INTL: Canadian AI-marketing company raises $235M at $2.5B 🔥

And PayPal Ventures Leads $21M Series A in Formance

Quick favor To make sure you keep getting our emails (and maybe some free swag 👀), do at least one of these:

1️⃣ Hit reply and say ‘Toaster’—it tells your email filter we’re legit. Plus, we’ll randomly send some Toaster swag to a few lucky readers!

2️⃣ Rescue us from spam—if past issues landed there, mark them as “safe.”

That’s it! Easy, right?

Looking for US News? Be sure to check out yesterday’s edition.

TL;DR

(We’re trying something out for the next few weeks and are separating US news from everything else. Let us know what you think!)

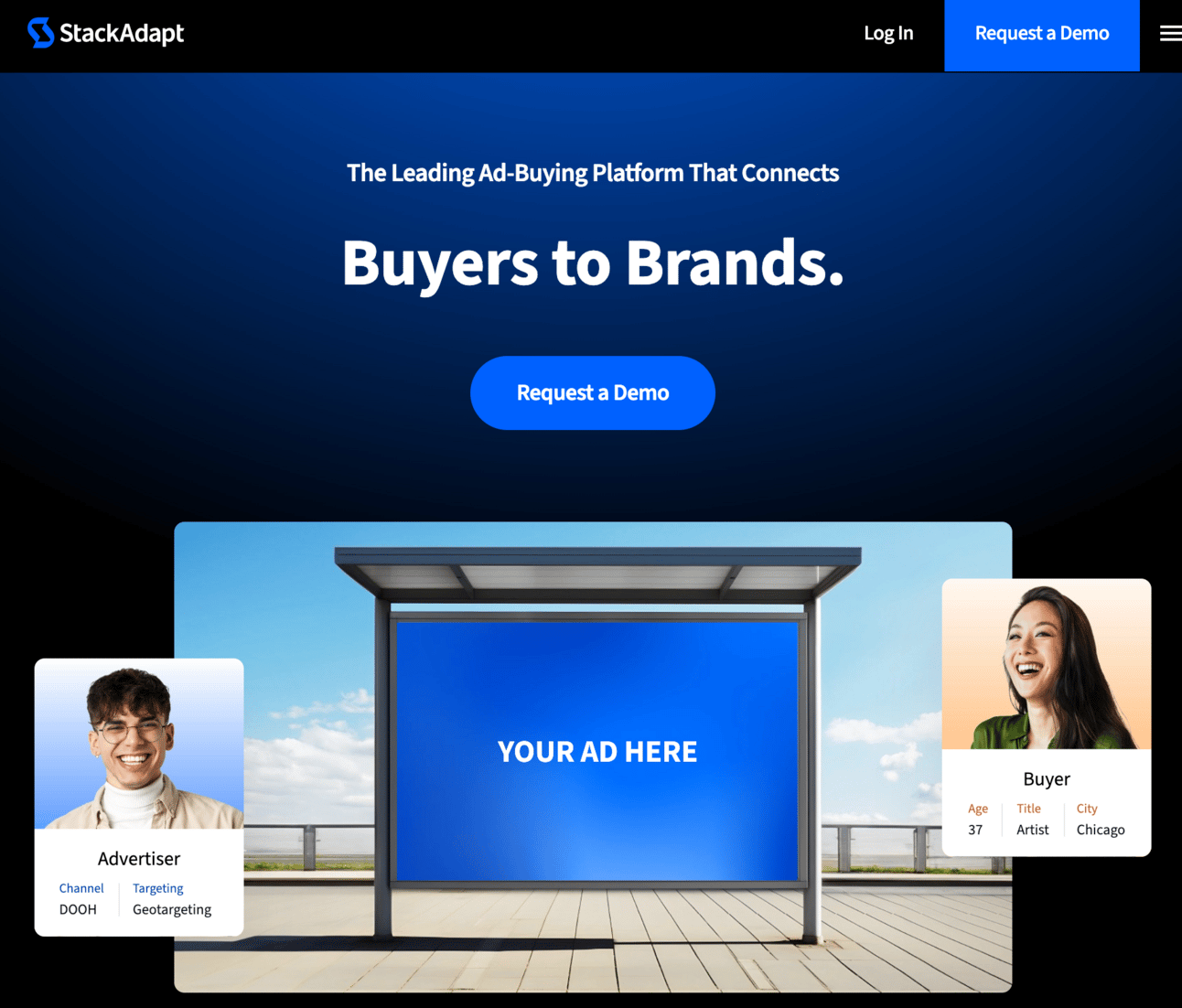

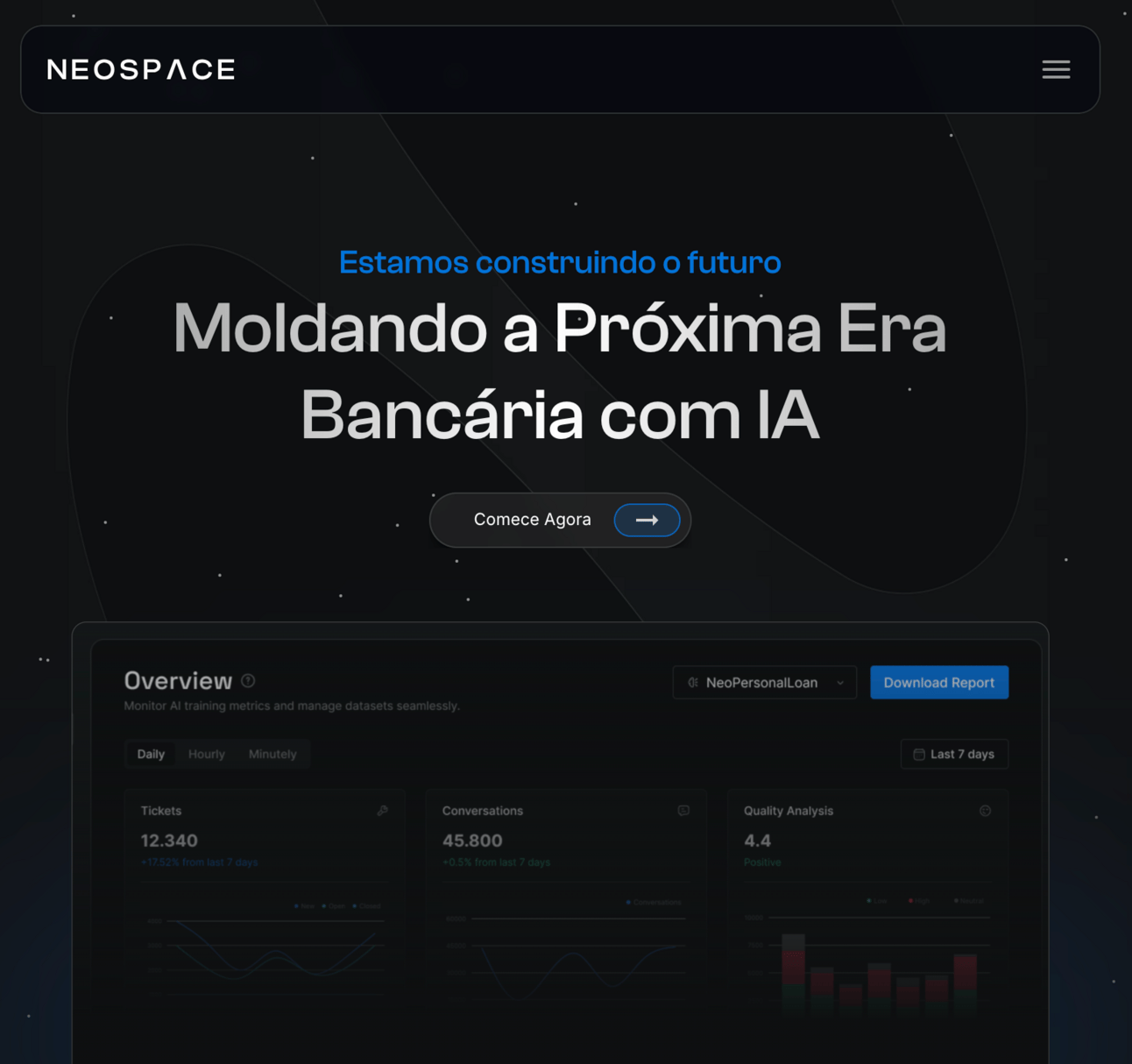

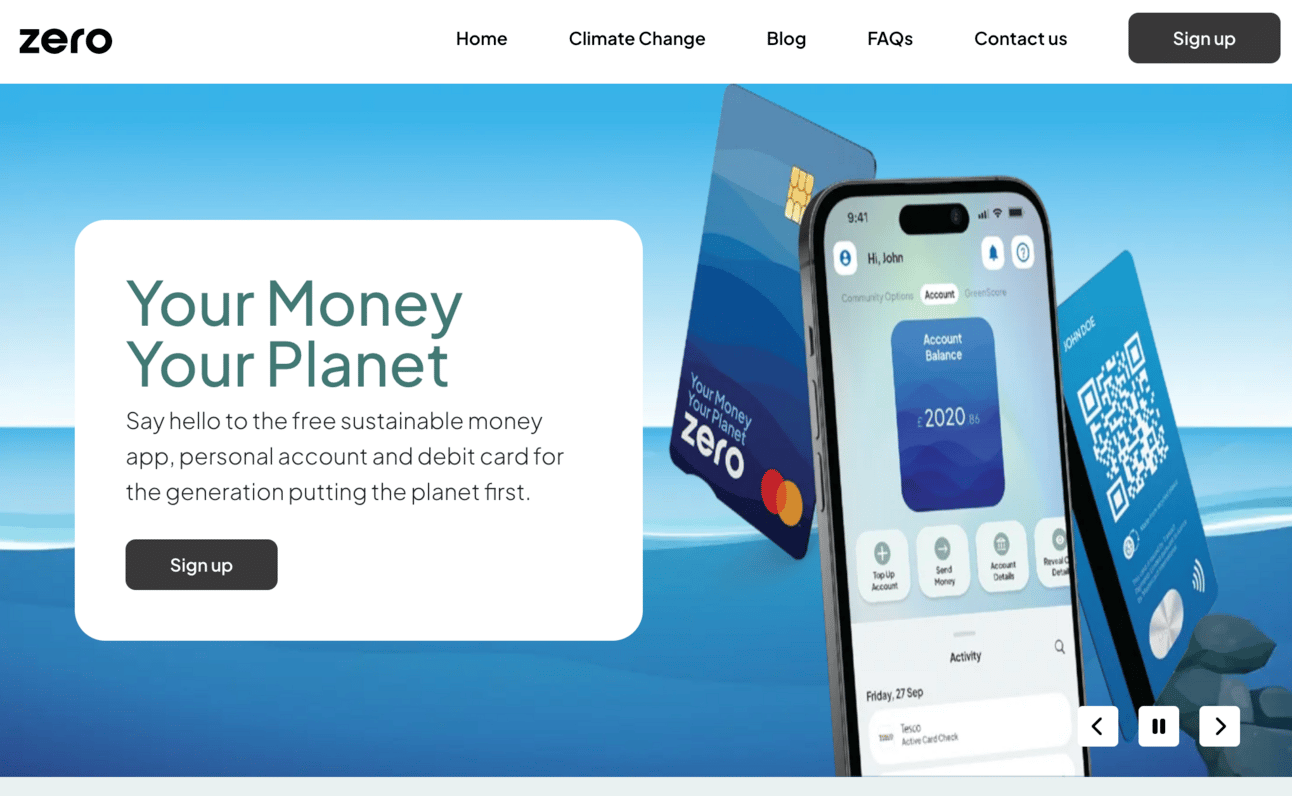

StackAdapt, a Toronto-based adtech company, raised $235 million at a reported $2.5 billion valuation as demand for AI-driven programmatic ads grows. Formance, a French fintech, secured $21 million to expand its modular financial infrastructure platform and plans to open a New York office. NeoSpace, a Brazilian