Klarna Targets High Spend Travelers, Socure Builds the BNPL Credit File, and Instacart Lands Inside ChatGPT

Plus Capital One’s Miami Art Week perks for premium cards, BHG and Engine by Gen’s new loan marketplace push, Flex’s 60 million raise for a mid-market card, and fresh data on where credit card debt is piling up.

Hey Toaster Readers,

This week is sponsored by our friends at Spinwheel.

Klarna is testing paid memberships in the U.S. that feel like a premium card without a spending requirement. Socure’s Qlarifi deal aims to turn BNPL into a real-time credit system instead of a black box. Instacart’s new app inside ChatGPT shows what happens when agents own the whole trip from search to checkout.

The rest of this week’s slate is about distribution and loyalty. Capital One is using Miami Art Week as a live lab for premium perks. BHG and Engine by Gen are wiring high intent borrowers into marketplaces. Flex raised $60 million for a mid-market card, and new state-by-state credit card debt data shows exactly where balances are starting to bite.

Private credit and alternative consumer lending are getting harder to track. Regulators are turning up the heat on rewards and card programs. Fraud, self-checkout abuse, and open banking risk keep rising. If you work in lending, growth, or risk, this is a week to think about how you price credit and which channels you trust to bring customers in the door.

Here’s what’s happening across fintech right now.

— Carlos Caro, Founder at New Market Growth

— Nick Madrid, Co-Founder of Uncovered Media and Ghostmode

PS: To support us, please ask one colleague to subscribe!

With a single call to our simple, dev-friendly APIs, Spinwheel offers the only comprehensive connection to your consumers' financial accounts. Spinwheel delivers PII, real-time, verified account data, and the ability to make payments across all major debt categories – all within your brand's experience.

With many happy customers, including:

Klarna Launches Premium and Max Memberships in the U.S., Offering Lounge Access and Premium Perks Without Spending Requirements, as Americans Face $1.23 Trillion in Credit Card Balances

Source: Klarna

Klarna is taking a direct swing at premium credit cards in the U.S., rolling out paid Premium and Max memberships that stack lounge access, travel protection, media subscriptions, and 1.5–2% cashback on top of the Klarna Card without revolving debt or spend requirements. The launch lands as U.S. credit card balances sit around $1.2 trillion and higher income consumers cancel cards while leaning into BNPL, giving Klarna a shot at card-like economics on debit and installment rails instead of traditional credit.

The benefits are built to look familiar to legacy travel cards, with LoungeKey access, travel and rental coverage, and the option to convert cashback into airline and hotel rewards across partners like Air France–KLM, British Airways, Accor, and Wyndham. What is different is the entry point. Consumers start from a debit-style Klarna Card with built-in flexibility, then opt into four paid tiers that layer on subscriptions like Headspace, ClassPass, and The New York Times, putting pressure on banks and networks to defend the loyalty layer that has historically kept prime borrowers tied to premium plastic. (Klarna)

Socure Acquires Qlarifi, Establishing the First Real-Time BNPL Credit System and Setting a New Standard for Safe, Low-Cost Payments

Socure is pulling BNPL into the main credit stack by buying Qlarifi, a real-time BNPL credit database built by former Klarna and Zip leaders. The combined platform ties Qlarifi’s cross-provider repayment data to Socure’s Identity Graph and RiskOS so lenders can see loan stacking, overextension, and first-party fraud across providers in real-time. Socure says that can cut first-party fraud losses by up to 70% in a channel that already accounts for nearly 6% of U.S. ecommerce and is on track for more than $700 billion in global spend by 2028.

For BNPL providers, this looks like the first serious attempt at a purpose-built bureau for small-ticket, millisecond credit decisions. It gives trusted customers a clearer way to signal good behavior and thins out the arbitrage for heavy users who hop between apps. It also speaks directly to regulators who have been asking for more transparency on BNPL exposure and repayment performance. (Socure)

