Imprint Raises $150M Series D at $1.2B Valuation, Co-branded Cards Catch On

Imprint hits a $1.2B valuation as Visa and Mastercard scale mobile wallets, Klarna faces IPO pressure, regulators reset the rules, and Amazon pushes Alexa into commerce.

Hey Toaster Readers,

This week is sponsored by our friends at Spinwheel.

This week starts with Imprint, which just crossed the unicorn mark as brands take more control over credit and loyalty. As legacy bank tech continues to slow product launches and limit customization, Imprint is showing why a full-stack approach to co-brand cards is gaining traction with large retailers and consumer brands.

From there, the issue moves through how distribution and regulation are shifting at the same time. Visa and Mastercard are scaling mobile wallets through global partnerships as NFC access opens up in Europe. Klarna is dealing with investor scrutiny following its IPO as credit losses rise. The Fed is asking whether a limited “skinny” master account could bring more nonbanks into the payments system without expanding risk. The CFPB is walking back its stance on earned wage access, giving providers more room to operate. And Amazon is pushing Alexa further into bookings and commerce through integrations with Expedia, Yelp, Angi, and Square.

Here’s what’s happening across fintech right now.

— Carlos Caro, Founder at New Market Growth

— Nick Madrid, Co-Founder of The Free Toaster and Uncovered Media

PS: To support us, please ask one colleague to subscribe!

With a single call to our simple, dev-friendly APIs, Spinwheel offers the only comprehensive connection to your consumers’ financial accounts.

Spinwheel delivers PII, real-time, verified account data, and the ability to make payments across all major debt categories – all within your brand’s experience.

With many happy customers, including:

Imprint Raises $150 Million Series D to Transform Co-Brand Cards into a True Loyalty Platform

Imprint has reached a $1.2 billion valuation following a $150 million Series D financing round. The raise was led by Khosla Ventures, with participation from Thrive Capital, Ribbit Capital, and Kleiner Perkins. The company said the funding will support its shift from offering co-branded bank products toward operating as a broader brand loyalty platform. Founded in 2020 and based in New York, Imprint focuses on giving brands more control over customer data and product development timelines compared with traditional bank-issued programs.

Imprint’s platform is built on its proprietary issuing and processing infrastructure, ImprintCore, which is designed to help brands launch customized financial products more quickly than legacy issuers. The company reports that partners using the platform have seen a 200% year-over-year increase in cardholders and an eightfold increase in lifetime value relative to non-cardholders. In retail applications, such as its work with the grocery chain H-E-B, the model supports features like brand-specific rewards and targeted offers, which Imprint says have led to higher wallet share and increased cardholder spending compared with previous programs.

Looking ahead, Imprint plans to expand beyond credit cards into debit products, secured cards, and flexible financing options, while increasing investment in automation and artificial intelligence to improve operational efficiency. Its current partners include Booking.com, Rakuten, and Crate & Barrel. The Series D follows several earlier rounds, including a $75 million Series C in 2023 at a $600 million valuation, a $75 million Series B in 2023 valuing the company at $240 million, a $38 million Series A in 2021 co-led by Kleiner Perkins and Stripe, and an approximately $15 million seed round backed by Affirm and Thrive Capital. (Business Wire)

Fiserv Collaborates with Visa to Accelerate Agentic Commerce

Fiserv announced a strategic collaboration with Visa to support agentic commerce by deploying Visa Intelligent Commerce and the Trusted Agent Protocol across Fiserv’s merchant ecosystem. The partnership is designed to let AI-driven agents securely discover, compare, and complete purchases on behalf of consumers, while giving merchants a way to accept these transactions with authentication, verified consumer intent, and protected payment credentials. Fiserv plans to integrate the protocol into its existing acceptance stack, including platforms used by Clover merchants and ISV and ISO partners.

Beyond transaction acceptance, the two companies are positioning the collaboration as infrastructure for broader intelligent commerce use cases. Fiserv will connect merchants to Visa’s authentication and tokenization services while providing integration tools, secure connectivity, and operational automation such as real-time routing and dispute handling. The effort reflects a broader push by payment networks and processors to define standards for agent-driven transactions before automated commerce scales further across consumer and merchant workflows. (Fiserv)

Mercury Applies for OCC National Bank Charter to Become the Bank for Builders

Mercury has applied for a national bank charter with the Office of the Comptroller of the Currency and submitted an application for FDIC deposit insurance, signaling a shift toward operating as a fully regulated bank. The company reported more than 200,000 customers, $650 million in annualized revenue, and three consecutive years of GAAP profitability at the time of the filing. Mercury said the move reflects its intent to pair its software-led banking platform with direct regulatory oversight, rather than continuing to rely solely on partner banks.

