F1 Breakdown - With 93 million users and profitable, Klarna's IPO might redefine fintech valuations.

Klarna's hybrid payment model, powered by a proprietary payment network and AI-driven underwriting, targets a $450B market, driving $105B GMV, 93M active users, and profitability ahead of its IPO.

Introduction

Klarna filed its F-1 late last week for its upcoming IPO, offering insights into one of the world's most recognizable fintech companies. This breakdown examines Klarna's business (with particular emphasis on the Klarna Card), market strategy, customer economics, financial performance, and future vision.

The Core Business

Key Numbers

93 million active consumers

675,000+ merchants across 26 countries

$105 billion in gross merchandise volume (GMV) in 2024

99% of transactions were interest-free

76% of 2024 revenue came from Transaction and Service revenue

24% of 2024 revenue came from Interest Income

“Our over 675,000 merchants include some of the largest global brands—on average, 44% of the top 100 merchants in each of the major markets we serve, which include the United States, the U.K., the Nordics, Germany, Austria, Belgium, Spain, France, Italy, the Netherlands and Switzerland (based on data from eCommDB and Digital Commerce 360) used Klarna in December 2024 to facilitate payments, while an even greater percentage (66%) advertised on our network in 2024.”

Business Model

Klarna operates a hybrid network combining features of both open and closed payment systems. Like Visa and Mastercard, it connects a broad ecosystem of consumers and merchants. However, it also maintains a proprietary closed-loop network where it issues, funds, processes, and settles payments while maintaining direct relationships with consumers and merchants.

No single merchant represents more than 10% of Klarna's GMV in any major market, demonstrating their diversified revenue stream. In Sweden, their most mature market, approximately 82% of adults used Klarna in 2024.

Payment Options

Klarna offers three main payment options:

Pay in Full: Settles transactions instantly

Pay Later: Allows consumers to defer payment to a later date or pay in installments

Fair Financing: Enables consumers to settle payments over longer periods

Market Opportunity

Klarna estimates its serviceable addressable market (SAM) at $450 billion in payment revenue opportunities from $18 trillion in annual consumer retail and travel spending across its current markets. Global retail and travel spending, excluding China, was $30 trillion in 2023, offering significant expansion potential.

The company grew its advertising revenue from $13 million in 2020 to $180 million in 2024, tapping into the approximately $475 billion global digital advertising market (excluding China).

Klarna, a licensed bank in the EEA since 2017, held $9.5 billion in consumer deposits as of December 2024. This position positions it well with highly stable and lower-cost funds relative to other non-bank funding strategies, such as asset-backed financing.

Klarna Card Strategy

Vision

"Klarna Card in Every Wallet"

Klarna aims to become the default payment method for its millions of active consumers by offering flexible payment options both online and offline.

Competitive Advantages

Broad Acceptance: Klarna Card integrates with Apple Pay and Google Pay, expanding its reach without requiring direct merchant integration.

Banking License: With its banking license, 94% of Klarna's lending is funded through stable, low-cost consumer deposits, giving it an edge over traditional asset-backed funding models. Klarna also partners with to offer their Fair Financing product in the United States.

AI-Driven Underwriting: Klarna uses sophisticated AI to approve credit in real time, adjusting credit limits dynamically based on user behavior to minimize risk.