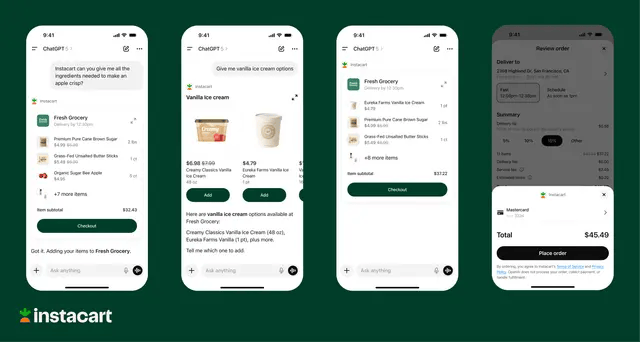

Instacart App Launches in OpenAI ChatGPT – First Company to Offer New Instant Checkout App Experience

Source: Instacart

Instacart just turned ChatGPT into a grocery checkout lane. The company is the first to launch a fully embedded Instacart app inside ChatGPT using the Agentic Commerce Protocol, letting users go from recipe ideas to a ready-to-pay cart and Instant Checkout without leaving the conversation. Instacart plugs its real-time inventory, pricing data, and retailer network into OpenAI’s interface, with Stripe handling familiar card flows and digital wallets coming next.

For AI and commerce teams, this is an early example of agents owning the full funnel, not just recommendation and search. Instacart is positioning its 1,800 retailers, 2 billion product instances, and fulfillment network as the grocery backbone for multiple AI platforms, betting that “shop through the agent” becomes a default behavior and that retailers will want access to those AI-driven baskets rather than building their own front ends. (Instacart)

Capital One Takes the Premium Credit Card Arms Race to the Next Level With Miami Art Week Perks

Source: Fast Company

Capital One used Miami Art Week as a live lab for what “premium” now means: not just higher earn rates and lounge access, but access to culture that feels rare and emotionally charged. Mirage Factory, the Alex Prager installation built with The Cultivist, plus a Diana Ross performance and a branded hotel takeover, turned one of the most gatekept weeks in American culture into a cardholder-only environment and a test of how far experiences can drive loyalty.

Behind the art is a clear strategy. Capital One now runs more than 300 branded experiences a year and talks about an “access pyramid” where points function less like savings and more like stored invitations. In a premium card market where Amex, Chase, and Capital One all compete on curated events, the question is no longer who has the richest earn table, but which brand feels most culturally fluent when a customer asks what their card actually lets them experience. (Fast Company)

BHG Financial and Engine by Gen Enhance Partnership to Connect Well-Qualified Borrowers with High-Dollar, Long Term Affordable Loans

BHG Financial is tightening its grip on high-income borrowers by deepening its partnership with Engine by Gen, the embedded marketplace now plugged into Gen’s 30 million–member ecosystem across brands like Norton, Avast, and LifeLock. BHG already uses Engine to reach prime borrowers who want large, long-term unsecured loans. The expanded deal puts BHG’s up-to-$250,000, 10-year personal loans in front of more of those users while also letting BHG embed Engine-powered marketplaces inside its own flows as a second distribution rail.

The interesting angle is that BHG now plays on both sides of Engine’s network, acting as a flagship product in the marketplace while also standing up its own white-label marketplace experiences. For Engine and Gen, it is another proof point that credit access can be pushed into security, identity, and wellness environments where consumers already log in. For BHG, it is a scale and targeting story: more high-intent leads, better matching, and a way to stay top of mind with well-qualified professionals who are shopping for large-ticket, fixed-payment loans. (Morning Star)

Events 2026: Smaller Rooms, Better Conversations

If you work in consumer lending, you already know how this goes. Big conferences pull you out of the office for days and send you home with a few good meetings and not much you can plug into your roadmap. The people who own credit policy, fraud, mail, and performance marketing rarely get a room designed around their work.

Next year, we want to change that.

We are planning a set of 2026 events built for operators first. Smaller groups. Working sessions instead of keynotes. Tables where you sit with peers who run similar programs and focus on what is actually working.

The goal is that if you get on a plane, you come home with contacts you will use, ideas you can test within a quarter, and at least one partnership that feels real.

If you want a say in how these look, reply to this email or message Carlos on LinkedIn. You can also read his post and tell us what would make an event worth the flight and hotel for you.