If approved, the charter would allow Mercury to hold deposits and expand its product set under its own license, while maintaining its focus on business banking for startups and small companies. The company also named Jon Auxier, former CFO of SoFi Bank, as Chief Banking Officer and proposed CEO of the future bank, pending regulatory approval. Mercury stated that there would be no immediate changes for customers during the application process, as it continues to operate through existing partner banks while engaging with regulators. (Mercury)

Enjoying this week’s issue?

If you’ve been enjoying The Free Toaster, help us spread the word. Forward it to someone who lives and breathes consumer lending, marketing, or fintech like you do.

Your shares help us reach more builders in consumer lending, and help us make the Newsletter & Podcast better every day.

Klarna Hit With IPO-Related Securities Class Action After 102% Jump in Credit Loss Provisions

Klarna Group is facing a securities class action lawsuit tied to its September 2025 IPO, following a reported 102 percent year-over-year increase in its provision for credit losses. The complaint alleges that Klarna’s IPO disclosures understated credit risk and failed to adequately warn investors about potential increases in loss provisions tied to lending to higher-risk and financially strained consumers. After the company reported its Q3 2025 results on November 18, Klarna shares fell to $31.63, roughly 20 percent below the $40 IPO price, prompting questions about whether material credit deterioration had already emerged before the offering. (PR Newswire)

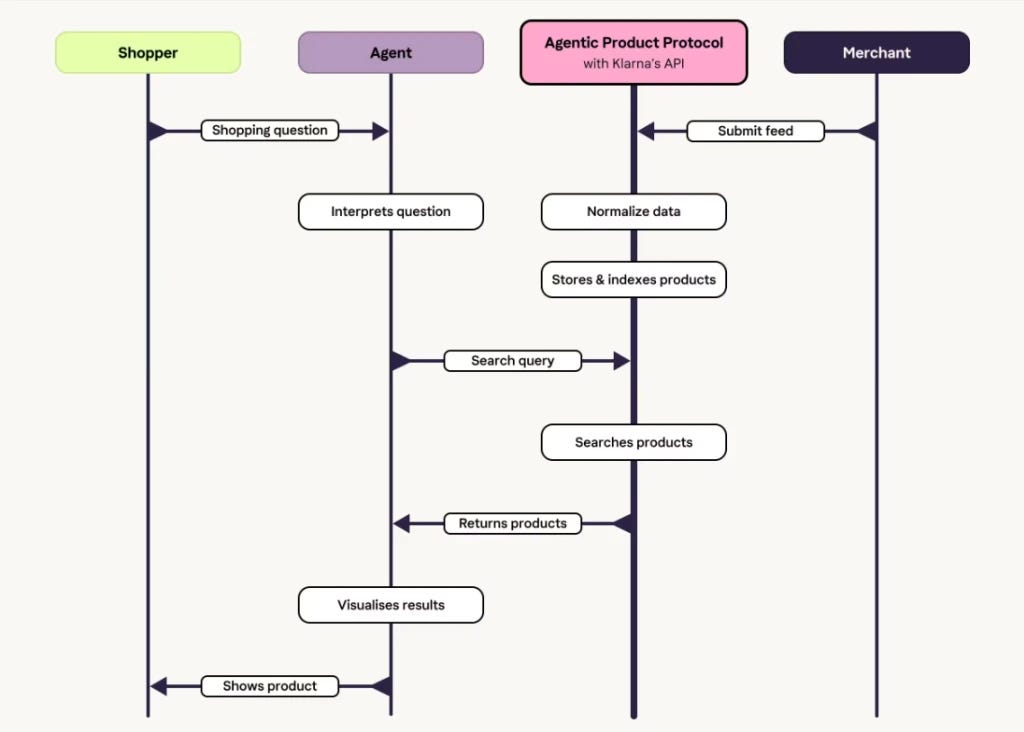

Inside Klarna’s agentic AI protocol

Klarna has introduced its Agentic Product Protocol, an open standard designed to make merchant product data discoverable and usable by AI-driven shopping agents. The protocol allows agents to access structured information such as product identity, price, availability, and attributes, enabling comparison and purchase decisions across merchants, and is intended to work alongside other emerging agentic commerce standards from companies such as Stripe, OpenAI, and Google. Klarna said the system is built on its existing product graph, which covers more than 100 million products and hundreds of millions of prices, while analysts noted that adoption will depend on merchant participation and whether large retailers allow third-party agents to access their catalogs. (American Banker)

