Esusu’s Rent Data is Becoming a Hot Credit Signal

Esusu’s $50M raise and Mercury’s consumer banking push lead this week’s issue. Klarna and Stripe push agentic commerce forward as student loan delinquencies rise, BNPL matures, and a divided Fed keeps policy tight.

Hey Toaster Readers,

This week is sponsored by our friends at Fintel Connect.

This week starts with Esusu, which just locked in a $50M round as rent moves deeper into the credit system. With rental data now cleared for mortgage underwriting and lenders looking for cleaner signals, Esusu is positioning itself as a core input across housing, credit, and financial identity.

Next up is Mercury, stepping beyond its startup-bank roots and into consumer banking. Backed by a $3.5B valuation and fresh capital, Mercury is betting that high-balance customers want control, transparency, and software-first banking, even if it means paying for it. Right after that comes Mesa, which quietly shut down its mortgage-rewards card, a reminder that not every elegant credit idea survives interchange math, compliance friction, and distribution realities.

The rest of the issue tracks how the stack is shifting underneath all of this. Klarna and Stripe are racing to wire commerce directly into AI agents. Student loan delinquencies are back on credit reports and starting to drag scores. BNPL is still growing, but discipline is replacing land grabs. And a divided Fed is cutting rates while signaling patience, not relief.

Different stories, same theme. Credit is getting more selective, more structured, and more dependent on data that actually holds up.

Here’s what’s happening across fintech right now.

— Carlos Caro, Founder at New Market Growth

— Nick Madrid, Co-Founder of Uncovered Media and Ghostmode

PS: To support us, please ask one colleague to subscribe!

Important Announcement The Free Toaster is Moving to Substack

Starting next year, the The Free Toaster News Edition will be sent from a new address:

Same coverage. Same lens on fintech, credit, payments, and growth. Cleaner reading experience.

To make sure you don’t miss an issue, add that email to your contacts or email whitelist.

Why the move?

Substack gives us more control over layout, formatting, and distribution. That means tighter stories, clearer sections, and a better way to surface what actually matters each week.

What to expect:

Cleaner layouts that are easier to read and skim

Sharper story selection and framing

More context on why each story matters

A higher bar as the News Edition continues to grow

No action needed beyond whitelisting the new email. The newsletter stays free and will keep hitting your inbox on schedule.

Same signal. Better delivery.

Thanks for reading The Free Toaster.

Esusu Locks in $50M at a $1.2B Valuation as Rent Becomes Credit Infrastructure

Source: Esusu

The latest round puts fresh capital behind a much bigger ambition. Esusu is scaling Rent Reporting as a Service, pushing rent data directly into banks, credit unions, and fintech products, while expanding Esusu Pay and its identity stack after the Celeri Labs acquisition. With rental data now approved for use in mortgage underwriting, Esusu sits at the center of a policy shift that lenders have been waiting on for years.

In 2022, SoftBank Vision Fund 2 led a $130M Series B, turning Esusu into one of the few Black-owned fintech unicorns and fueling nationwide scale. By then, rent reporting had moved from “nice idea” to institutional infrastructure. In 2021, a $10.6M Series A during the pandemic pushed Esusu beyond credit scores into rent relief, cementing its reputation as mission-first while landlords faced historic delinquency risk. Before that, early seed rounds between 2018 and 2019 were spent proving something radical at the time: that rent could be verified, reported, and monetized without breaking the system.

Founders Abbey Wemimo and Samir Goel both grew up watching family members locked out of credit despite paying their bills on time. They named the company after Esusu, a communal savings tradition, and built a B2B2C model where property owners pay, renters benefit, and lenders get cleaner signals.

Esusu covers over 5 million rental units and 12 million people, representing roughly $100 billion in annual lease volume. This Series C round moves beyond the initial phase of proving the value of rent reporting. Now, the goal is to make rent payments a standard input for credit, housing, and financial identity, while establishing the infrastructure needed to support that shift long-term. (Esusu)

Business-focused Fintech Mercury Makes Consumer Banking Push

Source: LinkedIn

The startup known for banking founders and startups just opened Mercury Personal to all U.S. adults, signaling a clear shift from business-only fintech to full-spectrum financial platform. The move comes months after Mercury more than doubled its valuation to $3.5B and raised $300M from Sequoia, giving it the capital and confidence to take on territory long dominated by banks.

