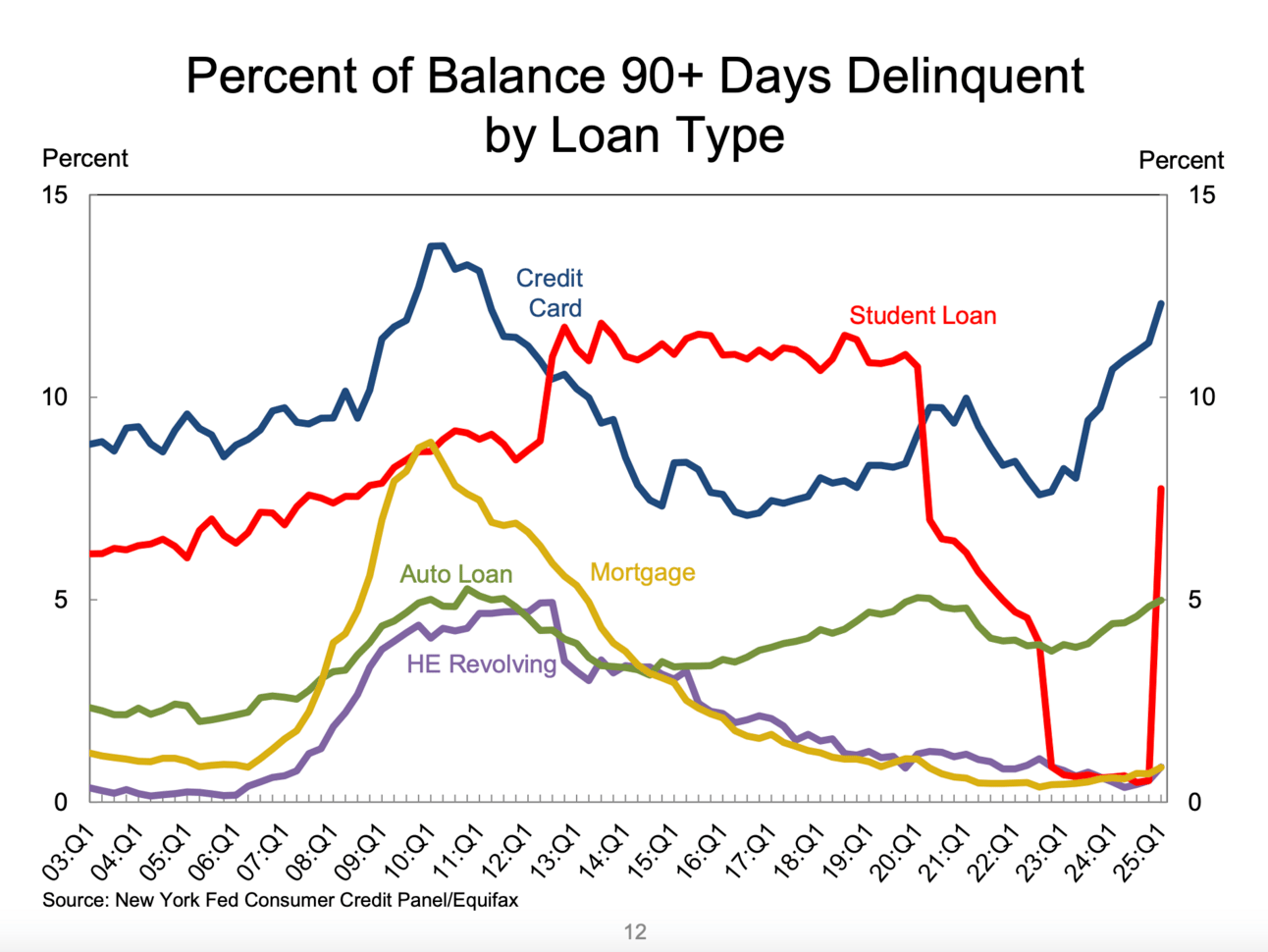

Household Debt Hits $18.20 Trillion; Student Loan Delinquencies Jump

Household debt climbed to a record $18.20 trillion in Q1 2025, up $167 billion from last quarter, according to the New York Fed. While mortgages (+$199B) and student loans (+$16B) rose, credit card and auto loan balances actually dipped by $29B and $13B, respectively. The big red flag? Student loan delinquencies surged, with 7.7% of balances now 90+ days late, after credit bureaus resumed reporting them post-pandemic. Meanwhile, overall delinquency ticked up to 4.3% of debt in some stage of late payment. [New York Fed Q1 2025 Household Debt and Credit Report]

As feds resume student loan collections, states try to catch borrowers before they sink

As federal student loan collections resume after a five-year pause, states are scrambling to soften the blow for overwhelmed borrowers. Nearly 10 million Americans risk default, and delinquencies are already spiking, especially in lower-income, Republican-led states like Mississippi and Alabama, where rates top 30%. While California’s ombuds office fields desperate calls from borrowers (some in their 80s!), other states are crafting local relief programs and legal protections. Still, experts say these patchwork efforts can’t fix a system that one advocate calls “broken” at its core. [South Carolina Daily Gazette]

In Other News

(Cards) Gen Z Card Users Are Dissatisfied With Rewards Programs PYMNTS

(Cards) Klarna and Visa Launch Pilot of New Debit Card with Increased Flexibility at Money 20/20 Europe Visa