AI-driven fintech, landed $18 million, with Itaú gaining exclusive access to its conversational AI tools for 12 months. Yuno is rolling out Mastercard’s Payment Passkey Service in Latin America, replacing OTPs with biometrics to improve online checkout security. Zero, a UK climate fintech, launched its sustainability-focused money app and kicked off a Crowdcube funding campaign to expand its eco-friendly financial tools.

This Week’s Highlights

Canada

(2/4) StackAdapt, a Toronto-based programmatic advertising startup, raised $235 million in equity funding, led by Teachers’ Venture Growth, the investment arm of Ontario Teachers’ Pension Plan. The company, which helps businesses across industries target ads using AI-driven automation, reportedly hit a $2.5 billion valuation on $500 million in annual revenue. This funding follows a $300 million investment from Summit Partners in 2022 and positions StackAdapt for further expansion amid rising demand for cost-effective, AI-powered ad solutions. [TechCrunch]

Europe

(1/29) Formance, a French fintech startup, raised $21 million in a Series A round led by PayPal Ventures and Portage to expand its modular financial infrastructure platform. Originally focused on an open-source financial ledger, Formance now offers a broader suite of tools, including payment orchestration, reconciliation, and connectivity services. The company, which has around 20 customers, plans to open a New York office and grow its team from 20 to 50 employees by the end of 2025. Unlike larger players like Stripe, Formance stays independent by not processing payments or holding client funds. [TechCrunch]

LatAm

(2/4) NeoSpace, a Brazilian fintech specializing in AI-driven customer interactions for financial institutions, raised $18 million in a round led by Itaú. The bank contributed $15 million, while investors Martín Escobari, Micky Malka, Nigel Morris, and Hans Morris added $3 million. As part of the deal, Itaú gets 12 months of exclusive use of NeoSpace’s conversational AI and perpetual exclusivity for co-developed products. NeoSpace plans to expand beyond financial institutions and enter international markets with the fresh funding. [LatamList]