Consumer banking brings heavier compliance, higher expectations, and real regulatory exposure. Mercury rebuilt its stack, swapped bank partners, and scaled internal compliance before opening the doors. The early results are interesting. Customers hold average balances north of $80K, pay a $240 annual subscription, and get a bundle built for control, not freebies. High-yield savings, no-fee wires, investment access, customizable permissions, and up to $5M in FDIC coverage through sweep networks.

For banks, this is familiar pressure from a new angle. Mercury is not chasing mass-market checking accounts. It targets founders, operators, and high-value customers who already use software-first tools and are willing to pay for transparency and control. If this works, the line between business banking and personal banking does not just blur. It disappears. (American Banker)

Mesa Shuts Down Credit Card That Rewarded Cardholders for Paying Their Mortgages

Mesa’s pitch was clean and intuitive. Reward people for paying their mortgage, not for flying first class.

The startup has shut down the Mesa Homeowners Card, deactivating all accounts and ending a program that tried to turn homeownership into a rewards category. Cardholders can no longer earn points, and the only exit left is a statement credit at 0.6%, a quiet ending after weeks of declined transactions and “temporary outage” explanations.

Mesa launched just over a year ago with $9.2M in funding, betting that homeowners wanted credit cards built around real-life expenses. Mortgage payments, utilities, gas, groceries, HOA fees. The idea mirrored what Bilt did for rent, but pushed it one step further. Make the biggest monthly payment count.

Rewarding mortgage payments sounds obvious, but it is tough on margins, operationally complex, and dependent on clean payment flows that card networks were not designed for. Mesa’s shutdown is a reminder that not every elegant idea survives contact with interchange math, compliance friction, and consumer expectations.

The timing matters too. Bilt has already said it plans to add mortgage rewards in its next card iteration. That puts pressure on standalone products that do one thing well but lack distribution, balance-sheet flexibility, or a broader ecosystem to absorb losses. (TechCrunch)

Audi Revolut F1 Team Reveals Official Name, Logo and Berlin Launch Date

Source: Revolut

The Audi Revolut F1 Team is now official, with a full brand reveal and immersive launch set for Berlin on January 20, 2026. This is not a passive sponsorship. Revolut is being woven directly into team operations, from Revolut Business handling financial workflows to Revolut Pay powering checkout in the team’s online store.

For fintech marketers, this is a clean example of how brand, product, and distribution converge. Formula 1 delivers reach. Revolut delivers the rails. Exclusive app-based perks, fan access, and integrated payments turn motorsport fandom into an owned channel, not just awareness.

As Revolut pushes toward 100 million customers, this partnership signals where big fintech marketing is heading: fewer ads, more platforms, and partnerships that feel closer to infrastructure than sponsorship. (Revolut)

Zilch Enters the ‘Payments Tent’ With FCA License

Source: PYMNTS

The BNPL and virtual card platform has secured a UK payment services license from the FCA, giving it the ability to build and run payment methods in-house instead of renting infrastructure. That shift matters. Owning the license means lower dependency, tighter economics, and more control over how products get built and scaled.

The timing is deliberate. Zilch is lining up Zilch Pay and its AI-driven Intelligence Commerce platform, positioning itself for a world where payments, data, and agent-led shopping blur together. Add newly secured Visa principal membership, and Zilch now has both regulatory credibility and network access. (PYMNTS)

Events 2026: Smaller Rooms, Better Conversations

If you work in consumer lending, you already know how this goes. Big conferences pull you out of the office for days and send you home with a few good meetings and not much you can plug into your roadmap. The people who own credit policy, fraud, mail, and performance marketing rarely get a room designed around their work.

Next year, we want to change that.

We are planning a set of 2026 events built for operators first. Smaller groups. Working sessions instead of keynotes. Tables where you sit with peers who run similar programs and focus on what is actually working.

The goal is that if you get on a plane, you come home with contacts you will use, ideas you can test within a quarter, and at least one partnership that feels real.

If you want a say in how these look, reply to this email or message Carlos on LinkedIn. You can also read his post and tell us what would make an event worth the flight and hotel for you.