Emboldened Activist Investors Are Circling U.S. Banks

Activist investors are increasingly targeting U.S. banks as regulatory pressure eases and deal activity rebounds, creating openings in a sector that has historically seen limited activism. HoldCo Asset Management has emerged as a visible player, opposing the proposed acquisition of Comerica by Fifth Third Bancorp and pushing for strategic changes at KeyCorp and other lenders, often arguing for asset sales or stock buybacks over expansion. Analysts note that a combination of deregulation under the Trump administration, rising competitive pressure from fintech and private markets, and renewed bank M&A activity has created a more favorable environment for activism, though resistance remains strong given banks’ regulatory roles, local ties, and shareholder structures; even so, data from S&P Global Market Intelligence shows bank deal values reaching their highest levels since 2021, and proxy firms such as Institutional Shareholder Services have acknowledged the growing influence of activist campaigns despite often supporting management-backed transactions. (WSJ)

Chase Sapphire Cardholders Get Extra Shot at FIFA World Cup Tickets

JPMorgan Chase said Chase Sapphire cardholders will receive access to an exclusive FIFA World Cup ticket sale in February 2026 through the Chase Experiences portal, with eligibility extending to Sapphire Reserve, Sapphire Preferred, and Sapphire Reserve for Business cards. The offer runs from February 10 to February 24 and follows similar promotions tied to the U.S.-hosted tournament, including ticket access and themed card designs from Bank of America, as issuers increasingly use large cultural and sports events to drive acquisition. Other recent examples include travel and entertainment tie-ins from American Express, a joint campaign from PayPal and Venmo, and tour-linked promotions from Capital One, highlighting how event-based access is being used to attract cardholders and create brand affiliation that can later be extended through on-site and in-market experiences during the tournament. (Emarketer)

US Watchdog Says Paycheck Advances No Longer Subject to Lending Law

The Consumer Financial Protection Bureau said earned wage access products are generally not subject to the Truth in Lending Act, reversing guidance issued in 2024 that treated paycheck advances as consumer loans. In a nonbinding advisory opinion, the agency said most advances do not require disclosures on credit costs or terms, a shift that affects providers such as Chime, which offers interest-free access to earned wages without mandatory fees. The CFPB said the opinion is intended to provide clarity amid state-level exemptions in places like Nevada and Wisconsin, while noting that Congress has not set a federal standard; the move aligns with broader efforts under the Trump administration to roll back prior regulatory positions and narrow certain financial industry requirements. (Reuters)

Wisconsin Lawmakers Propose “True Lender” Test and 36% APR Cap for Consumer Loans

Wisconsin lawmakers introduced Senate Bill 759, which would impose a 36% APR cap on consumer loans and adopt a broader “true lender” standard that expands which entities are treated as lenders under state law. The proposal would apply a predominant economic interest and totality-of-the-circumstances test, add anti-evasion provisions, and require expanded reporting to the state’s banking regulator, with loans exceeding the cap deemed unenforceable. If enacted, the measure would materially change how bank-fintech partnerships and nonbank lending programs are structured in the state, adding compliance risk for platforms that market, fund, or control lending programs even if they are not named as the lender. (Troutman Pepper Locke)

Fed Seeks Public Input on ‘skinny’ Master Account Concept

The Federal Reserve Board is seeking public comment on a proposed “skinny” master account that would provide limited access to Fed payment services for eligible institutions, including certain state-chartered banks and fintech firms. The accounts would exclude interest, central bank credit, and expanded legal eligibility, and would be subject to balance caps, with the Fed framing the move as a way to support payments innovation while managing risk; Governor Christopher Waller said the goal is to issue a final rule by the end of 2026. The request for information passed in a 6–1 vote, with Governor Michael Barr dissenting over concerns about safeguards against money laundering and terrorist financing, while groups such as the Bank Policy Institute urged closer scrutiny; the proposal comes as regulators assess how to integrate a growing nonbank sector that now holds roughly half of global financial assets, according to the Financial Stability Board. (American Banker)