LatAm

(2/6) Yuno, a global payments orchestrator, is bringing Mastercard Payment Passkey Service to merchants in Brazil, Argentina, and Chile to streamline online checkouts and combat fraud. The service replaces vulnerable authentication methods like OTPs with biometric verification and advanced tokenization, enhancing both security and convenience. Yuno, already a key provider of Mastercard’s Click to Pay technology in Latin America, aims to help merchants reduce cart abandonment and fraud-related revenue losses. Backed by investors like Andreessen Horowitz and Tiger Global, Yuno continues expanding globally while offering access to over 1,000 payment methods. [Fintech Finance]

Canada

(2/4) H&R Block Canada partnered with Peoples Group to continue offering the H&R Block Advantage Prepaid Mastercard, giving Canadians a faster and more flexible way to access their tax refunds. Clients can choose Instant Refund (IR) for immediate access to funds or Pay with Refund (PWR) to cover filing fees after their refund is processed. The reloadable card requires no credit check and works anywhere Mastercard is accepted. Peoples Group, a major prepaid card issuer, sees this as a step toward expanding financial accessibility in Canada. [GlobeNewswire]

UK

(1/29) Zero, a Cardiff-based climate fintech, publicly launched its sustainability-focused money app alongside a Crowdcube campaign targeting an £8.3 million pre-money valuation. Founded by Richard Theo, who previously launched Wealthify and ActiveQuote, Zero offers personal accounts and debit cards with a GreenScore feature that rates the carbon impact of transactions. Swedish fintech Doconomy powers the carbon estimates, while ClearBank and Marqeta support banking infrastructure. With over 600 early investors expressing interest, Zero aims to raise funds to expand its eco-friendly financial offerings. [FinTech Futures]

The Free Toaster Exclusive Content

Direct Mail 101 Podcast 🎧 - This week, on The Free Toaster Podcast, we sat with a 25-year veteran in direct mail for lenders. He spent 90 minutes walking us through:

Why Direct Mail is critical for fintech growth

The size of the channel

Trends he’s seeing (growth, operations, creative, etc)

A deep dive into the unit economics

How to launch a program

Whether to insource or outsource

How to assess vendors

And much more!

Subscribe to The Free Toaster to be notified when we publish the 90-minute Podcast 🎧.

Be sure read our other editorials:

UK

A2A paytech Vyne set to wind down UK operations [FinTech Futures]

CFPB fines fintech Wise, alleging it charged deceptive fees [TechCrunch]

Sokin (UK headquartered payments firm) gets $15m debut funding [Finextra]

AI Regulation in 2025 - Has the UK Government’s Wait-and-See Gamble Played Off? [JD Supra]

Alphabet-backed GoCardless halves losses, targets profitability by end of 2025 [Sifted]

Metro Bank in early talks to sell performing consumer loan portfolio [Reuters]

Europe

Swan Raises $43 Million to Expand Embedded Banking Services [PYMNTS]

Enable Banking & Qred partner to offer seamless financial solutions [IBS Intelligence]

Adyen Selects Yapily to Expand Open Banking Capabilities in Europe [The Fintech Times]

Is Europe Still a Hub for Fintech Investment? [Fintech Magazine]

Canada

BMO Launches Embedded Banking Solution with FISPAN [Fintech.ca]

BMO partners with Porter Airlines and Mastercard to launch new Travel Rewards Credit Card [BMO]

Bank of Canada cuts interest rate to 3% amid trade uncertainty with the United States [Financial Post]

LatAm

Moove bolsters LatAm presence with acquisition of Kovi [Motor Finance Online]

Wise Launches Services in Mexico to Support Growth in Latin America [MarketWatch]

[#53] Neobanks, eSIMs & Telecom: The rise of sticky financial ecosystems [The Painted Stork]

Brazilian paytech PagBrasil lands Payment Institution licence [FinTech Futures]

SPONSORED BY SPINWHEEL

Streamline your lending application pages with 2-fields.

If you’re anything like us, friction on application pages makes you nauseous.

It makes your CACs go up. It makes your volumes drop. It causes your CFO and CEO to say mean things.

The trouble is, application friction isn’t easy to fix. Your prod/eng is busy. We get it.

Spinwheel’s APIs streamline a lending application form with just a phone number and a birthdate - like magic (but it’s really just smart tech)! Then you get a 20-30% lift in your application rate.

Additionally, they can give you real-time, verified consumer credit data and seamless payment processing, which can help you serve customers beyond the initial application.

To see a demo, click below to connect with their Head of Growth and see this thing in action.

Schedule a free 15-minute demo

About Us

Welcome to The Free Toaster! The newsletter for marketing pros at banks and lenders.

Inspired by the free toasters banks used to give to each new customer, we’re here to help you acquire more customers at scale. We deliver fresh news, data, and insights to help you acquire more customers—minus the breadcrumbs.

Want to follow the authors on social media? Find Nick Madrid and Carlos Caro on LinkedIn.

Have an idea for a newsletter?

Ghostmode built this newsletter and can build yours, too.

(click here or reply to this email to learn more)