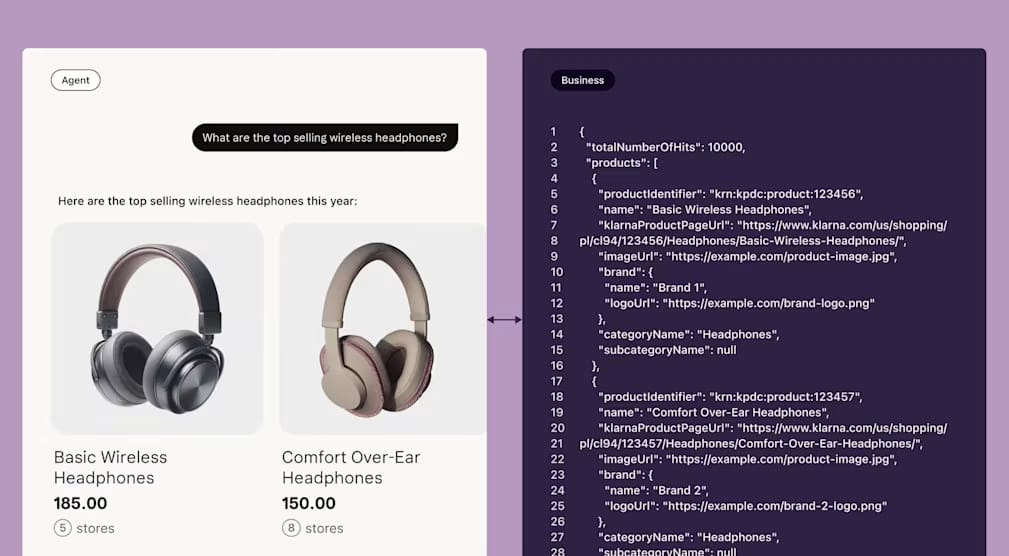

Klarna Launches Agentic Product Protocol: The Open Standard That Makes 100m+ Products Instantly Discoverable by AI Agents

Source: Klarna

Klarna is not waiting for AI agents to figure commerce out on their own. It is giving them the map. The company just launched the Agentic Product Protocol, an open standard that makes 100M+ products and 400M live prices readable by AI agents across 12 markets. Instead of scraping or ads, agents can pull structured, real-time product data that lets them actually compare, recommend, and transact.

Discovery shifts from search results to conversations. Distribution moves from paid placement to structured access. Merchants that plug in once can surface everywhere agents operate, without rebuilding feeds or buying traffic.

This is Klarna staking a claim on the layer beneath agentic commerce. If AI becomes the interface, the winners will not be the loudest brands. They will be the ones whose data is clean, live, and ready when the agent asks. (Klarna)