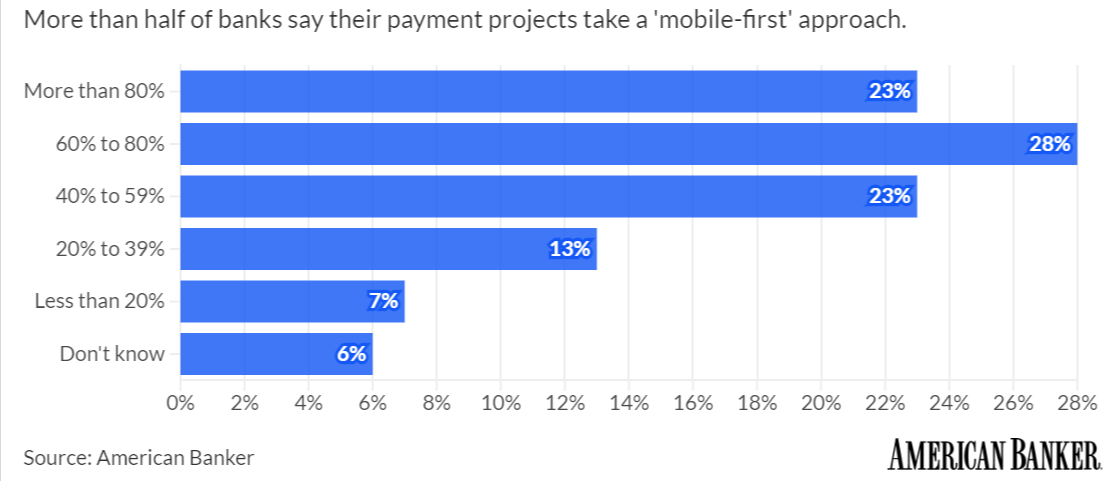

Visa, Mastercard Make a Global Push for Mobile Wallets

Visa and Mastercard are expanding mobile wallet distribution through a series of international partnerships as contactless and smartphone-based payments continue to gain share. Mastercard has recently partnered with TerraPay to extend NFC-based wallet acceptance across more than 150 million locations and is working with Telefónica on a mobile wallet rollout in Latin America, while also supporting integrations with Alipay for travelers and contactless payments. Visa, meanwhile, has launched or announced wallet partnerships with BBVA, Klarna, Vipps MobilePay, and Bancomat, citing internal data that shows mobile wallets now account for a majority of e-commerce transactions in Europe. Both networks are positioning these efforts ahead of broader wallet competition expected after Apple agreed with EU regulators to open access to its NFC technology, a move that could accelerate the entry of bank-led and non-card payment wallets that bypass traditional card rails. (American Banker)