Bank of America is Turning the World Cup Hype into a Card Acquisition Play by Offering Access to Tickets

Source: Bank of America

Bank of America is turning World Cup hype into a card acquisition play, offering new Customized Cash Rewards and Unlimited Cash Rewards Visa applicants a shot at buying FIFA World Cup 2026 tickets if they apply between December 4 and January 5 and are approved by early February. The hooks are familiar on the surface: 6% back in a chosen category for the first year on Customized, 2% unlimited cash back on Unlimited, no annual fee, and a standard intro APR, but the real lure is a unique link that lets eligible cardholders purchase up to two match tickets from a limited pool on a first come basis. It is not a sweepstakes, just controlled access wrapped around Visa sponsorship, and it shows how issuers are using event inventory as a front-end filter and loyalty tool rather than relying only on bonus cash and points tables. (Bank of America)

Block Doubles Down on Teen Focus With Advisory Council

Block is turning Gen Z into co-designers, not just users, by launching a paid Teen Advisory Council of about 20 highly active Cash App customers who will weigh in on product design, safety, and strategy through monthly virtual sessions and quarterly in-person meetings. The group, selected from more than 2,000 applicants, fits Jack Dorsey’s long game of using teen cards, savings, Lightning payments, stablecoin P2P, and tools like MoneyBot and Cash App score to pull younger cohorts into primary relationships early, giving parents controls they like while building a base of users whose income and financial needs will grow with the network. (American Banker)

Euronet Targets Credit Growth With CoreCard Acquisition

Euronet is leaning hard into credit growth by buying CoreCard, the processor behind Apple Card, and wiring it into its Ren issuing platform so banks and fintechs can launch modern revolving credit and BNPL products without rebuilding cores from scratch. The bet is that credit, not debit or prepaid, will drive the next wave of revenue, and that institutions stuck on 30-year-old tech need a migration path that keeps the “highway” running while new exits are built. CoreCard brings proof it can handle billions of complex credit transactions, while Euronet layers in its private cloud, 680,000 payment touchpoints, and microservices so clients can start with a single program and phase into a full upgrade. For operators, this is less about another processor logo and more about whether you can ship flexible credit and installment products at scale without getting trapped in a maze of patches and one-off fintech add-ons. (Fintech Magazine)

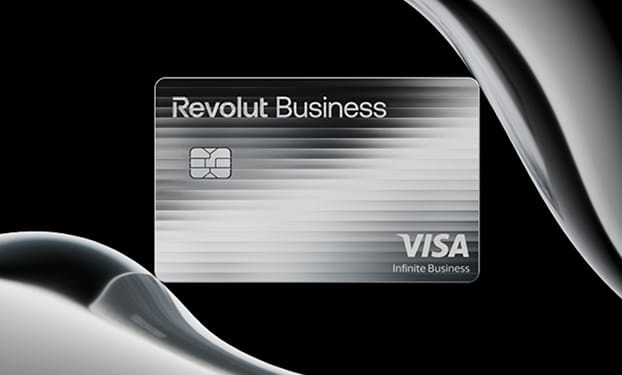

Revolut Preps Launch of Titan ‘Ultra-Premium’ Business Card

Source: PYMNTS

Revolut is moving upmarket in business spend with Titan, an “ultra premium” Visa corporate card aimed at fast-growing companies that want both high-end travel perks and tighter control from finance. Titan bundles lifestyle and travel benefits with real-time expense and receipt management, pitching itself as a single tool that replaces the patchwork of standalone travel and spend platforms most firms still pay for. The product arrives as corporate cards shift from back-office utility to growth infrastructure, with CFOs using them to streamline workflows, tighten approvals, and move faster on new opportunities, and as Revolut itself leans into scale with more than $1 billion in annualized revenue and a reported $75 billion valuation. (PYMNTS)

Enjoying this week’s issue?

If you’ve been enjoying The Free Toaster, help us spread the word. Forward it to someone who lives and breathes consumer lending, marketing, or fintech like you do.

Your shares help us reach more builders in consumer lending, and help us make the Newsletter & Podcast better every day.