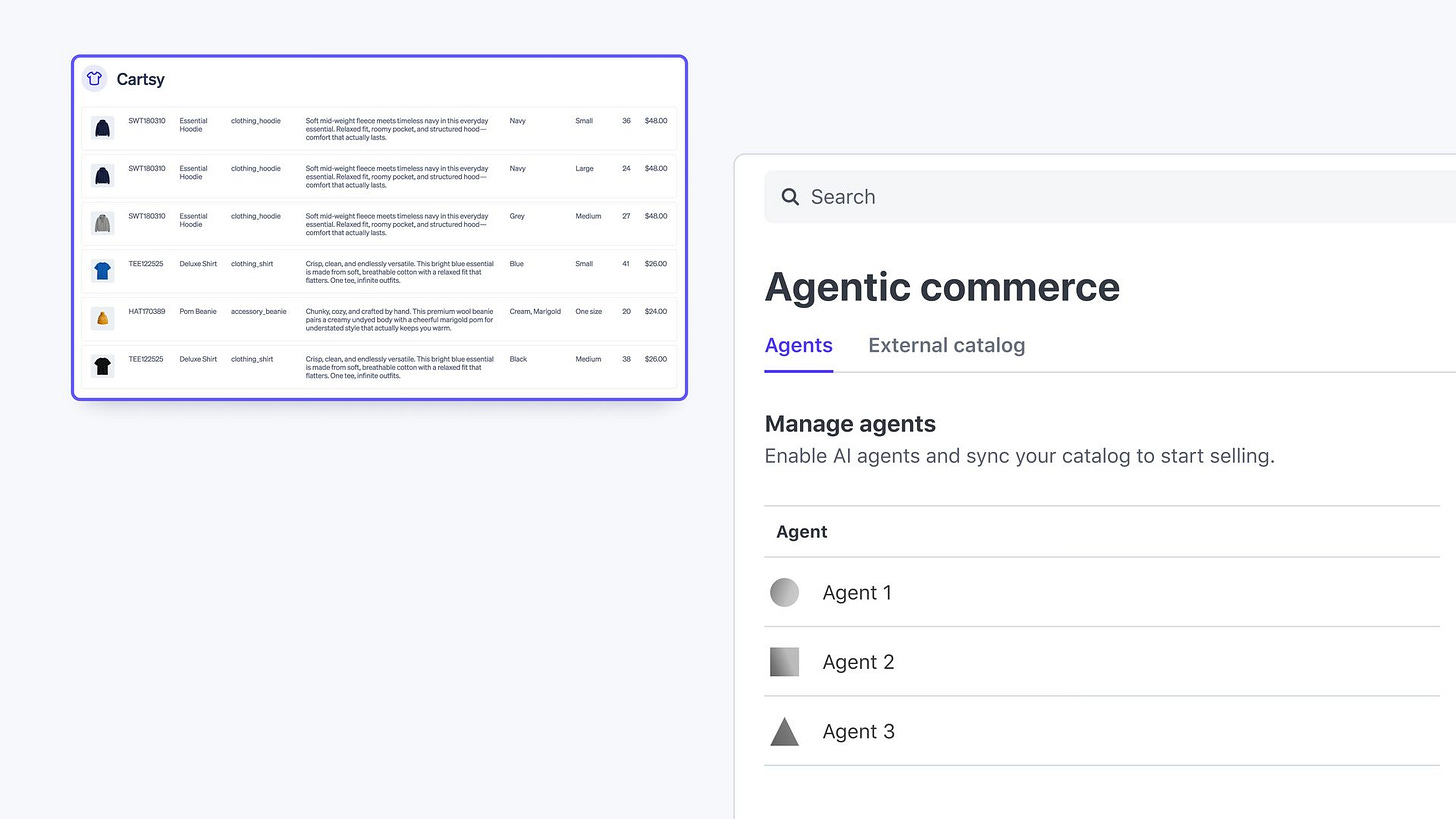

Stripe Invests in Agentic Commerce Infrastructure

Source: Stripe

Stripe is trying to do for agentic commerce what it did for online payments: make it boring. The new Agentic Commerce Suite is a one-integration bundle that handles the messy parts of selling through AI agents: discovery, checkout, payments, and fraud. Instead of every merchant building and maintaining custom endpoints and catalogs for each agent, Stripe hosts the ACP endpoint, syndicates product data, and routes order events back into your existing stack.

Stripe is pushing Shared Payment Tokens (SPTs) as the “agent-safe” payment primitive: tokens scoped to a specific seller, bounded by time and amount, and trackable across their lifecycle. That is a direct response to the next fraud problem, where real agents look like bots and bad actors try to manipulate agents into risky orders. When brands like Etsy, URBN, Coach, and Kate Spade start onboarding, it is no longer a demo. It is an emerging channel, with Stripe positioning itself as the toll road. (Stripe)