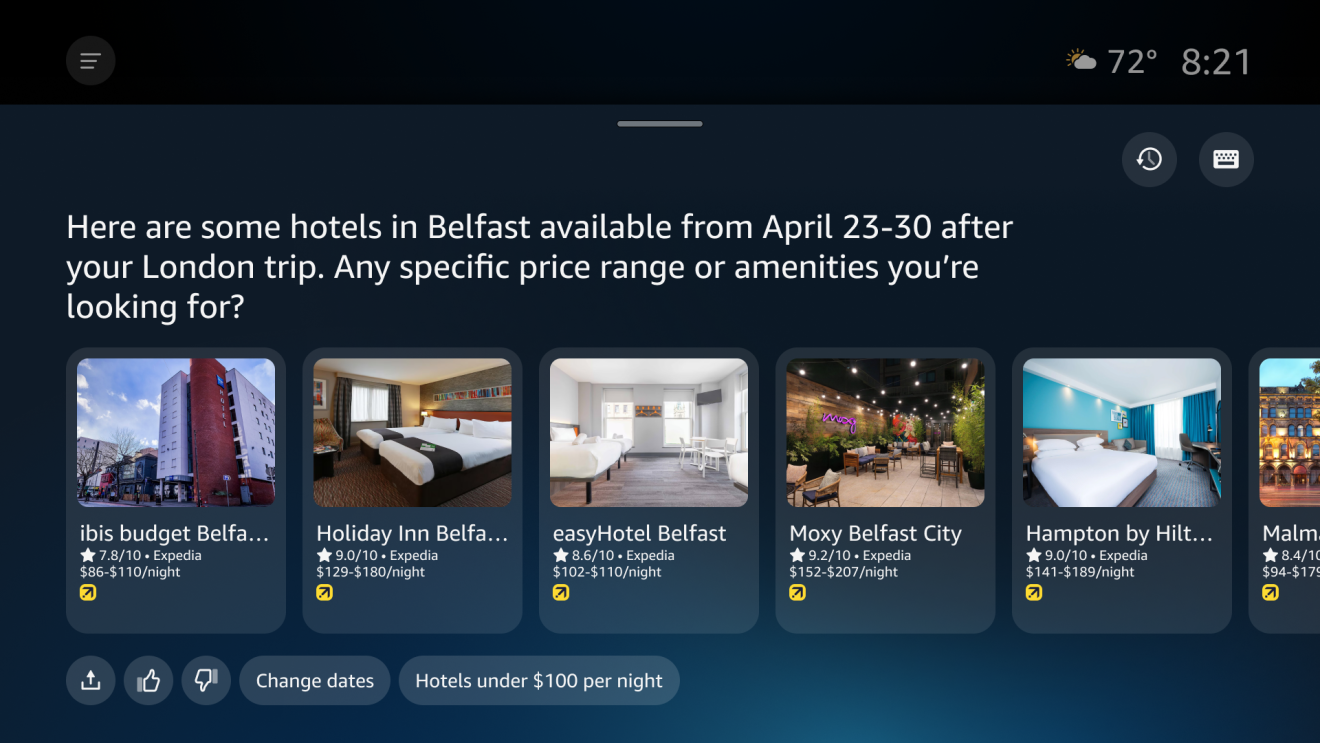

Expedia, Yelp, Angi, and Square to Build New Agentic Experiences for Alexa+

Amazon said Alexa+ will add integrations with Expedia, Yelp, Angi, and Square starting in 2026, expanding its ability to handle service discovery and bookings through voice and agentic AI. The integrations will allow users to search, compare, and book travel, home services, and local beauty and wellness appointments directly through Alexa+, while giving merchants and service providers new distribution inside Amazon’s assistant ecosystem. The move reflects Amazon’s push to position Alexa+ as a transaction layer for services, not just information, as competition grows around agent-driven commerce and voice-enabled booking. (Amazon)

FINRA Flags Gaps in Oversight as Gen AI Expands Across Financial Operations

FINRA said member firms’ use of generative AI is expanding faster than the governance, documentation, and supervisory controls needed to manage associated risks, based on findings in its Annual Regulatory Oversight Report. Examinations found uneven oversight as firms deployed large language models across customer service, research, compliance, and content creation, often without formal risk assessments, clear ownership, or sufficient documentation of model behavior and outputs. FINRA flagged gaps in supervision of AI-generated communications, overreliance on vendor-provided tools with limited transparency into data handling and model updates, and weak controls around sensitive information and cybersecurity risks, noting that communications and recordkeeping rules apply regardless of whether content is produced by humans or AI. The report said governance structures remain fragmented at many firms, even as adoption accelerates and external research from groups such as PYMNTS Intelligence points to growing ROI from generative AI use, while studies from organizations including Anthropic highlight the potential for small amounts of malicious data to introduce hidden model vulnerabilities. (PYMNTS)

Please support our Newsletter by recommending us to one of your colleagues!

And, please check out our sponsors:

Need an affiliate marketing platform/network? Chat with Fintel Connect

Need to improve application page conversions? Chat with Spinwheel

Need to accelerate your affiliate marketing? Chat with New Market Growth

Need to win on other growth channels? Chat with FIAT Growth

Looking for your next fintech role?

Stay ahead of where the industry is hiring. The Free Toaster Jobs newsletter curates standout openings in fintech marketing, product, data, and risk each week, along with insights into the trends shaping hiring across leading lenders, neobanks, and fintech startups.

Subscribe to The Free Toaster Jobs to get the latest roles and hiring insights delivered straight to your inbox (Toaster subs that don’t opt-in won’t get the Friday jobs Edition).

Missed last week’s edition? Check out the most recent job listings here.

Other News We’re Reading

(Retail) Amazon Faces ‘leader’s Dilemma’ — Fight AI Shopping Bots or Join Them (CNBC)

(Banking) PNC Adds Tech From Extend to Support Virtual Cards (American Banker)

(Crypto) Intuit and Circle Partner to Unlock the Future of Money Movement with Stablecoins (Intuit)

(Cards) Alaska Hiring Manager To Teach Flight Attendants How To Pitch Credit Cards (One Mile at a Time)

(Regulation) Oregon Enters $1.56M Consent Order With Two Companies for Alleged Excessive Interest Charges Under a Bank Partnership Model (Orrick)

(Fintech) Finastra Expands Global Footprint with New U.S. and India Offices (PR Newswire)

(Banking) Interactive Brokers Applies for National Trust Bank Charter (Bloomberg)

Spot something worth sharing with your team? Drop this week’s edition in their inbox:

https://thefreetoaster.substack.com/p/imprints-take-on-co-brand-cards-is

Happy New Year!

Catch you next week,

The Free Toaster Team

p.s. If you’re working on anything new in acquisition or credit, we’re always curious to hear about it.