(Cards) Orange is the New Gold: Introducing the Bitcoin Credit Card™ Gemini

(BNPL) How much Buy Now, Pay Later debt is out there? Marketplace

(BNPL) Klarna Promises Customers ‘Human Connection’ Amid AI Adoption PYMNTS

(BNPL) Sezzle Lawsuit Accuses Shopify of Stifling BNPL Options PYMNTS

(EWA) ZayZoon Launches Perks Marketplace to Expand Financial Benefits for Frontline Workers Business Wire

(Brand) Venmo Taps White Lotus Stars to Expand the Brand Definition Adweek

(Brand) Kiwi brand tracking martech Tracksuit trousers another $38 million in Series B Startup Daily

(Credit Quality) Gen Z credit use up 30%, as Canada’s consumer debt hits $2.5 trillion Canadian Mortgage Trends

(Credit Quality) Equifax Canada Reports Rising Delinquencies and Declining Credit Demand in Q1 2025 Business Credit Trends Nasdaq

(Credit Quality) Auto loan late payments at record high for Q1; costs of car ownership blamed Autonews

(Credit Quality) Consumer debt is rising fast. Is that necessarily a bad thing? Marketplace

(Credit Quality) Citigroup Increases Provisions for Potential Losses on Loans Due to ‘Macro Environment’ PYMNTS

(Credit Union) Shoreline Hometown Credit Union Selects Mahalo Banking to Accelerate Digital Evolution Business Wire

(Credit Union) Treasury Prime Partners with People Trust to Advance Financial Inclusion via Embedded Banking Business Wire

(Credit Union) Credit Unions Monetize Member Data Through FinTech Ties PYMNTS

(Embedded Lending) Just 37% of Consumer Lenders Connect at eCommerce Checkout PYMNTS

(Fintech) Monzo hits profitability for second year running amid IPO speculation Sifted

(Fintech) DAVE's CashAI: Is This Underwriting Engine a Fintech Game-Changer? Zacks

(Growth Channels) Reddit: The social-media dark horse gaining momentum with advertisers Campaign US

(Growth Channels) Wells Fargo Is Leaning Hard Into Branches Again – And With a Fresh Take The Financial Brand

(Lending) Small-dollar loans are a winning proposition for banks and borrowers American Banker

(Macro) Private credit: Investment opportunities and US consumer credit UBS

(Macro) Money20/20 Europe Highlights—Collaboration is Key in the Fintech Industry Technowize

(Macro) Fed’s Beige Book Shows Muted Hiring and Spending as Uncertainty Lingers PYMNTS

(Macro) New York Fed: Consumers Expect Inflation to Slow PYMNTS

(Macro) Wells Fargo Expects Consumer Loan Growth to Remain Flat or Slow PYMNTS

(Payments) US Bank Looking To Sell Its Payment Unit, Elan PYMNTS

(Payments) Mastercard and PayPal Partner to Develop Features Using Credential Solution PYMNTS

(Payments) Banks Bet on Virtual Cards as the New Credit Battleground PYMNTS

(Payments) Plaid Launches Request for Payment PYMNTS

(Payments) Deep Dive: Agentic AI in Payments and Commerce: By Sam Boboev Finextra

(Regulation + Compliance) MoneyLion Must Wait To Challenge CFPB's Fed Funding Law360

(Regulation + Compliance) Greenlite AI is on a mission to revolutionize banking compliance Hey Nexus

(Regulation + Compliance) Senate curtails path for swipe fee bill addition to stablecoin legislation American Banker

(Underwriting) Experian and Plaid Team Up To Unlock Smarter Credit Decisions With Real-Time Cashflow Insights FF News

(Underwriting) Experian and Plaid Partner on Cash Flow Data for Lenders PYMNTS

(VC + Fundraising) Kiwi Raises $7.8M Series A to Scale AI-Driven Credit Platform for Underbanked U.S. Latinos FF News

(VC + Fundraising) Plug and Play closes $50 million Fintech & AI Fund to drive impact through direct access to global decision makers PR Newswire

(Other News That Caught Our Eye) Capital One CEO to get one-time award valued at $30 million American Banker

(Other News That Caught Our Eye) New York legislature pushes ban on cashless stores American Banker

(Other News That Caught Our Eye) Yotta sues Evolve alleging ‘Ponzi scheme’ in new lawsuit Banking Dive

(Other News That Caught Our Eye) JP Morgan Chase unveils new 12-week accelerator for UK fintechs Fintech Futures

Support The Free Toaster

Need an affiliate marketing platform/network? Chat with Fintel Connect

Need help hiring key roles? Email Connie Buehler and mention TOASTER

Need to improve application page conversions? Chat with Spinwheel

Need to accelerate your affiliate marketing? Chat with New Market Growth

Need to win on other growth channels? Chat with FIAT Growth

None of the above? Share our Newsletter in your favorite Slack channel

Jobs

We send a separate jobs edition every 1-2 weeks. You can always view it at thefreetoaster.com or, click here if you want to receive the jobs edition via email

About Us

Welcome to The Free Toaster! The newsletter for marketing pros at fintechs, banks, and lenders.

Inspired by the free toasters banks used to give to each new customer, we’re here to help you acquire more customers at scale. We deliver fresh news, data, and insights to help you acquire more customers, minus the breadcrumbs.

Want to follow the authors on social media? Find Nick Madrid and Carlos Caro on LinkedIn.