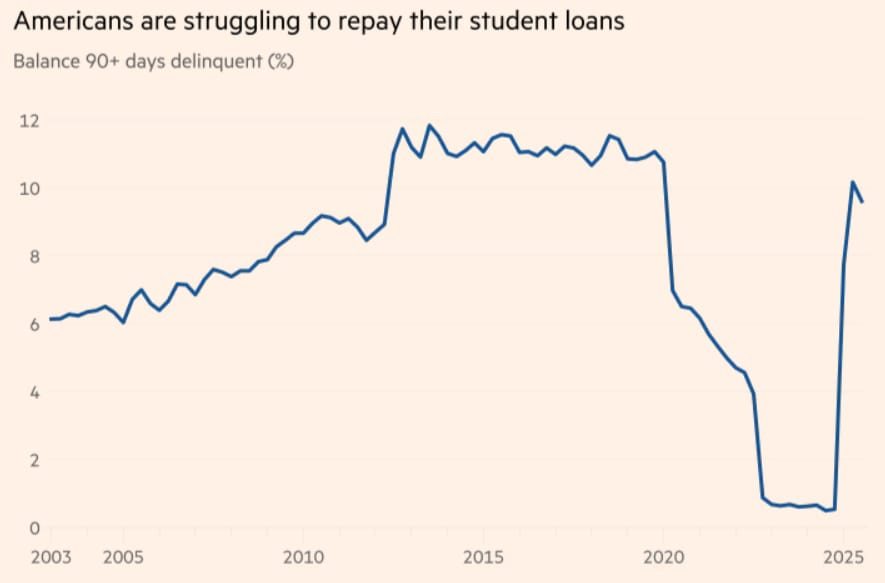

More Than 9 Million Us Borrowers Miss Student Loan Payments as Delinquencies Rise

Source: Financial Times

Nine million borrowers missed a payment, and the “help” line is backed up. Since credit reporting resumed for late federal student loan payments, over 9 million borrowers have slipped into delinquency, turning student debt into the standout weak spot in household credit, according to the Financial Stability Oversight Council. Credit scores are taking the hit too, with FSOC pointing to an average near-100 point VantageScore drop among affected borrowers. That kind of damage shows up fast in auto approvals, mortgage pricing, and anything that depends on “near-prime” staying near-prime.

At the same time, the forgiveness and repayment machinery is moving like it is stuck in traffic. The Education Department’s latest court-filed status update shows a huge IDR backlog (802,000 applications outstanding) and a PSLF Buyback backlog above 80,000. In November, the department processed hundreds of thousands of IDR applications, but approved only 170 discharges, and none under ICR or PAYE, citing systems that are not yet programmed to routinely check eligibility for those plans.

Now stack on the next wave. With the SAVE plan slated to end pending court approval, millions of borrowers may have to switch repayment plans, which is likely to dump more volume into the same pipelines that are already clogged. (Financial Times, Forbes)

TransUnion 2026 Outlook: Moderate Credit Card Balance Growth and Stable Delinquency Rates Signal Consumer Perseverance

TransUnion’s 2026 forecast calls for 2.3% YoY credit card balance growth, the smallest annual increase since 2013 (excluding the pandemic dip), with balances projected to hit $1.18T by end of 2026. That is a very different world from the double-digit surge years, and it lines up with what lenders have been signaling all year: tighter underwriting, more account management, fewer “spray and pray” approvals.

The other headline is what did not get worse. TransUnion expects 90+ DPD card delinquencies to stay basically flat at 2.57%, up just one basis point. Stability here is the story, especially with inflation still above target and unemployment projected to tick up.

But the pressure shows up elsewhere. TransUnion’s table on page 3 projects 60+ DPD mortgages rising to 1.65% and auto 60+ DPD to 1.54% by end of 2026. Translation: consumers are holding up, but the soft spots are moving around the balance sheet. (TransUnion)

Enjoying this week’s issue?

If you’ve been enjoying The Free Toaster, help us spread the word. Forward it to someone who lives and breathes consumer lending, marketing, or fintech like you do.

Your shares help us reach more builders in consumer lending, and help us make the Newsletter & Podcast better every day.

AFSA Consumer Credit Conditions Index Shows Mixed Q3 Results with Optimistic Outlook

AFSA’s Q3 Consumer Credit Conditions Index slipped into negative territory for the first time in over a year, with current business conditions posting a -5.9 reading as loan demand softened and performance weakened. Subprime stress is the pressure point. Expectations for subprime loan performance over the next six months fell sharply, signaling that risk remains concentrated at the lower end of the credit stack.

The six-month forward view jumped to +20.6, the strongest since late 2024, driven by falling rates and a dramatic improvement in expected funding costs. Lenders see cheaper capital coming fast, even if near-term credit quality stays uneven.

The takeaway is familiar but important. Demand may be muted today, but easing financial conditions are resetting lender confidence. Credit is not loosening yet. It is lining up for a more selective rebound. (PR Newswire)

BNPL Keeps Growing, but Discipline Replaces the Land Grab

The CFPB’s latest BNPL Market Data Spotlight shows volume and usage continuing to climb, but at a more measured pace. From 2022 to 2023, BNPL loan originations rose 23% and dollar volume grew 26%, slower than prior boom years but still expanding. The user base hit 53.6 million consumers, up 12% year over year, with borrowers taking more loans per year and spending more per lender.