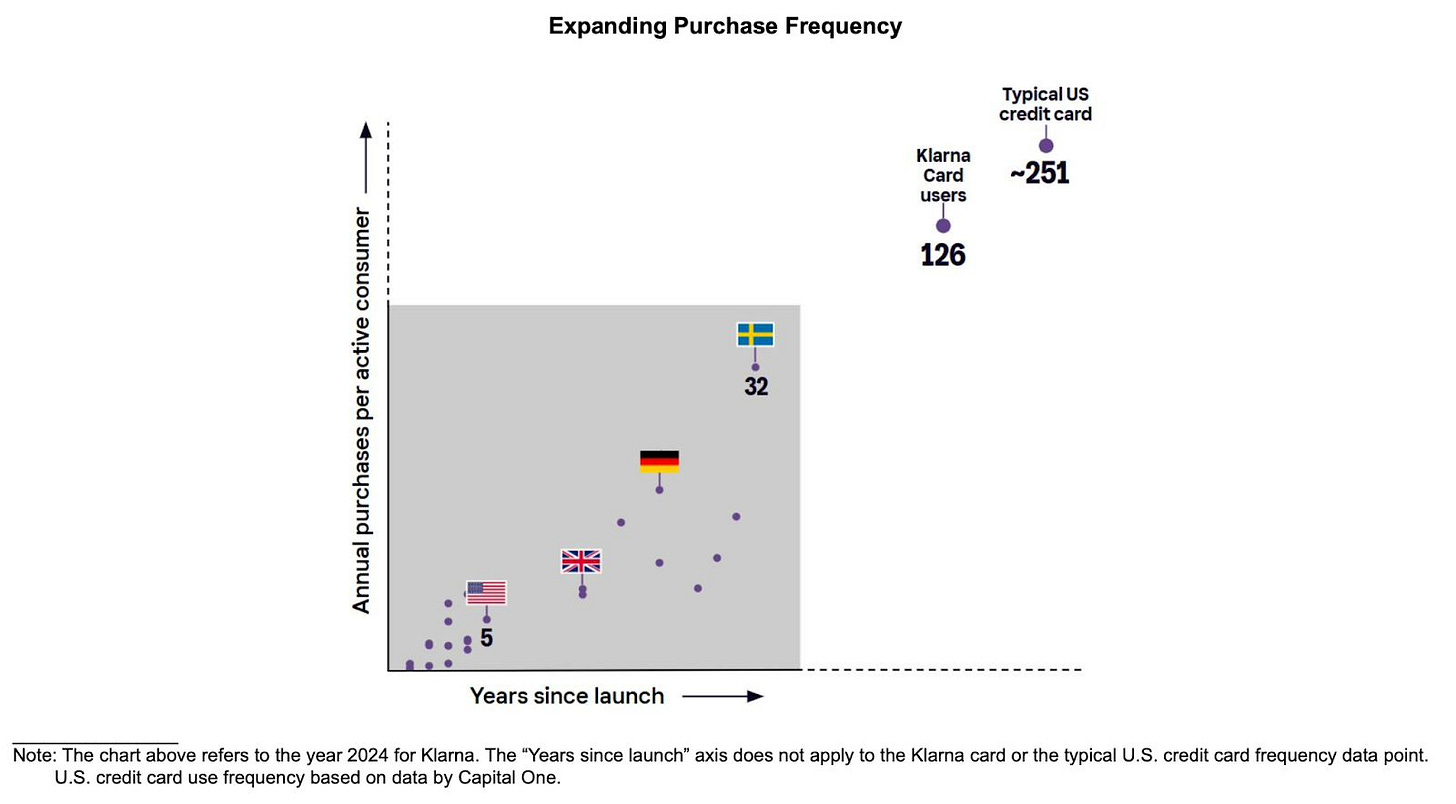

“Klarna enjoys powerful network effects. Our personalized, highly engaging consumer experiences drive consumers to our network. As more consumers engage at scale, more merchants join our network and grow their businesses. As more merchants join the network, consumers benefit from increased selection across verticals, channels and geographies, and can purchase more frequently using, and demonstrate preference for, our network. Klarna has established a high-utility, high-frequency model, enabling the purchase of everyday goods and services that benefits both our consumers and merchants.”

Credit Underwriting Capabilities

Klarna's credit underwriting is powered by proprietary data from approximately 2.9 million daily transactions across its 93 million active consumers.

Key features include:

Fully automated underwriting decisions made in seconds

Real-time transaction assessment

Gradual credit limit increases based on responsible spending

Clear repayment terms encouraging on-time payments

This results in:

The average balance per active consumer is just $87 (compared to $6,730 for U.S. credit cards)

Average loan duration of 40 days (versus 5+ years for a typical Nordic bank loan and an average of 2.9 years for a typical US personal bank loan)

Consumer credit losses were 0.47% of GMV in 2024, down from 0.66% in 2022 but up from 0.38% in 2023.

Credit losses were lower in mature markets at less than 0.20% of GMV.

The overall increase from 2023 to 2024 was due to a larger share of GMV from the earlier-stage U.S. market and an increased use of the Fair Financing product.