Student Loan Delinquencies Among Renters Double in Early 2025

Student loan repayment is starting to show up in the rental market. TransUnion reports that the share of rental applicants who are 90 days or more delinquent on student loans jumped from 15% in January to 32% in May, with many Prime and even Super Prime renters sliding into lower credit tiers as payments restart. That shift means applicants who used to clear standard credit score cutoffs for leases are now getting screened out, even though traditional scores were built to predict loan repayment, not rent performance. TransUnion is using the data to push purpose-built resident scores and fraud tools, arguing that financial stress will drive more document tampering and income misrepresentation and that property managers need rental-specific models if they want to manage risk without shrinking their applicant pools. (TransUnion)

What The Fed’s 2025 Rate Cuts Mean For Banks And Fintech

Fed cuts are finally here, but borrowers are not feeling it yet. With the funds rate drifting lower around a 3.75%–4% range and more easing expected, banks and fintechs are still pricing loans and deposits as if they are in a higher-rate world, keeping mortgage, auto, and especially card APRs elevated while deposit costs stay sticky. Small business and consumer credit remain tight as banks nurse CRE risk and margin pressure, leaving room for fintech lenders like Upstart and LendingClub to grow originations with stricter models and selective repricing. The next year comes down to how fast deposit costs roll down, how card and auto delinquencies behave, and how quickly each side of the market is willing to reprice, which will determine whether rate cuts translate into real relief or just a slow grind of cautious easing through 2026. (Forbes)

Consumer Loans Are Getting Harder to Tally—and the Risks Harder to Gauge

Source: WSJ

Consumer credit is getting harder to see and therefore harder to price. KBW estimates private-credit funding deals for fintech lenders could support nearly $140 billion of consumer lending over the next few years, up from under $10 billion in 2024, as more BNPL and personal loans move off bank balance sheets and into opaque private structures. Bank card portfolios are skewing toward higher tier borrowers and even shrinking on average, while alternative lenders quietly pick up the rest, which helps some households stay afloat but fragments the data that usually signals stress. That split helps explain why bank credit metrics still look healthy even as retailers report more trading down and stretched shoppers. For investors, the problem is less an obvious crack and more a fog: slower government stats, scattered private performance data, and a growing slice of lending that sits outside traditional reporting all raise the odds of being surprised by consumer credit risk in 2026. (WSJ)

Please support our Newsletter by recommending us to one of your colleagues!

And, please check out our sponsors:

Need an affiliate marketing platform/network? Chat with Fintel Connect

Need to improve application page conversions? Chat with Spinwheel

Need to accelerate your affiliate marketing? Chat with New Market Growth

Need to win on other growth channels? Chat with FIAT Growth

Looking for your next fintech role?

Stay ahead of where the industry is hiring. The Free Toaster Jobs newsletter curates standout openings in fintech marketing, product, data, and risk each week, along with insights into the trends shaping hiring across leading lenders, neobanks, and fintech startups.

Subscribe to The Free Toaster Jobs to get the latest roles and hiring insights delivered straight to your inbox (Toaster subs that don’t opt-in won’t get the Friday jobs Edition).

Missed last week’s edition? Check out the most recent job listings here.

Other News We’re Reading

(Personal Loans) Progressive Insurance® and Best Egg Enhance Access to Personal Loans (Progressive)

(Payments) Block Doubles Down on Teen Focus With Advisory Council (American Banker)

(Credit Cards) Government Agency Skewered by Banking Group for Stern Take on Credit Card Rewards Programs (The Independent)

(Aggregators) SurgePays Adds Three New Subprime Lead Generation Aggregators to Accelerate ProgramBenefits.com Activations (Issuer Direct)

(Fraud) TransUnion Unveils Enhancements to Next-Generation Device Risk Solution to Combat Rising Fraud Losses (TransUnion)

(Economy) Paycheck-to-Paycheck Shoppers Outspend Income as Sentiment Drops (PYMNTS)

(Financial Crime) Financial Crime in Open Banking – 2025 Update (Open Banking)

(Payments) Six payment trends for 2026 (Mastercard)

(Government) Trump Administration Declares CFPB Funding Illegal (Politico)

(AI) LSEG Announces New Collaboration With OpenAI (LSEG)

(Payments) Trulioo Joins Google’s Agent Payments Protocol (AP2) to Help Build Trust in Agent-Led Payments (Trulioo)

(AI) Trump Promises Executive Order to Block State A.I. Regulations (New York Times)

(Fraud) Visa Analysis Confirms Reinforced Fraud Protection This Black Friday (Visa Perspectives)

Spot something worth sharing with your team? Drop this week’s edition in their inbox:

Catch you next week,

The Free Toaster Team

p.s. If you’re working on anything new in acquisition or credit, we’re always curious to hear about it.