What stands out is credit performance. Late fees declined meaningfully, with only 4.1% of loans assessed a late fee in 2023, down from 5.2% the year before. Charge-offs also improved, falling to 1.83%, the lowest level in the CFPB’s five-year dataset.

Growth is shifting from new-user land grabs to deeper engagement with existing customers, paired with tighter underwriting and cleaner portfolios. BNPL is maturing into a steadier, more controlled credit product, and that changes how regulators, lenders, and partners will treat it going forward. (Consumer Financial Protection Bureau)

Divided Fed Lowers Rates, Signals Pause and One Cut Next Year as Growth Rebounds

The Fed cut rates again, but it looked more like damage control than a green light. Officials lowered the benchmark rate by 25 basis points to a 3.50%–3.75% range, marking the third straight cut. Then they told everyone to stop expecting a smooth slide downward. The Fed’s own projections still point to just one more cut in 2026, and the committee is nowhere close to aligned on what comes next.

Three dissents came from both directions, with two policymakers wanting no cut and one pushing for a larger half-point move. It was the most divided rate vote in six years, a clear sign the Fed is stuck between two problems that are moving the wrong way at the same time. Inflation is still above target, but the job market is softening and unemployment has been creeping up.

Both Reuters and NPR flagged that the Fed had to make the call without fresh government data after the shutdown delayed key inflation and jobs reports. Powell leaned into patience, saying the Fed is positioned to wait and watch rather than commit to a path.

The takeaway for lenders, operators, and anyone pricing credit is simple. Rates came down, but policy is not getting easier. The Fed is trying to hold the line, and the next move depends on what the delayed data finally says, not on what markets want to believe. (Reuters, NPR)

Please support our Newsletter by recommending us to one of your colleagues!

And, please check out our sponsors:

Need an affiliate marketing platform/network? Chat with Fintel Connect

Need to improve application page conversions? Chat with Spinwheel

Need to accelerate your affiliate marketing? Chat with New Market Growth

Need to win on other growth channels? Chat with FIAT Growth

Looking for your next fintech role?

Stay ahead of where the industry is hiring. The Free Toaster Jobs newsletter curates standout openings in fintech marketing, product, data, and risk each week, along with insights into the trends shaping hiring across leading lenders, neobanks, and fintech startups.

Subscribe to The Free Toaster Jobs to get the latest roles and hiring insights delivered straight to your inbox (Toaster subs that don’t opt-in won’t get the Friday jobs Edition).

Missed last week’s edition? Check out the most recent job listings here.

Other News We’re Reading

(Crypto) Visa Launches Stablecoin Settlement in the United States, Marking a Breakthrough for Stablecoin Integration (Visa)

(Crypto) Klarna partners with Privy to develop simple, secure crypto wallet for the masses (Klarna)

(Lending) Mastercard and LoanPro Announce Partnership to Modernize Lending (Mastercard)

(Fintech) Airwallex raises $330M Series G at $8B valuation, establishes San Francisco as dual global headquarters (Airwallex)

(Regulation) US consumer bureau to issue 'interim final' open banking rule, cites funding shortfall (Reuters)

(Regulation) Bank-Fintech Partnership Enhancement Act (H.R. 6552) introduced by Rep. Andy Barr (Congress.gov)

(Regulation) American Fintech Council (AFC) Urges Passage of Bank-Fintech Partnership Enhancement Act to Strengthen Community Banking and Modernize Oversight (Fintech Council)

(AI/Fraud) Informed.IQ Secures $63 Million from Invictus Growth Partners to Advance AI-Powered Fraud Prevention and Loan Verification (PR Newswire)

(Cybersecurity) Data breach at credit check giant 700Credit affects at least 5.6 million (TechCrunch)

Spot something worth sharing with your team? Drop this week’s edition in their inbox: https://www.thefreetoaster.com/p/esusu-s-rent-data-is-becoming-a-hot-credit-signal

Catch you next week,

The Free Toaster Team

p.s. If you’re working on anything new in acquisition or credit, we’re always curious to hear about it.