“In the second half of 2022, we implemented a strategic initiative to adjust our underwriting standards in an effort to improve the overall credit quality of our portfolio. The initiative was driven by our strategic recalibration to a more balanced growth and shift towards profitability. These changes included updates to our credit underwriting decision framework, such as launching new risk models to manage risk return trade-off in line with our profitability targets for 2023, including first-generation new-consumer-level risk models, targeted risk-based down-payment policies, updating decline thresholds following the new model implementation and adjusting our risk-based pricing policies for our consumer loans to drive a higher yield on the portfolio. In particular, we increased the number of consumers that were required to make a down payment in order to take advantage of our financing products. We also increased the average amount of such down payment based on our updated credit risk models, historical delinquency behavior and information from credit bureaus. As a result, in the fourth quarter of 2023, our credit portfolio comprised loans extended to consumers with either a well-established repayment history with Klarna or a repayment behavior similar to our existing well-performing customer base. Consequently, in 2024, our consumer credit losses represented 0.47% of total GMV.”

Customer Acquisition Strategy

Klarna acquires users primarily through:

Direct merchant integrations

Partnerships with Payment Service Providers (PSPs), think Worldpay, Stripe, and Adyen

This approach significantly reduces customer acquisition costs compared to traditional financial institutions.

By the end of 2024, Klarna had built a global consumer base of 93 million active users and achieved 41% global brand awareness, outperforming peers with an average of 29%.

Financial Performance

Revenue & Growth

Klarna's revenue comes primarily from merchant fees rather than consumer interest, aligning its incentives with merchant growth. The company periodically updates its risk model to align with strategic objectives.

In 2019, Klarna expanded into the US and 12 additional markets over the next three years. This higher risk appetite led to rapid GMV growth and increased credit losses.

In mid-2022, the company strategically shifted toward profitability by implementing stricter risk management measures, including risk-based down payments, tighter debt limits, and accelerated collections processes.

These changes and improved underwriting capabilities significantly reduced US market credit losses from 3.6% of GMV in 2021 to just 1% in 2024 while maintaining 15% GMV growth during this period.

2024 Results

$105 billion GMV, up 14% year-over-year

$2.8 billion revenue, up 24% year-over-year

$181 million adjusted operating profit, a 466% improvement

$1.22 billion in transaction margin dollars up 12% year-over-year

Transaction margin dollars are defined as total revenue less total transaction costs, which consist of processing and servicing costs, consumer credit losses and funding costs

$21 million net profit, a 109% improvement from a $244 million loss in 2023

Network Structure

Klarna has built a network that directly connects consumers and merchants, reducing reliance on traditional card networks and issuing banks. This provides:

Better data collection (2.5 billion SKU-level data points in 2024)

Improved understanding of consumer preferences

More accurate credit underwriting

Clearer insights into consumer purchasing power

Cost advantages compared to traditional providers

Future Vision

Klarna aims to expand its card business to become the default payment choice for consumers in both online and offline transactions. Key strategies include:

Deepening integration with Payment Service Providers

Expanding into new verticals like groceries, travel, and entertainment

Increasing everyday spending capture

Enhancing consumer engagement through AI-driven personalized financial services

Key Risks

Payment Ecosystem Dependencies

Klarna collaborates with card networks, PSPs, and other participants in the payment ecosystem. Any disruption in these relationships could adversely affect its business.

The company derives substantial merchant revenue through Merchant of Record (MoR) partners like Adyen and Stripe. These partnerships allow Klarna to reach many merchants without direct integration but create dependency risks.

Funding Model Challenges

While Klarna funded 94% of its lending through consumer deposits in 2024, it faces potential risks:

Market volatility affecting deposit stability

Increasing funding costs due to rising interest rates

Dependency on maintaining an investment-grade credit rating

Potential difficulties in renewing or replacing existing funding arrangements

Competitive Landscape

Klarna faces intense competition from multiple fronts:

Traditional credit and debit card issuers (JP Morgan, Citibank, HSBC)

Payment networks (Visa, Mastercard, American Express)

Digital-focused banks (Revolut, NuBank)

"Buy now, pay later" solutions (Affirm, AfterPay)

E-commerce platforms with integrated payment capabilities (Shopify, Amazon, Walmart)

Many competitors have advantages, including:

More diversified product offerings

Broader consumer and merchant bases

Ability to cross-sell products

Operational synergies

Cross-subsidization capabilities

Lower funding costs

Conclusion

Klarna is positioning itself as more than just a payment option. It's building a comprehensive platform connecting consumers and merchants through a data-driven, AI-enhanced commerce network. The Klarna Card is central to this vision, serving as a core growth driver and a primary means of deepening consumer engagement.

Will Klarna's unique blend of banking, payments, and AI redefine fintech—or is it too dependent on favorable market conditions? Only time will tell. Until then, congrats to the Klarna team!